WorldACD Weekly Air Cargo Trends (week 13) 2024

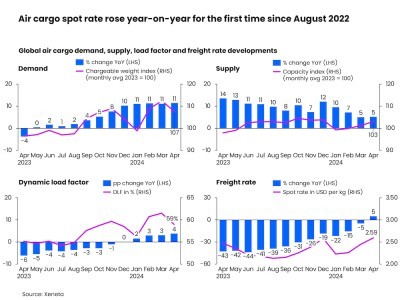

Apr 08, 2024Global air cargo rates continued to rise throughout March, thanks to strong demand and rising rates from Asia and Middle East origins, taking average prices to within -7% of their elevated levels this time last year and recovering to their levels during last year’s winter peak season, according to the latest weekly figures and analysis from WorldACD Market Data.

Average rates rose, week on week (WoW), by around +2% in week 13 (25-31 March) to $2.48 per kilo, following consecutive weekly WoW rises of between +2% and +3% last month, on a globalized basis, progressively narrowing the gap between rates this year and the equivalent periods last year. Average rates in January and February were -19% below their equivalent levels in 2023, but throughout March the gap narrowed, from -15% in week 9 to just -7% in week 13, based on the more than 450,000 weekly transactions covered by WorldACD’s data.

Rates recover to Q4 peak levels

The narrowing of the rates gap compared with last year partly reflects high comparison rates in January 2023 of $2.92 per kilo, which dropped to $2.70 in February and $2.68 in March 2023, as rates continued to gradually slide from the extreme highs of early 2022. But it also reflects a recovery in average rates since the start of the fourth quarter (Q4) of 2023. And despite the usual seasonal drop at the start of this year, and after Lunar New Year, average rates have recovered to close to their peak levels in Q4 last year.

Indeed, the current average worldwide rates of $2.48 per kilo are almost exactly equivalent to their average level in Q4 – $2.47 per kilo – which, coincidentally, was also their average level for the whole of 2023. And it is also significantly above pre-Covid levels (+38% compared to March 2019).

Examining what’s behind this consistent recovery in prices in March reveals that it is chiefly driven by increases in rates for air cargo from Asia Pacific and Middle East & South Asia (MESA) origin points, boosted by strong demand from cross-border e-commerce and because of the ongoing disruptions to container shipping in the Red Sea. Rates from Asia Pacific went up significantly to all regions in March, with average Asia Pacific-Europe rates ($3.78, flat YoY) and Asia Pacific-North America rates ($4.69, +3% YoY) by week 13 reaching or exceeding their levels this time last year. For MESA, the main driver was MESA to Europe destinations. MESA to Europe rates averaged around $2.40 in week 9, already up +28% compared with the same week last year. But by week 13 they had risen to $3.00 per kilo, up +62%, year on year (YoY).

Expanding the comparison period to two weeks, average worldwide rates in weeks 12 and 13, combined, rose by +5% compared with the previous two weeks (a 2Wo2W comparison), boosted by a +11% 2Wo2W increase from MESA origin points and +7% rise from Asia Pacific. Rates from Africa (+3%), Central & South America (+2%), Europe (+1%) and North America (+1%) origin points recorded modest rises.

Tonnage comparisons

Preliminary full-month figures indicate that global air cargo tonnages in March were up, year on year, by around +6%, although the figures for the final few days of March are impacted by the Easter holiday in parts of the world. The year-on-year growth for the first three full weeks combined in March was +8% – still a strong performance, although growth has slowed compared to the +13%, YoY, reported for the January-February 2024 period.

Worldwide tonnages in week 13 were down -5% compared with the previous week, dropping in the last four days of the week for many of the carriers reporting to WorldACD’s database, mainly due to Easter. Origin Central & South America (CSA) showed a decline in capacity that could further explain part of the ex-CSA tonnage decline, whereas available capacity was stable from the other main origin regions.

Tonnages for weeks 12 and 13, combined, were down -3% compared with the previous two weeks, led by declines from MESA (-7%), North America (-6%), and Africa (-5%), with smaller declines from Europe (-3%), Asia Pacific (-2%) and CSA (-1%) origins.

Nevertheless, tonnages from most of those origin regions were still up significantly compared with the equivalent two weeks last year, with Africa up +15%, Asia Pacific up +10%, MESA up +7%, and Europe +3% ahead, year on year (YoY), and only North America (-3%) recording a YoY decline in demand.

Ex-MESA surge slows

Although overall demand for air cargo capacity from MESA origins has softened slightly in the last two weeks from its extraordinarily high levels in February and early March, fresh analysis this week by WorldACD illustrates that tonnages from certain key airports in the region – notably important Asia-Europe sea-air hubs such as Dubai and Colombo – remain significantly elevated compared with this time last year, or compared with the period before the disruptions to container shipping in the Red Sea.

Dubai-Europe and Colombo-Europe tonnages were both down by -9% in week 13 compared with the previous week, but they remain up by +94% and +17%, respectively, year on year. Combining weeks 12 and 13, Dubai-Europe and Colombo-Europe tonnages were up, YoY, by 121% and 18%, respectively.

Although it is difficult to draw meaningful conclusions on the basis of figures for any one or two single weeks, particularly because of the effects of the Easter holiday period, Dubai-Europe demand appears to have softened in the last two weeks from the peak levels in weeks 8, 10 and 11. And Colombo-Europe tonnages in the last five weeks are down significantly from their peak in weeks 6, 7 and 8.

Southeast Asia road-air developments

Further analysis shows that Asia-Europe traffic via another leading Asia-Europe multimodal hub, Bangkok, also remains significantly elevated compared with this time last year (+41%), with Bangkok-Europe tonnages in weeks 11, 12 and 13 significantly higher than in the previous three weeks and close to their peak levels this year in weeks 6 and 7. Air cargo sources in Thailand have indicated that this traffic is being boosted by road-air volumes trucked down from Vietnam and other origin points in southeast Asia where ocean freight traffic and supply chains have also been impacted by the disruptions to Asia-Europe container shipping.

Similar Stories

Air cargo’s ‘black swan’ event sees demand peak, as attention turns to Q4 market

View Article

The WestJet Group’s growth strategy comes to life in Halifax this summer amidst return of transatlantic air connectivity

View Article

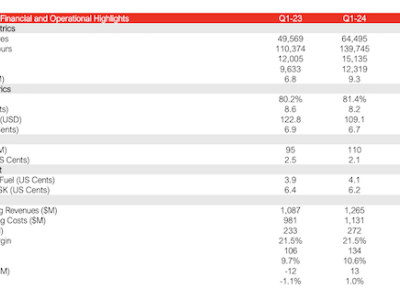

Avianca Group announces first quarter 2024 financial results

View Article

Biden paves way for US corn to profit from green jet fuel

View ArticleBoeing Starliner space capsule faces a shaky commercial future

Boeing Co,’s space taxi is finally about to carry its first astronauts to orbit, after years of delays and a botched test flight.

View ArticleVertical Aerospace overhauls leadership as CFO takes on top job

Vertical Aerospace elevated its finance chief to the role of chief executive officer, taking over from founder and current CEO Stephen Fitzpatrick as the UK flying taxi company rushes to…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!