WorldACD Weekly Air Cargo Trends (week 16)

Apr 29, 2024

Global air cargo tonnages returned to growth in the third week of April, thanks in part to a surge in traffic from Central & South America (CSA), as flower shipments ahead of upcoming Mother’s Day events in large parts of the world made up for stalling demand from Middle East & South Asia (MESA), linked to Eid.

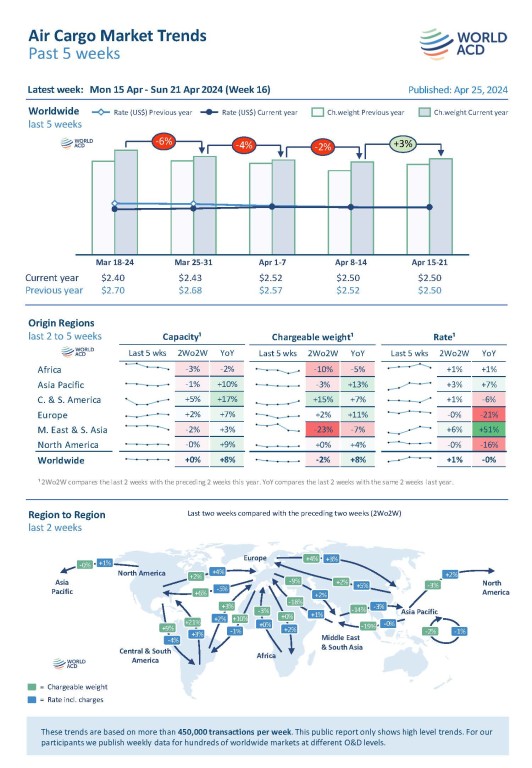

According to the latest weekly figures and analysis from WorldACD Market Data, total worldwide tonnages rose by +3% in week 16 (15-21 April), after recording week-on-week (WoW) declines of -2%, -4% and -6% in the previous three weeks due to a combination of the effects of various holiday periods such as Easter and Eid resulting in subdued cargo booking levels. Average worldwide rates held firm at US$2.50 per kilo in week 16, the same level as the previous week and the equivalent week last year, based on the more than 450,000 weekly transactions covered by WorldACD’s data. That rate remains significantly above pre-Covid levels: +39% compared to April 2019.

Flower phenomenon

Both CSA (+16%) and Africa (+15%) recorded strong WoW increases in tonnages in week 16. Most (84%) of the tonnage growth ex-CSA can be attributed to higher flower exports to North America, ahead of Mother’s Day in the USA and Canada on 12 May, with flower export tonnages ex-CSA up by around 40%, WoW – representing more than one third (1 percentage point) of the (+3%, WoW) worldwide growth in tonnages in week 16. But the tonnage growth ex-Africa was led by fruits & vegetables (31% of Africa’s WoW growth) and general cargo (29% of Africa’s WoW growth), whereas flower exports represented only 10% of the WoW growth for origin Africa.

Although around 90 countries or territories around the world celebrate Mother’s Day on the second Sunday in May, analysis by WorldACD reveals that North America is by far the most important destination market for flowers shipped by air, consuming 63% of all the flowers flown from CSA and Africa in week 16 (and 92% of the WoW growth in flower exports from CSA and Africa combined).

Two-week comparisons

Expanding the comparison period to two weeks, tonnages in weeks 15 and 16, combined, were down slightly (-2%) compared with the previous two weeks (a 2Wo2W comparison), with CSA the only origin region to record any meaningful 2Wo2W growth (+15%), thanks chiefly to a +21% increase in tonnages from CSA to North America. But after some strong growth in recent weeks, tonnages from the MESA region dipped sharply (-23%), compared with the previous two weeks, and there were 2Wo2W declines from Africa (-10%), and Asia Pacific (-3%). But compared with weeks 15 and 16 last year, tonnages are up by +8% on a worldwide basis, with strong year-on-year (YoY) increases from Asia Pacific (+13%), Europe (+11%), CSA (+7%) and North America (+4%), with only MESA (-7%) and Africa (-5%) recording YoY declines.

Despite the big (-23%) drop in tonnages ex-MESA, average outbound rates from the region continued to rise, on a 2Wo2W basis – albeit at a lower pace (+6%) than in some recent previous weeks – while there were smaller rates rises from Asia Pacific (+3%), CSA and Africa (both +1%). And average rates ex-MESA remain up tremendously (+51%), YoY, as they have for several weeks. Average rates ex-Asia Pacific are also elevated compared with last year (+7%), while they remain notably lower, YoY, ex-Europe (-21%) and ex-North America (-16%).

MESA analysis

Closer analysis by WorldACD indicates that air cargo tonnages from MESA and parts of Asia Pacific are not yet recovering post-Ramadan to the elevated tonnage levels seen for much of this year from that region, especially to European destinations, linked to strong demand developments combined with supply issues caused by disruptions to container shipping. For the Gulf sub-region, this is partly explained by the heavy rainfall at the start of week 16 that mainly impacted Dubai, where flooding led to some flight cancellations.

Dubai recorded a WoW volume drop of -18% in week 16, whereas nearby fellow emirates Abu Dhabi and Sharjah recorded volume increases of +20% and +103%, respectively – boosted by cargo and flights diverted from Dubai. After already dropping by -20% the previous week, Dubai-Europe tonnages fell by a further -29% week 16, but they remained at more than twice their level this time last year (+107%), boosted by sea-air tonnages resulting from the disruptions to container shipping in the Red Sea. Other hub airports and countries in the region also recorded WoW tonnage declines to Europe, including Colombo (-24%) and Bangladesh (-37%), as MESA to Europe tonnages as a whole dropped back by -14%. India-Europe tonnages fared better, slipping by just -1%, WoW and YoY, whereas the other countries in South Asia (Bangladesh, Pakistan, Sri Lanka, Maldives, Nepal) are, in total, down by -27%, WoW.

Spot rates from MESA to Europe also dropped back slightly in week 16, but they remain massively elevated compared with this time last year. Indeed, average spot rates from MESA to Europe in week 16 were more than twice their level this time last year (+117%), with India-Europe spot rates still averaging close to $4 a kilo in week 16 ($3.95/kg) despite a slight WoW drop, leaving them up by +172% compared with week 16 last year. Bangladesh-Europe spot rates also dropped back slightly in week 16 to $4.39 a kilo, but remain up +168%, YoY. Meanwhile, Sri Lanka-Europe prices remain up +43%, YoY, despite falling -10%, WoW. And Dubai-Europe spot prices rose in week 16 by +10%, presumably because of the restricted capacity caused by the flooding, and are up +18%, YoY.

Similar Stories

The WestJet Group and AMFA reach tentative agreement, averting work stoppage

View Article

U.S. airlines’ March 2024 fuel cost per gallon down 2.2% from February 2024

View ArticleRiyadh Air teases follow-up aircraft orders ahead of 2025 debut

Riyadh Air plans to expand its fleet with additional aircraft orders following its initial purchase of Boeing Co. long-range jets last year, as the startup Saudi carrier seeks to establish…

View Article

Riege Software marks success with Inside Scope in Frankfurt

View ArticlePivotal Helix eVTOL wins 2024 MUSE Transportation Design of the Year Award

Excellence, innovation and industry impact recognized in production aircraft

View ArticleLufthansa names Streichert from Amadeus as next finance chief

Deutsche Lufthansa AG named Till Streichert as chief financial officer to succeed Remco Steenbergen, who announced his surprise departure a few months ago as part of a broader management overhaul.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!