Malaysia Airports Said to Plan Stake Sale in Sabiha Istanbul

Malaysia Airports Holdings Bhd plans to sell a minority stake in its Istanbul unit, which operates Turkey’s second-biggest airport, people familiar with the matter said.

The Malaysian company is seeking an investor for Istanbul Sabiha Gokcen International Airport, also known as ISG, and plans to maintain control of the company, the people said, asking not to be identified because the talks are private. Malaysia Airports is also talking to banks about a possible advisory role on the deal, they said.

Malaysia Airports plans to start a 130 million euro ($142 million) expansion of ISG this year as it nears capacity, Azmi Murad, the airport’s executive director, said in an interview last month. The airport will add 8 million passengers a year to its current capacity of 33 million passengers once a new boarding hall is completed in 2018, he said.

Malaysia Airports was part of a consortium that won a 1.9 billion euro contract to operate the airport in 2007. The company in 2013 agreed to raise its holding in ISG to 60 percent by acquiring the 40 percent stake held by Indian partner GMR Infrastructure Ltd. for 225 million euros. It bought the remaining 40 percent from Turkey’s Limak Holding in 2014 for 285 million euros.

New Airport

TAV Havalimanlari Holding AS, the Istanbul-based company that has a contract until 2020 to operate Istanbul’s largest airport, Ataturk International, surged as much as 5.7 percent after the news on Wednesday. TAV is preparing for Ataturk to be closed as Turkey builds a larger new hub in the city. TAV bid for a stake in Sabiha Gokcen in 2014, but was shut out when Malaysia Airports decided to exercise its right of first refusal on the shares.

Malaysia’s plan to sell “rekindled optimism for TAV and its ability to continue operations in Istanbul” when its Ataturk contract ends, said Selim Kunter, an analyst at Deniz Invest in Istanbul. Melis Pocar, an analyst at Oyak Securities, cited TAV’s “long-known interest in Sabiha,” improved traffic data for Istanbul Ataturk as well as reports that TAV would bid for Sofia Airport in Bulgaria as “positive catalysts for the stock.”

TAV shares have gained 12 percent this year, underperforming the 23 percent increase on the benchmark Turkish stock index.

Turkey’s biggest low-cost airline, Pegasus Hava Tasimaciligi AS, uses ISG as its main hub, while Pegasus and national flag-carrier Turkish Airlines make up more than 90 percent of all airlines using the airport. A spokesman for Malaysia Airports declined to comment.

Similar Stories

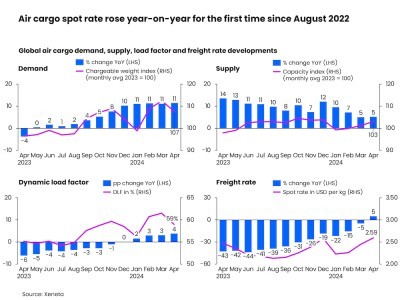

Air cargo’s ‘black swan’ event sees demand peak, as attention turns to Q4 market

View Article

The WestJet Group’s growth strategy comes to life in Halifax this summer amidst return of transatlantic air connectivity

View Article

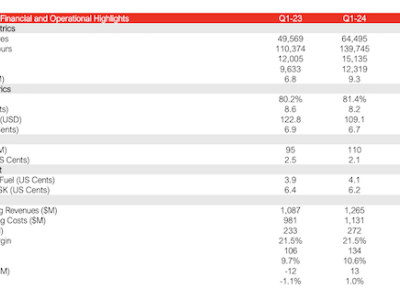

Avianca Group announces first quarter 2024 financial results

View Article

Biden paves way for US corn to profit from green jet fuel

View ArticleBoeing Starliner space capsule faces a shaky commercial future

Boeing Co,’s space taxi is finally about to carry its first astronauts to orbit, after years of delays and a botched test flight.

View ArticleVertical Aerospace overhauls leadership as CFO takes on top job

Vertical Aerospace elevated its finance chief to the role of chief executive officer, taking over from founder and current CEO Stephen Fitzpatrick as the UK flying taxi company rushes to…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!