Vietnam growth slows more than forecast on trade turmoil

Vietnam’s economy slowed in the first quarter, weighed by an uneven growth in exports and factory output as well as tepid consumption activity.

Gross domestic product rose an annualized 5.66% in the January-March period after gaining 6.72% in the previous quarter, according to estimates released by the General Statistics Office on Friday. That compares with the median 6.4% expansion seen in a Bloomberg survey of economists.

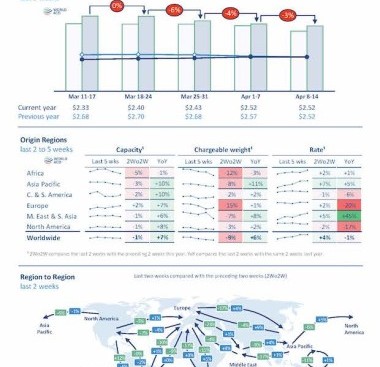

Vietnam’s trade-reliant economy is struggling with an uneven recovery in exports and manufacturing activity amid still subdued external demand. While sticky inflation in developed markets have kept the much-anticipated lowering of interest rates at bay, new risks to global commerce have emerged in the form of disruption of traffic in the Red Sea — a route that allows carriers to use the Suez Canal shortcut between Asia and Europe.

Exports shrank during one of the three months under review, while the 42% growth in overseas shipments notched in January was largely a statistical effect due to the lower base of comparison a year ago.

Total lending in Vietnam’s banking system climbed 0.26% this year through March 25, according to data released Friday by the statistics office. The central bank aims to boost credit growth to 15% this year.

At home, companies are struggling with limited access to bank lending and relatively high borrowing costs. Domestic vehicle sales declined 51.2% in February, the most in nine months, data previously released by the Vietnam Automobile Manufacturers’ Association showed.

“Many businesses have scaled down or ceased operations due to a lack of orders and rising raw material prices,” State Bank of Vietnam’s Deputy Governor Dao Minh Tu said at a March 14 conference in Hanoi. As a result, banks are tightening requirements on collateral assets on concern about a rise in bad debt, according to Tu.

Tu added that although commercial lending interest rates have declined for new loans, they are still not commensurate with the reductions in the deposit rates, and the borrowing costs of existing loans remain high.

Similar Stories

Mexico trade surplus soars as slowing demand damps imports

Mexico’s trade surplus was four times as large as economists had forecast in March as slowing demand damped imports.

View ArticleBritons finally taste full Brexit as costly border checks begin

EU food imports to the UK are about to get more expensive and complicated as the British government implements the Brexit deal.

View Article

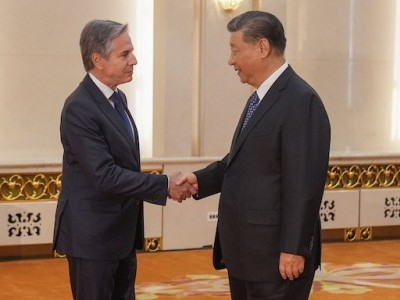

Xi warns Blinken against ‘vicious competition’ between US, China

View ArticleNCBFAA elects new officers and board members for 2024-2026

The National Customs Brokers and Forwarders Association of America (NCBFAA), following its 51st Annual Conference in Fort Lauderdale, Florida, on April 14-17, finalized its election today of a new slate…

View Article

Biden tightens gun export rules to fight criminal diversion

View Article

Brazil iron ore exports seen surging in 2024 if rivers stay high

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!