BEA News: US international transactions, first quarter 2021 and annual update

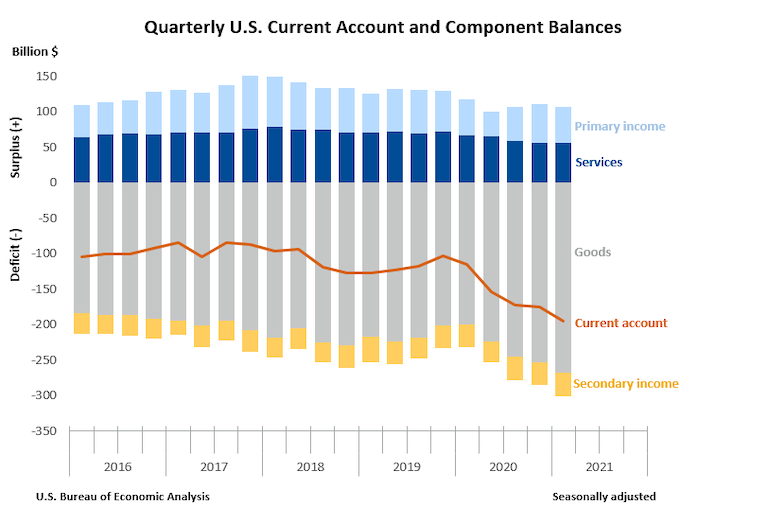

Jun 23, 2021The U.S. current account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, widened by $20.7 billion, or 11.8 percent, to $195.7 billion in the first quarter of 2021, according to statistics from the U.S. Bureau of Economic Analysis (BEA). The revised fourth quarter deficit was $175.1 billion.

The first quarter deficit was 3.6 percent of current dollar gross domestic product, up from 3.3 percent in the fourth quarter.

The $20.7 billion widening of the current account deficit in the first quarter mostly reflected an increased deficit on goods and a reduced surplus on primary income.

Current Account Transactions (tables 1-5)

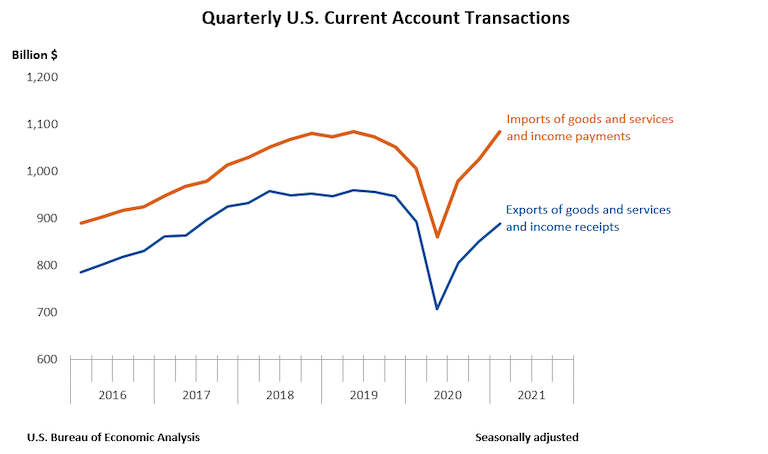

Exports of goods and services to, and income received from, foreign residents increased $36.8 billion, to $888.7 billion, in the first quarter. Imports of goods and services from, and income paid to, foreign residents increased $57.5 billion, to $1.08 trillion.

Trade in Goods (table 2)

Exports of goods increased $24.5 billion, to $408.6 billion, and imports of goods increased $39.9 billion, to $677.0 billion. The increases in both exports and imports reflected increases in nearly all major categories, led by industrial supplies and materials, primarily petroleum and products, that were partly offset by a decrease in automotive vehicles, parts, and engines.

Trade in Services (table 3)

Exports of services increased $1.1 billion, to $175.9 billion, reflecting mostly offsetting changes in several major categories. Increases were led by travel, mainly other personal travel; decreases were led by charges for the use of intellectual property, mainly for licenses to reproduce and/or distribute computer software. Imports of services increased $1.8 billion, to $120.2 billion, mostly reflecting an increase in transport, primarily sea freight transport.

Primary Income (table 4)

Receipts of primary income increased $9.6 billion, to $261.7 billion, mostly reflecting an increase in direct investment income, primarily earnings. Payments of primary income increased $13.5 billion, to $211.4 billion, mainly reflecting increases in direct investment income, mostly earnings, and in portfolio investment income, mostly interest on long-term debt securities.

Secondary Income (table 5)

Receipts of secondary income increased $1.6 billion, to $42.6 billion, mostly reflecting an increase in general government transfers, primarily public sector fines and penalties. Payments of secondary income increased $2.3 billion, to $75.9 billion, mainly reflecting an increase in general government transfers, primarily international cooperation.

Capital Account Transactions (table 1)

Capital transfer payments increased $1.6 billion, to $2.8 billion in the first quarter, mostly reflecting an increase in investment grants.

Financial Account Transactions (tables 1, 6, 7, and 8)

Net financial account transactions were −$175.2 billion in the first quarter, reflecting net U.S. borrowing from foreign residents.

Financial Assets (tables 1, 6, 7, and 8)

First quarter transactions increased U.S. residents’ foreign financial assets by $382.0 billion. Transactions increased portfolio investment assets, primarily long-term debt securities, by $304.7 billion; direct investment assets, primarily equity, by $64.0 billion; and other investment assets, primarily loans, by $15.4 billion. Transactions decreased reserve assets by $2.1 billion.

Liabilities (tables 1, 6, 7, and 8)

First quarter transactions increased U.S. liabilities to foreign residents by $554.9 billion. Transactions increased portfolio investment liabilities, primarily long-term debt securities, by $326.5 billion; other investment liabilities, primarily deposits and loans, by $163.9 billion; and direct investment liabilities, primarily equity, by $64.5 billion.

Financial Derivatives (table 1)

Net transactions in financial derivatives were −$2.3 billion in the first quarter, reflecting net U.S. borrowing from foreign residents.

Updates to Fourth Quarter 2020 International Transactions Accounts Balances Billions of dollars, seasonally adjusted | ||

|

Preliminary estimate |

Revised estimate |

Current account balance |

−188.5 |

−175.1 |

Goods balance |

−253.0 |

−253.1 |

Services balance |

53.0 |

56.3 |

Primary income balance |

47.9 |

54.2 |

Secondary income balance |

−36.4 |

−32.5 |

Net financial account transactions |

−262.4 |

−271.2 |

The statistics in this release reflect the annual update of the U.S. international transactions accounts. With this update, BEA has incorporated newly available and revised source data for 2018–2020 and updated seasonal adjustments for 2016–2020 for most statistical series. The major exceptions are 1) direct investment positions, transactions in financial assets and liabilities, and related income receipts and payments for 2017–2020, which are revised to incorporate the results of BEA’s 2017 Benchmark Survey of Foreign Direct Investment in the United States, and 2) insurance services exports and imports and insurance-related transfers in secondary income receipts and payments for 2013–2020, which are revised to incorporate the results of BEA’s 2018 Benchmark Survey of Insurance Transactions by U.S. Insurance Companies with Foreign Persons.

Newly Available and Revised Source Data: Key Providers and Years Affected

Agency |

Data |

Years affected |

BEA |

Benchmark and quarterly insurance services surveys |

2013–2020 |

Benchmark, annual, and quarterly direct investment surveys |

2017–2020 | |

Quarterly international services surveys |

2018–2020 | |

U.S. Census Bureau |

Revised source data for Census-basis goods |

2018–2020 |

U.S. Department of the Treasury |

Annual portfolio investment surveys |

2019–2020 |

Quarterly and monthly portfolio and other investment surveys |

2017–2020 |

Similar Stories

CBP officers seize counterfeit Tiffany & Co. jewelry

View ArticleAAFA applauds USTR on the 2024 Review of Notorious Markets for Counterfeiting and Piracy report

Reiterates need for accelerated efforts to stop dangerous fakes

View Article

U.S. international trade in goods and services, November 2024

View Article

Mexico announces increased tariffs on apparel imports, forcing a “scramble” to reshore operations in the United States

View ArticleCPA applauds Biden Administration action to block Nippon Steel’s purchase of U.S. Steel

The Coalition for a Prosperous America (CPA) commends President Biden’s decisive action to block Nippon Steel’s $14.9 billion bid to acquire U.S. Steel. This decision reflects a necessary commitment to…

View Article

Avocados will continue strong surge in 2025 and beyond

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!