The ‘no-fail’ mission to protect the Red Sea isn’t working

The gray F/A-18 fighter jets hurtled one by one from the deck of the USS Dwight D. Eisenhower into the heat of the Red Sea morning, scrambling to counter the latest attack drone launched by the Houthis. The $56 million aircraft were part of a coalition operation that nullified the attack, returning hours later as they have almost daily for the last several months.

Yet for all the costly hardware the US and its allies have thrown at the Islamist group from northwest Yemen, they haven’t been able to stop the attacks on civilian freighters and warships. As a result, the world’s biggest shipping companies are still largely avoiding a route that once carried 15% of global commerce.

The success of the Iran-backed rebel group in stymying the world’s most sophisticated militaries is the latest setback for Washington’s efforts to limit the spread of a regional conflict that began with Hamas’ deadly attack on Israel on Oct. 7.

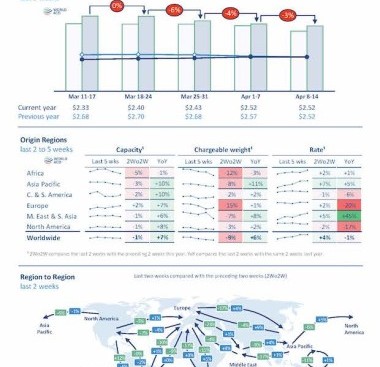

The Houthi campaign, which claimed its first civilian ship sunk in early March and its first fatalities not long after, is also a growing threat to the global economy. The number of vessels sailing through the southern Red Sea is down about 70% compared with the start of December. Container shipping has dropped about 90% and gas tankers have also all but ceased transit.

Sailing around southern Africa adds about two weeks to the voyage. As a result, the cost of sending a container from Shanghai to Rotterdam is about double the level of a year earlier, according to Drewry Shipping.

More than three months into a major naval policing operation, Admiral Marc Miguez, commander of the flotilla, concedes the US and its allies have more work to do.

“We know that we have reduced some of their capability,” he said, standing on the navigation bridge of the Eisenhower. But with the Houthis’ backers in Iran still sending money, weapons and intelligence - including from a spy ship sailing hundreds of miles from the Eisenhower just outside the Red Sea - he won’t forecast when the job may be done.

He points to a slowdown in Houthi attacks and a shift from attacks with cruise missiles to less-dangerous drones as evidence the operation is wearing the group down. But that’s been little comfort for shipping companies.“It’s a quite binary situation,” Rolf Habben Jansen, chief executive officer of Hapag-Lloyd AG said on an earnings call this month. “It is either safe for our people or it is not. As long as it is not safe, we will not send our people through the Red Sea.”

He said he’s hoping the disruptions will ease in the next few months or so, but concedes that others in the business fear it could last into 2025. Apparel retailer Abercrombie & Fitch Co. recently ditched a prediction freight costs would fall this year, citing the Red Sea disruption.

The Houthis, meanwhile, have told China and Russia their ships can sail through the Red Sea without fear of attack. Still, the Houthis hit a Chinese oil tanker with a missile on Saturday, an attack that could have been a case of mistaken identity and reflecting that no ships are totally safe.

One Western official said the Houthis likely have the ability to keep launching strikes on other ships at something close to its current pace for months to come. How many missiles the Houthis had in their arsenals at the outset of the conflict was “kind of a black hole for the US intelligence-wise,” conceded Miguez.

At the same time, US officials admit there’s no sign that Iran, without which the Houthis couldn’t sustain the attacks for long, sees any reason to stop. The Islamic Republic’s oil exports aren’t affected since they mostly use another route. US warnings to Tehran so far aren’t working.

“Iran is undeterred in support to the Houthis,” General Michael Kurilla, commander of the US Central Command, bluntly told a Senate hearing on March 7. “There has to be cost imposition on Iran.”

Through a combination of overland shipments and dozens of small dhow ships plying the seas in the region, Iranian supplies are getting through. Iran has also sent advisers, including specialists in laying mines at sea, according to people familiar with the situation.

The Houthis are “putting it all together and assembling,” Kurilla said. “They don’t create inertial navigation systems. They don’t create medium-range ballistic missile engines. They don’t create the stage separations on these medium-range ballistic missiles or the anti-ship cruise missiles.”

A top Iranian commander, Abdul Reza Shahlai, directed the first Houthi attacks from inside Yemen in October, according to several people with direct intelligence from the ground. The US is offering $15 million for information about Shahlai, who’s accused of masterminding deadly attacks on Americans in the region. He’s also the de facto commander of the Houthis’ drone and missile forces, with a direct line to the group’s leader, according to people familiar with the group.

“As far as Iran is concerned, he has done an amazing job, he’s built the Houthis into this monster,” according to Joel Rayburn, a former US military officer and diplomat who’s worked on countering Iran.

The US has been cautious about attacking Iranian supply lines directly, fearing it would escalate the already unstable situation in the region. NBC reported that Iran’s intelligence vessel was targeted by a US cyberattack for sharing intelligence with the Houthis.

Admiral Miguez said two Iranian ships are currently active in the region: an intelligence vessel which has operated off the coast of Djibouti for years, and a support ship.

“We’re at a point where Iran has influence over, if not strategic control over, three of world’s six major economic choke points,” said John Miller, a former commander of the US Fifth Fleet, under which the Ike now sits, referring to the Suez Canal at the north of the Red Sea, the Bab el-Mandeb strait in the south, and the Strait of Hormuz.

Iran admits backing the Houthis, but not arming them, and it says they make their own decisions.

Iran has threatened and used force itself, seizing a US-linked oil cargo, vowing retaliation if its own ships are attacked and rehearsing the “liberation” of commercial ships “hijacked by pirates” in joint drills with Russia and China in the nearby Gulf of Oman.

Despite the nearly daily strikes on their bases in Yemen, the Houthis have basked in the global attention that’s catapulted them to the front ranks of the Arab resistance to Israel’s war in Gaza and shown their value to their patrons in Tehran.

“The Houthis have proved themselves to be an important and effective regional actor and Iran serves their political ambitions,” said Maysaa Shuja Al-Deen, Senior Researcher at the Sana’a Center for Strategic Studies, a think tank.

The group conducted a drill to confront a simulated landing of US and UK forces in Yemen this month, according to the Houthi-controlled Saba news agency, with leaders vowing to repel any attack.

They aren’t likely to get that chance, with allies so far rejecting any talk of an operation in Yemen.

But if one of the regular attacks on the allied warships were to succeed, killing foreign troops, the US would likely have to step up its response. The next level of escalation could be attacks targeting Houthi leaders, according to western officials.

One US military official, who asked to remain anonymous discussing matters that aren’t public, said the US is on the wrong side of the cost curve in its campaign. America can sustain the costs, the official said, but it’s getting very expensive.

For the moment, the costly game of cat and mouse continues. On the Eisenhower, officials said the Houthis stopped using their drones for high-level reconnaissance once the allies began to target them. Instead, they fired them low across the water to avoid detection and attack allied ships directly.

In response, the allies have taken to using fighters like the F/A-18s to take out the drones with air-to-air missiles, keeping them further from the ships and conserving the expensive weapons they had used to defend themselves.

“Our goal is no loss of life. No loss of equipment,” said Captain Colin Price, the ship’s executive officer. “It’s a no-fail mission.”

Similar Stories

Sanctioned tankers giant passage to India is test case for oil

View Article

Galveston Wharves board approves $29 million construction contract for cargo area

View Article

Canaveral Port Authority opens applications for Junior Ambassador Program

View Article

Port of Brownsville awards $1,000 scholarships to high school graduates

View Article

Baltimore’s trapped ships start leaving as new channel opens

View Article

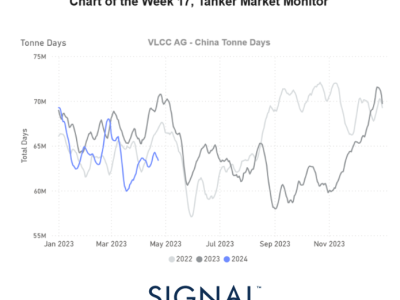

Tanker - Weekly Market Monitor - Week 17, April 26, 2024

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!