Tanker - Weekly Market Monitor - Week 17

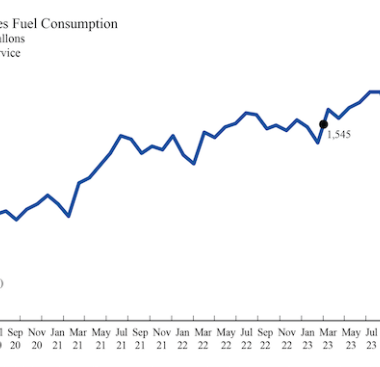

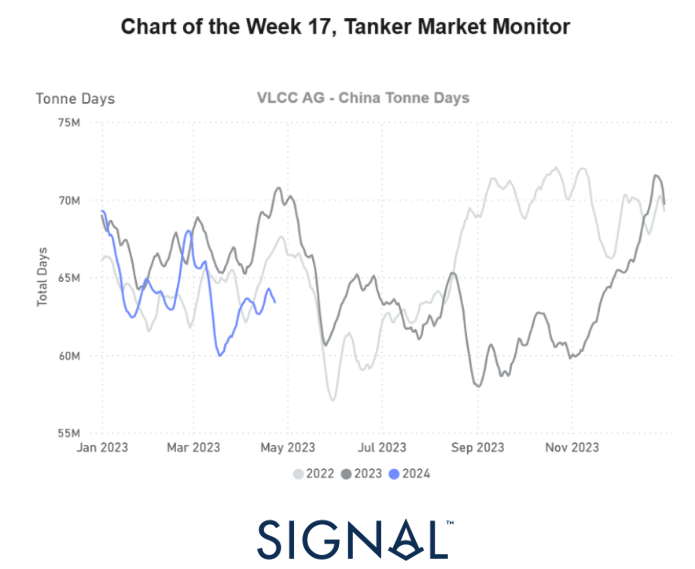

Apr 26, 2024A downward revision in the growth of VLCC tonne days from AG to the Far East from March onwards

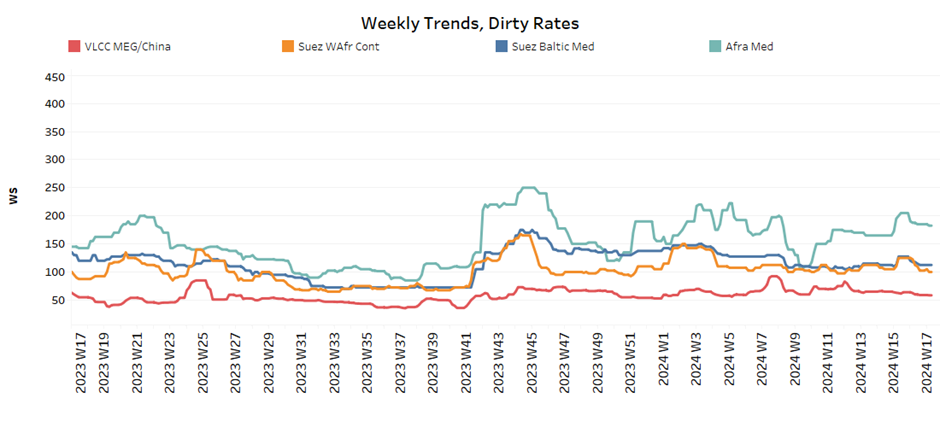

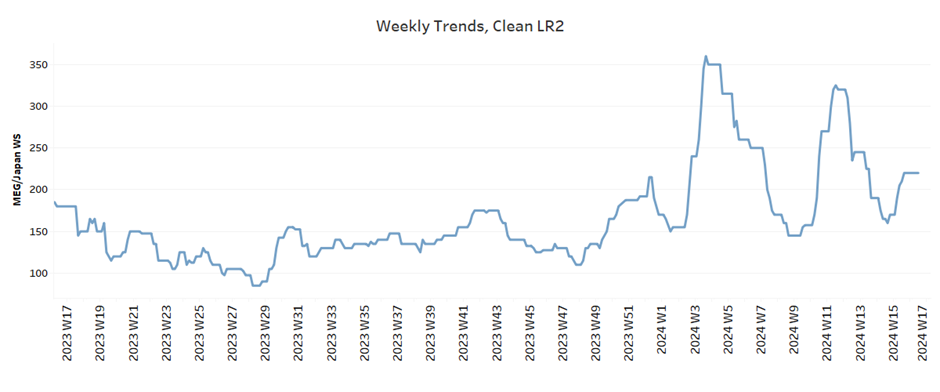

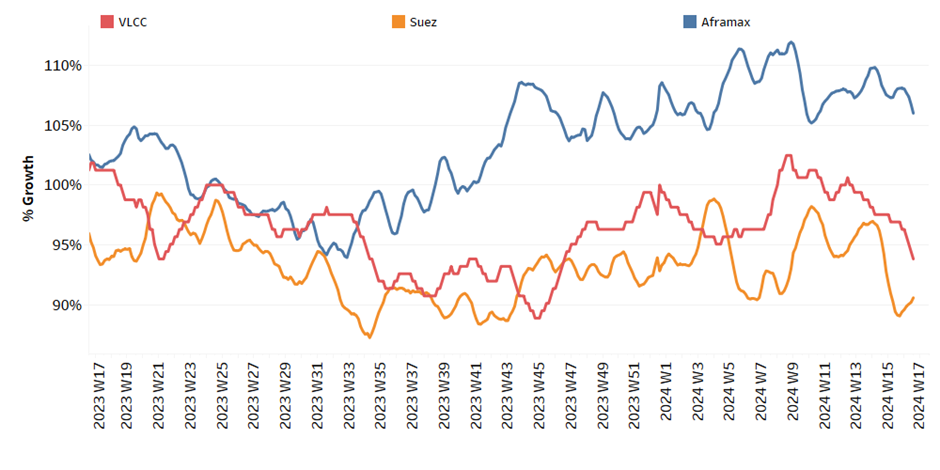

As April draws to a close, the crude freight market sentiment for VLCC and Suezmax tankers segments confirms a downward trajectory, contrasting with a sense of stability observed in the Aframax Med route, albeit accompanied by a decline in vessel activity. Turning to the demand side, the outlook for both dirty and clean tanker vessel sizes paints a challenging picture for the upcoming days of May. A clear downward trend is evident, poised to exert pressure on market prices, while signals of increased supply further compound the situation.

A closer look at the AG-China route reveals an interesting observation: the growth of VLCC tonne days recorded from March onwards is notably lower than the performance seen two years ago during a comparable period. Moreover, unlike the stable dry bulk shipping market, recent growth in tankers appears highly unlikely to reach the peak recorded in May of last year.. Meanwhile, the International Energy Agency (IEA) projects a moderate global oil demand growth of 1.1 million barrels per day (mbd) for 2025, slightly below the 1.2 mbd anticipated for 2024. Noteworthy is the significant demand growth anticipated in India, other developing Asian economies, and the Middle East. In contrast, OECD demand is forecasted to decline slightly, with European consumption easing as economic conditions improve.

SECTION 1/ FREIGHT Market Rates (WS)

|

|

|

In the waning days of April, there's a discernible shift in the sentiment surrounding crude oil freight market trends. Notably, there's a consistent downward pressure observed on the VLCC MEG-China route.

|

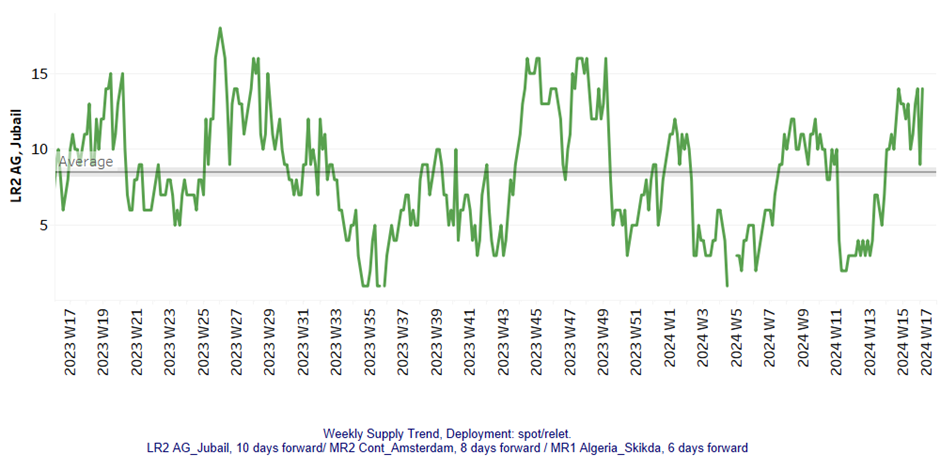

‘Product’ WS LR2 Firmer |

|

|

| LR1 Weaker |

|

|

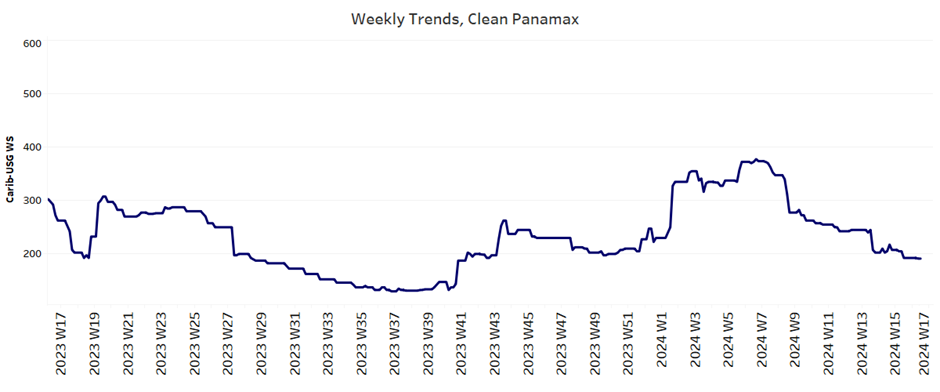

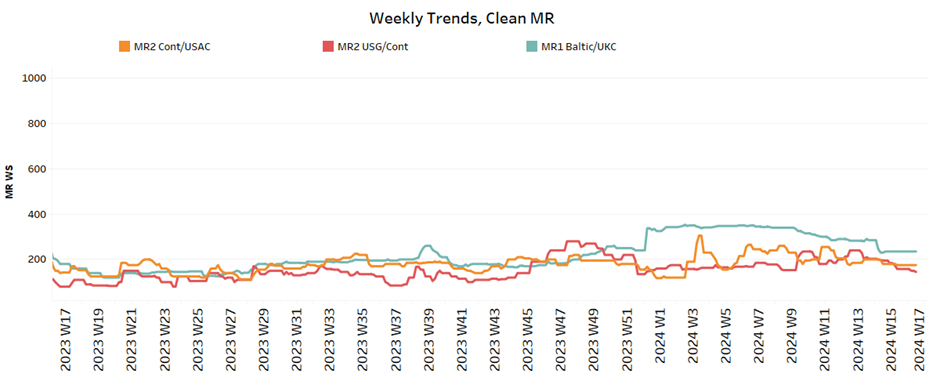

‘Clean’ |

|

|

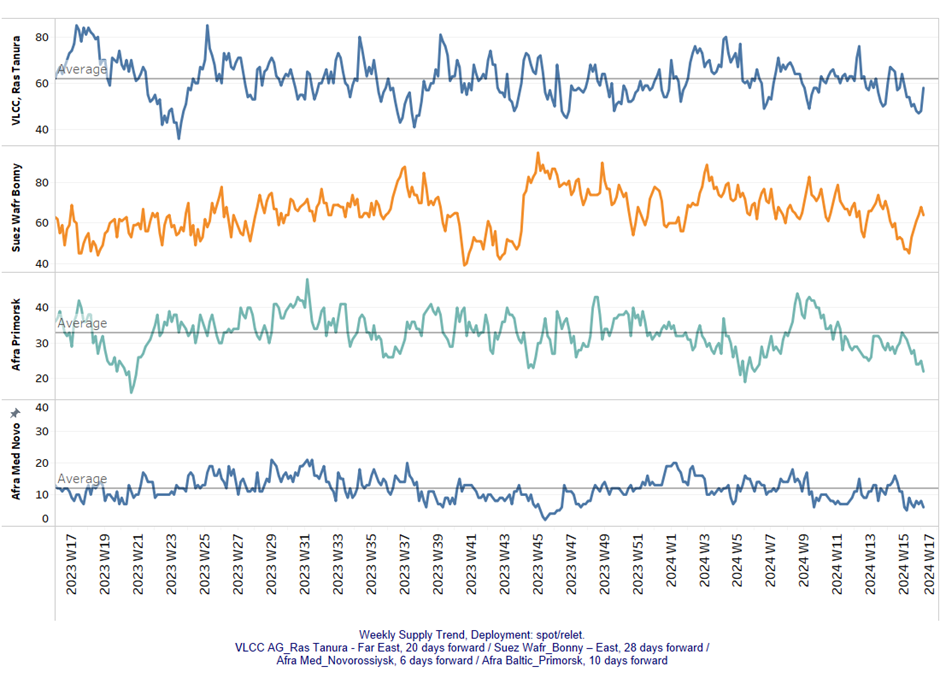

SECTION 2/ SUPPLY |

‘Dirty’ (# vessels) - Mixed |

|

|

The supply trend for crude tankers is showing an upward trajectory in the VLCC Ras Tanura and Suez WAfr segments, while a downward trend appears to persist for the Aframax Med and Primosk segments.

|

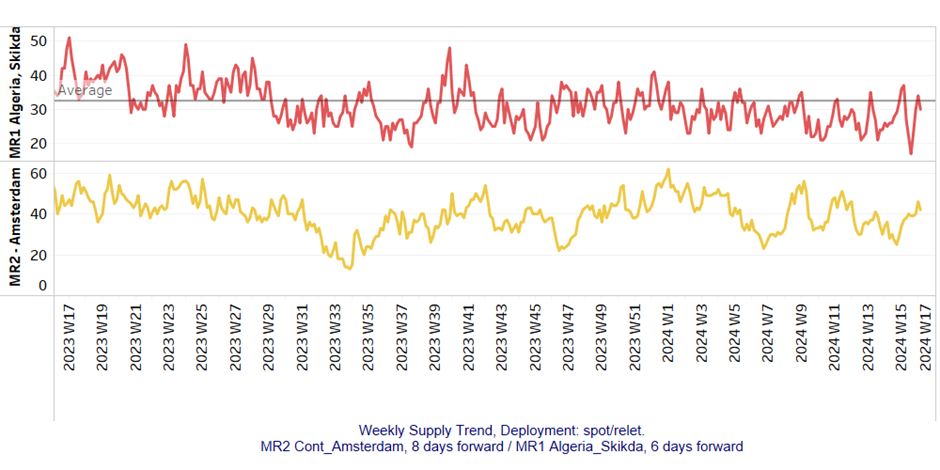

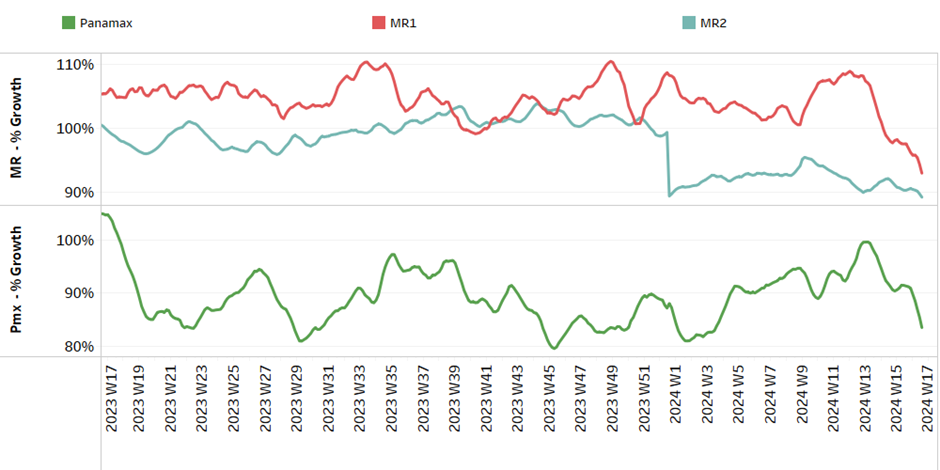

'Clean' |

|

MR (#vessels) - Increasing |

|

|

SECTION 3/ DEMAND (Tonne Days) |

‘Dirty’ Decreasing |

|

|

‘Clean’ Decreasing |

|

|

Similar Stories

Venezuela’s oil monopoly eases with deal to allow private firm to import diesel

Venezuela is allowing a small startup to import fuels even as the country struggles to feed its owns refineries and the recent reimposition of US sanctions presses on its industry.

View Article

ACL announces new faster service between North America and Ireland

View Article

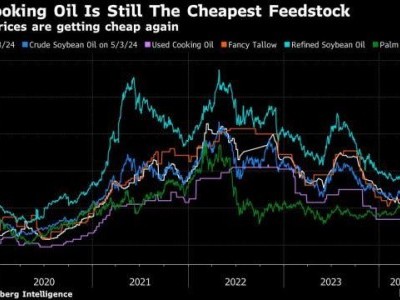

Suspicious frying oil from China is hurting US biofuels business

View ArticleCMA CGM PSS02 - from Asia to West Africa

CMA CGM informs of the following Peak Season Surcharge (PSS02):

View ArticleMSC GRI - scope: Indian Sub-continent to USA East Coast / USA Gulf Coast/ San Juan

MSC will apply the following General Rate Increase (GRI) for all cargo loaded ex Bangladesh:

View Article

The London P&I Club announces CEO transition

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!