Venezuela’s oil monopoly eases with deal to allow private firm to import diesel

Venezuela is allowing a small startup to import fuels even as the country struggles to feed its owns refineries and the recent reimposition of US sanctions presses on its industry.

The country’s oil minister granted Eway, founded in 2022 to cater to the private aviation industry, a permit in March to import low and ultra-low sulfur diesel and gasoline from its storage facility in Colombia, Eway’s executive president Luis Leon said in an interview with Bloomberg. The company is in talks with authorities on settling the sale price before bringing the fuel into the country, he added.

The move signals Venezuela’s willingness to open its monopoly on fuels given its state oil company, Petróleos de Venezuela S.A., has faced a decade-long struggle over the supply of diesel due to the mishaps of a deteriorated refining system.

Eway says its strategy is to focus on products PDVSA doesn’t provide to customers and industries, filling gaps in the local market. The initial scope will be limited to importing low sulfur diesel for industrial use only, Leon said.

The company has been importing avgas, a fuel used by small aircrafts, including air ambulances and spray crops planes, through a permit issued in 2022, becoming the first private company to enter Venezuela’s fuel market.

After decades of mismanagement in its state-owned companies, ultimately hit by US sanctions, President Nicolas Maduro has allowed more room for the private sector, in some cases even undoing expropriation policies of the late Hugo Chavez. Maduro’s government has given oil majors more operational control in their local joint ventures with PDVSA and recently allowed a foreign company to help manage Venezuela’s failing steel industry.

Industries that run on diesel for transportation and electricity have complained of shortages that risk productivity. Venezuela also rolled back a decades-long policy of subsidies for drivers and public transportation and raised fuel prices in 2020. Over time, PDVSA has struck temporary deals to import fuels with Iran and lately, after the easing of US sanctions in October, with Italy’s Eni and Spain’s Repsol.

With an investment of more than $4 million, Eway aims to increase its fuel distribution fleet and continue to expand storage capacity at airports across Venezuela, Leon said. The company currently distributes fuel in six airports through an alliance with regulators, but plans to reach nine locations in the short term.

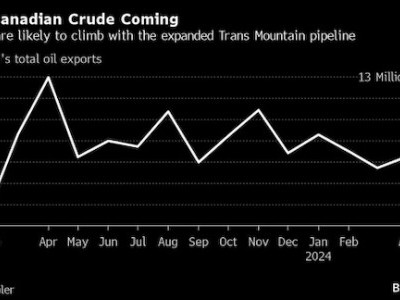

Eway’s imports are a drop in the ocean of Venezuela ’s fuel needs, which amount to 55,000 barrels a day of diesel and 105,000 barrels a day of gasoline, according to a PDVSA official. Venezuela has the largest oil reserves in the world.

Similar Stories

Iraq stops diesel import deals as refinery upgrades boost output

Iraq halted contracts to import diesel after the upgrade of some refineries helped bolster local output, putting the country on track for fuel self sufficiency.

View Article

California ports gear up to build offshore wind ports

View Article

Red Sea disruption is splitting global LNG trade in regions

View Article

One oil cargo’s odd journey highlights a global market in flux

View Article

Biden-Harris Administration celebrates progress in domestic floating offshore wind

View ArticleEngine Technology Forum calls on House leaders to prioritize action on the Diesel Emissions Reduction Act

The Engine Technology Forum issued the following statement from Executive Director Allen Schaeffer following the U.S. Senate’s passage of S. 2195.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!