Signal Tanker - Weekly Market Monitor

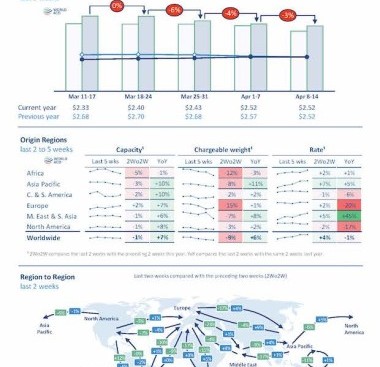

Mar 28, 2024Chart of the Week: Aframax Dirty Tonne Days Cross Med

The growth trajectory of dirty Cross Med Aframax tonne days and rates has shown a notable upward trend since mid-March

As March draws to a close, the crude freight market is witnessing a softening momentum in VLCC MEG-China rates, juxtaposed with continued weekly growth in demand tonne days. Notably, the Aframax cross Mediterranean rates have rebounded, spurred by an accelerated pace of growth in dirty tonne days since mid-March (refer to the image above).

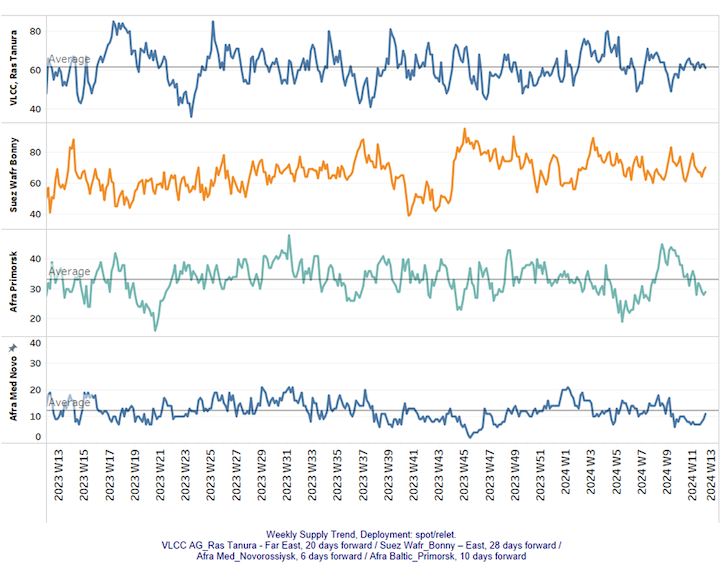

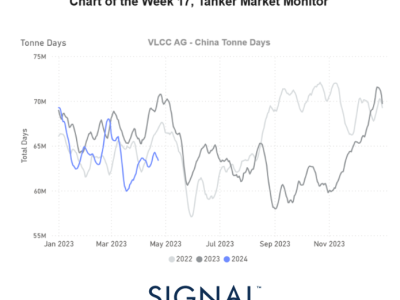

Reflecting on the first quarter of the year, the evolution of VLCC freight rates from MEG and Africa to China has been marked by challenges. Despite a promising spike in MEG-China rates in mid-February, this surge was short-lived, leaving behind a more subdued sentiment. The recent tightness in vessel supply observed in the VLCC Ras Tanura raises anticipation regarding its potential impact on market prices. However, demand in tonne days growth has yet to demonstrate a firmer pace of expansion.

Meanwhile, market discussions suggest that Chinese oil demand growth may pose further tests, as the world's second-largest economy enters a new era of lower growth. Speculations indicate that growth levels could potentially halve compared to pre-COVID 2019 levels, particularly as key segments of the Chinese economy grapple with a slowdown.

For more information on this week's trends, see the analysis sections below:

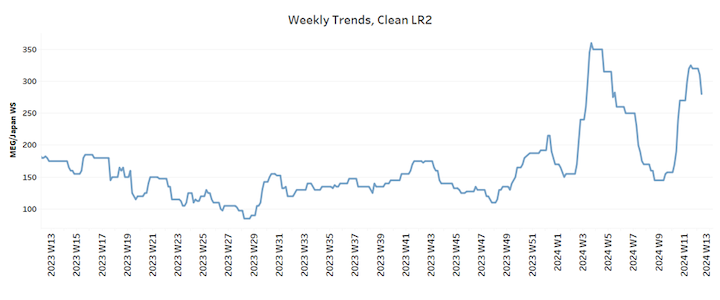

Freight Market, Supply and Demand

SECTION 1/ FREIGHT

Market Rates (WS)

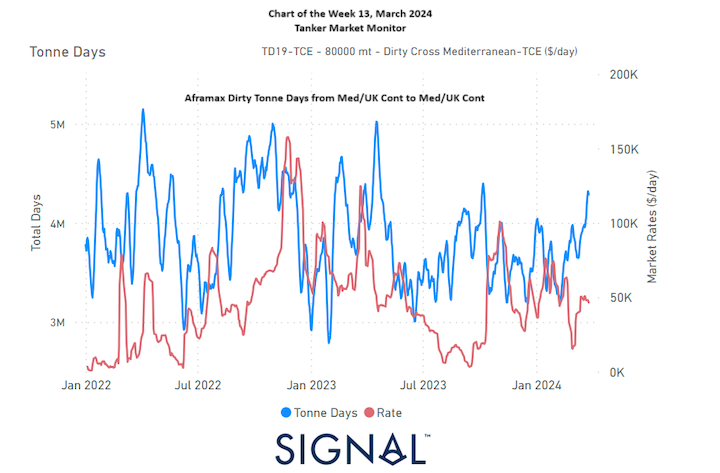

‘Dirty’ WS - Mixed

VLCC - Suezmax - Aframax

Towards the end of March, the sentiment in the crude freight market presented a mixed picture. VLCC MEG-China rates displayed a softening trend, contrasting with the steady sentiment observed in the Aframax Med rates. In the Suezmax segment, Wafr-Continent rates experienced a notable increase this week, although a peak in sentiment has not yet been reached.

• VLCC MEG-China freight rates have settled at 63WS, indicating a significant 20% decrease compared to the previous week. This figure also sits 30 points lower than the peak recorded in mid-February.

• Suezmax freight rates for shipments originating from West Africa to continental Europe have maintained a level slightly above 110WS in the final days of March, indicating a 7% weekly increase. Conversely, in the Suez Baltic Med route, rates appeared to reflect a comparable momentum, standing at 115WS, but marked a significant 38% decrease compared to the previous year.

• Aframax Med freight rates have maintained their resistance, not falling below 160WS after surpassing 175WS in the previous week. The current rates reflect a noteworthy 27% monthly increase, although they stand 35% weaker than during a comparable week a year ago.

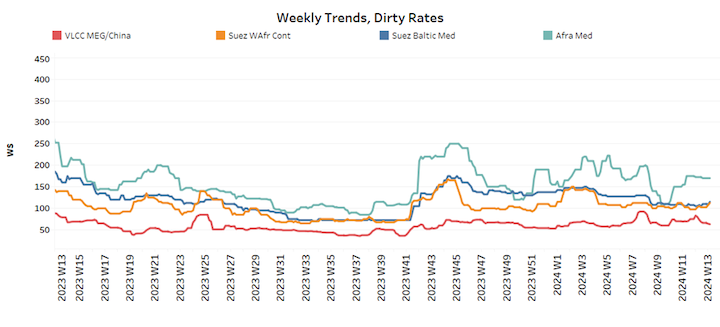

‘Product’ WS

LR2 Weaker

• LR2 AG freight rates have experienced a downturn in momentum after reaching recent weekly highs, dropping to a level below 300WS. This marks a significant 15% decrease compared to the previous week but remains 56% stronger than rates observed a month ago.

LR1 Weaker

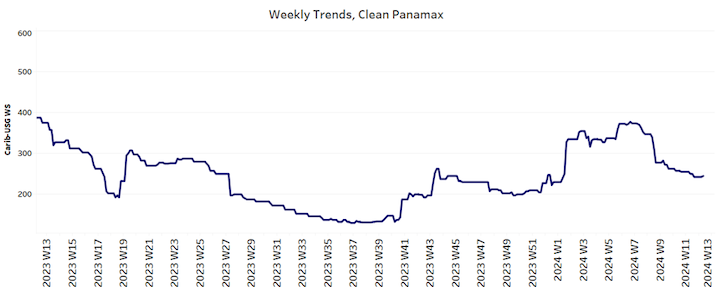

• Panamax Carib-to-USG rates have declined to 245WS, marking a 30% decrease compared to the rates observed during a comparable week just a month ago.

‘Clean’

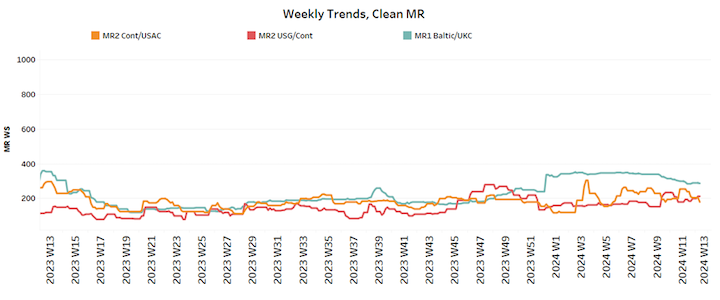

MR Mixed

• MR1 rates for shipments from the Baltic continent have remained stable, hovering around 280WS for the past ten weeks. This consistent momentum reflects a decrease of 15% from the rates observed a month ago. Meanwhile, MR2 rates for shipments from the continent to the USAC have plummeted below 200WS, indicating a significant 30% decrease compared to rates observed a month ago.

SECTION 2/ SUPPLY

'Dirty' (#vessels) - Mixed

The supply trend for crude tankers has presented a mixed picture recently. While there's been a downward trend observed in the VLCC Ras Tanura and Aframax Primorsk, an intense volatility has been recorded in the Suez Wafr-Bonny route leading up to the end of the month.

• VLCC Ras Tanura: For the second consecutive week, the ship count has maintained levels close to the annual average of 60, defying expectations of surpassing this benchmark. However, it's worth noting that the last significant low was observed during week 9.

• Suezmax Wafr: The current ship count has surged to 70, marking a notable increase, while heightened volatility has been observed over the past three weeks.

• Aframax Primorsk: The current ship count has remained consistently below 30 since the end of last week, representing a nearly 30% decrease from the peak recorded during week 9.

• Aframax Med Novo: The vessel count has consistently remained below the annual average of 10. However, recent trends suggest an uptick in activity, indicating a potential upward movement in the coming days.

'Clean'

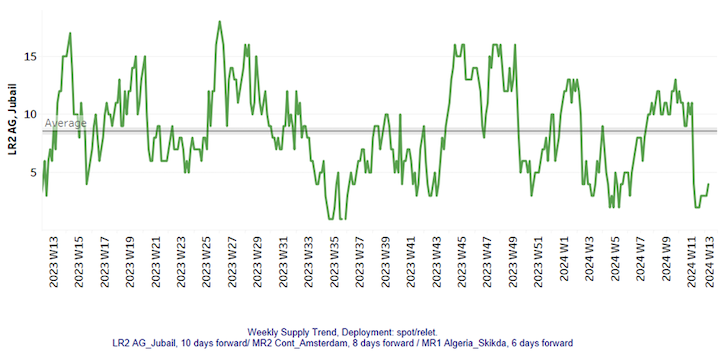

LR2 (#vessels) - Increasing

MR (#vessels) - Decreasing

• Clean LR2 AG Jubail: The downward trend observed in the previous two weeks has started to reverse to an upward trend, however, current levels are still hovering at one of the lowest points recorded since week 4.

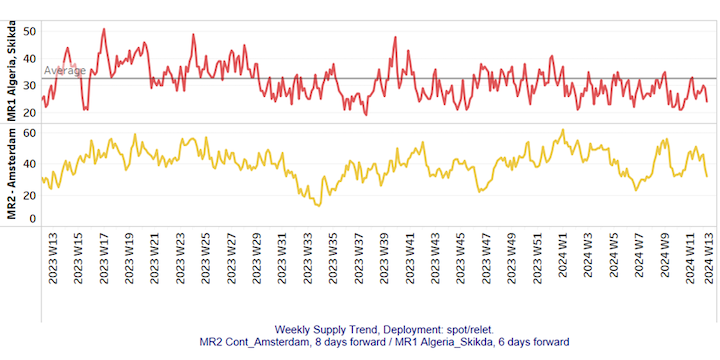

• Clean MR: Vessel activity for MR1 in Algeria's Skikda port has stayed below the annual average, with around 24 vessels recorded. Similarly, in MR2 Amsterdam, there has been a decline to 32 vessels, significantly lower than the peak of around 50 observed during week 11.

SECTION 3/ DEMAND (Tonne Days)

‘Dirty’ Decreasing

• Dirty tonne days: In the VLCC segment, the growth trajectory has closely paralleled that of Suezmax vessels over the past two weeks, following a decreasing trend towards the end of the month. Meanwhile, in the Aframax segment, the expansion of dirty tonne days seems to have slowed down, although it remains higher than the low point recorded before the end of January.

‘Clean’ Decreasing

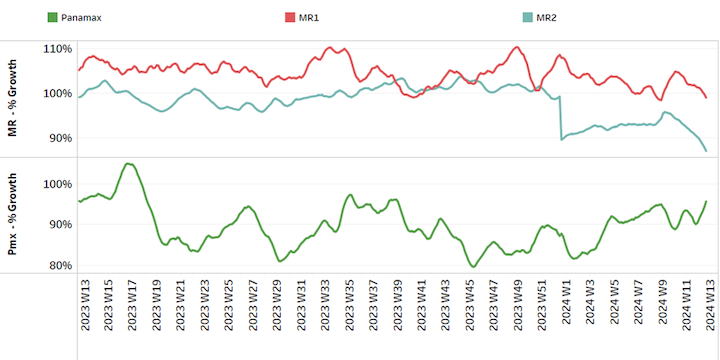

• Panamax tonne days: The final week of March saw a reversal to a firmer growth, defying previous weekly estimates that suggested a potential downward revision. However, it remains to be seen whether this trend will persist into early April.

• Clean MR tonne days: The tonne-days growth for both MR1 and MR2 vessel sizes has been persistently trending downward over the last five weeks. Interestingly, the growth of MR2 now appears to be the weakest it has been since the beginning of the year.

Similar Stories

Next US LNG export plant aims to begin production in mid-2024

Venture Global LNG Inc. expects to begin production at its second liquefied natural gas export facility in Louisiana in mid-2024, further cementing to the US as the world’s biggest supplier…

View Article

Sanctioned tankers giant passage to India is test case for oil

View Article

Baltimore’s trapped ships start leaving as new channel opens

View ArticleAdnoc buys Iraqi oil in plan to export its own more pricey crude

United Arab Emirates oil giant Abu Dhabi National Oil Co. imported a crude oil cargo in a rare move after upgrading its only refinery, which will allow it to sell…

View Article

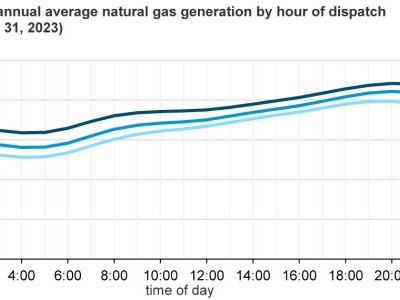

Today in Energy: U.S. natural gas-fired electricity generation consistently increased in 2022 and 2023

View Article

Tanker - Weekly Market Monitor - Week 17, April 26, 2024

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!