Qantas Finds Tonic in Cathay’s Poison as Chinese Tour Australia

The flood of cheap Chinese airfares that’s undoing Cathay Pacific Airways Ltd. is proving a boon for Qantas Airways Ltd.

Hong Kong-based Cathay posted its first loss in eight years last month, overwhelmed by pricing competition from mainland rivals including China Eastern Airlines Corp. and China Southern Airlines Co. For Qantas, it’s doing the opposite—bringing a record number of Chinese visitors to Australia and generating new business for the flagship carrier, which ferries them on its local network.

“The growth opportunity is the Chinese market,’’ Qantas Chief Executive Officer Alan Joyce, 50, said in an interview at Bloomberg’s Sydney office Tuesday. “We see the Chinese visitors exploring the entire domestic network.”

The cut-price Chinese fares that are threatening marquee Asia-Pacific carriers such as Cathay and Singapore Airlines Ltd. are supercharging one of Australia’s fastest corporate turnarounds. Joyce has led Qantas to record earnings and widened its profit margins by more than any of the world’s 20 largest airlines in the past two years, according to data compiled by Bloomberg.

Chinese tourists in Australia typically take two or three domestic flights to popular destinations such as Uluru, the Great Barrier Reef or Tasmania, according to Qantas. That’s easy money for a national carrier that controls almost two-thirds of the local market, and whose domestic network makes almost twice as much profit as its international flights.

Job Cuts

Joyce is in the final months of a three-year, A$2 billion ($1.5 billion) recovery plan that’s seen him chop thousands of jobs, cut money-losing routes to Europe, and simplify the fleet. That helped propel Qantas’s total earnings before tax and one-time items to a record A$1.53 billion in the 12 months ended June 2016.

The result was underpinned by Qantas’s lowest fuel bill in at least a decade. The price of jet fuel, at about $62 a barrel, is still less than half what it was five years back, according to data compiled by Bloomberg.

Not everyone is convinced the rebound is permanent.

Financial markets are most skeptical about Qantas’s ability to keep its international business in profit as overseas rivals add capacity, said Sean Fenton, who oversees about A$1 billion of assets including Qantas shares at Tribeca Investment Partners in Sydney. Neither do investors know how well Qantas could withstand an economic downturn, he said.

“Airlines are still cyclical,’’ said Fenton. “Does it swing to extreme losses or does it swing to smaller profits? That’s what investors need to see.’’

Amid a glut of overseas capacity, operating profit at the carrier’s international division dropped 23 percent to A$208 million in the final six months of 2016 as ticket prices fell. At the domestic business, profit declined 4 percent to A$371 million as travel tied to the resources industry ebbed following the end of the nation’s mining-investment boom.

Qantas shares have fallen about 2.5 percent in the past 12 months after more than tripling in the previous two years. Cathay shares have fallen 14 percent in the past year while the Bloomberg World Airlines Index rose 2.3 percent.

Joyce says he needs to notch up a string of consistent results to win over skeptical investors.

“The market needs to see a couple of years of billion-dollar profits,” he said. “The consistency argument comes around a bit.’’

He’s also targeting the lucrative corporate market to China. In January, Qantas, which has an alliance with China Eastern, resumed services to Beijing from Sydney for the first time since the route was axed following the global financial crisis.

Even if the route isn’t immediately profitable, Beijing will join Hong Kong and Shanghai among the carrier’s top 10 business markets within two years, he said.

“It’s a market you absolutely need to serve,” Joyce said. “We’re happy to develop a route if it’s a new route and take a couple of years to make money.’’

China will displace the U.S. as the world’s largest aviation market around 2024, according to the International Air Transport Association. Mainland Chinese airlines have opened 75 long-haul markets since 2006, led by Air China Ltd., according to the CAPA Centre for Aviation.

Australia drew 1.2 million Chinese visitors in 2016. In 10 years, that number could snowball to 4 million if projections bear out, Joyce said. Arrivals from China and Hong Kong reached fresh highs in January, Australian government data showed.

“The numbers are just phenomenal,’’ said Joyce. “It’s massive growth and a massive market.’’

Similar Stories

IAG gets EU warning shot over €400 million Air Europa deal

View Article

Air France KLM Martinair Cargo transport Lions Vasylyna and Nikola to South Africa

View Article

Air China orders homegrown C919s in challenge to jet duopoly

View Article

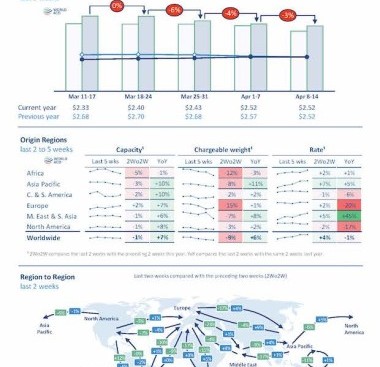

WorldACD Weekly Air Cargo Trends (week 16) - 2024

View Article

Qatar Airways Cargo elevates live animal transport launching its Advanced Animal Centre

View Article

Southwest Air pulls out of four airports in growth slowdown

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!