Into the nitty-gritty of Biden’s clean energy plan: Engineering jobs to benefit but project costs will rise

Jul 30, 2020US presidential contender Joe Biden’s Clean Energy Plan aims to achieve “net-zero” greenhouse gas emissions by 2050, a feat he proposes to bring to reality through the investment of $2 trillion across a multitude of sectors. Jobs will be created, and the plan would shift domestic labor supply and demand fundamentals, a Rystad Energy analysis reveals.

“Regardless of the political implications, this ambitious strategy would cost the domestic upstream oil and gas industry greatly and propel green energy segments forward, changing the energy landscape in the United States,“ says Rystad Energy’s Vice President at Energy Services Research, Matthew Fitzsimmons.

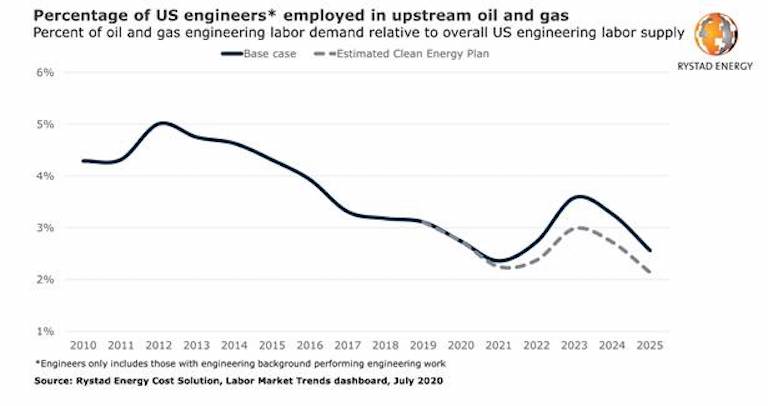

To execute the huge volume of work required, the Clean Energy Plan would draw on US engineering labor, an area which has seen steady growth over the last decade averaging a 2.6% increase per year. In contrast, domestic engineering labor demand from the upstream oil and gas industry is usually quite cyclical, and typically fluctuates based on market conditions and operator workloads.

Since 2012, demand for engineering labor in the US has either remained flat or decreased. It is true that 2018-2019 showed the first year-over-year growth in domestic engineering demand for the US oil and gas industry, however, the Covid-19 pandemic has erased these gains and then some. Biden’s plan will be welcome news for those who have been laid-off from the oil and gas industry, but it will also serve to inflate project costs when upstream work begins to pick up again.

During oil and gas up-cycles, increased wages have typically been able to entice workers and grow the oil and gas engineering labor force. This has helped maintain predictable productivity and meet the staffing needs that arise from a robust pipeline of projects, a phenomena we would expect to see in the near term as domestic engineering contracts increase in 2022 and 2023.

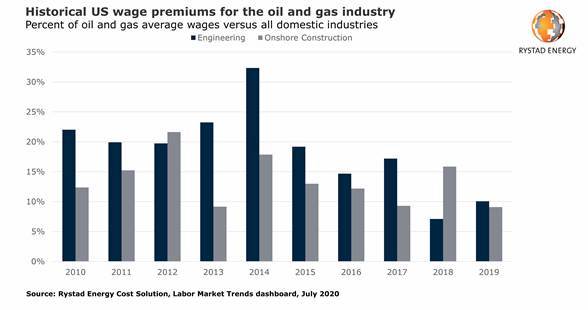

The proposed Clean Energy Plan will increase competition for these engineering resources, boosting the engineering labor base to nearly 1.5 million. Normal premiums, meaning the difference in labor rates in oil and gas relative to all industries, have ranged between 20%-30% during up-cycles, but higher than normal premiums will be required to attract talent back into the oil and gas industry when opportunities abound elsewhere. Given these changes to the engineering supply-demand balance, premiums will outstrip previous highs despite not exceeding the required full-time equivalents from the previous up-cycle.

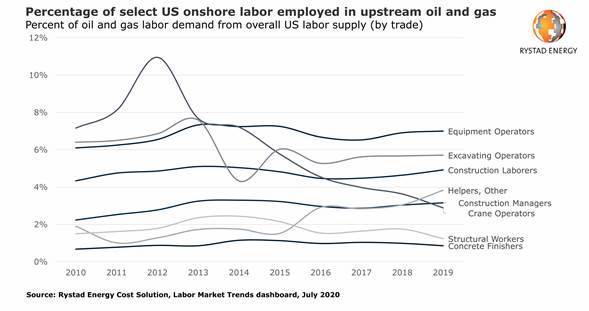

Engineers will not be the only group in high demand, as the strategy for the infrastructure, transit, power, buildings, housing and conservation segments will all require onshore construction resources. While engineers have seen a 3% swing from peak to trough in oil and gas labor demand, most onshore construction trades have seen labor demand fluctuations of less than 1%.

The difference is predominantly due to the regional nature of the work; a US engineer can work internationally, while onshore construction work must be completed at the work-site (and thus, increased international project investment won’t increase the demand for US onshore construction workers).

Rystad Energy expects oil and gas onshore construction expenditures will decline from $7.9 billion in 2019 to under $4.0 billion in 2021 (USD, real). Yet when the industry rebounds in 2023, rising to over $8.5 billion, Mr. Biden’s plan will directly compete for the same onshore construction resources as the oil and gas sector.

“We expect oil and gas premiums to rise an additional 10%-15%, on top of normal cyclical premiums – an increase which will be required to bring workers back into the industry and execute a high volume of work post-pandemic,“ Fitzsimmons points out.

Biden’s plan also calls for the increased unionization of labor. The US can look to their neighbors in the north to see how high degrees of unionization will impact future wage negotiations; while traditional US construction trades in oil and gas industry have seen wages ebb and flow with market conditions, Canadian labor unions in Alberta have prevented wage cuts despite poor market conditions.

If Biden’s vision for high construction unionization is achieved, operators and service companies alike will have to account for this changing dynamic in their upcoming project estimates and contracts. Wage reductions to counter-balance poor market conditions could become a thing of the past, echoing the stability of Alberta’s labor market.

Similar Stories

PIL accelerates fleet renewal with order for five more LNG dual-fuel vessels

View Article

Cadeler signs firm contracts with ScottishPower Renewables for East Anglia TWO foundation and turbine T&I

View Article

Final topside load-in completed for Brent field decommissioning project

View Article

U.S. summer nuclear outages declined in 2024, returning to 2022 levels

View Article

Chevron expands supply of marine lubricants to include Port Elizabeth, South Africa

View Article

Don’t EU worry. Compliance without the complexity

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!