FIS Air Freight Report July 27, 2020

Jul 28, 2020Price Comment 27th JULY 2020

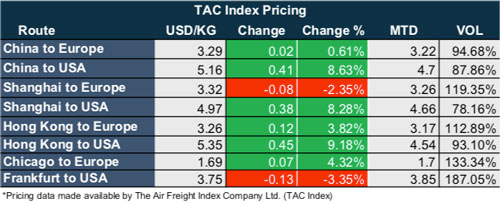

China to Europe and China to USA continue to climb in line with over-riding market sentiment indicative of a rebound in volume, with September forw ard pricing mid-value climbing 27 and 45 cents respectively along the two routes. China to Europe July 2020 MTD value settles 13 cents below its last week of trading, whilst China to USA July 2020 settles 7 cents higher, reflective of a more bullish trans-Pacific market. Europe - USA outbound continues to slowly slip, with Frankfurt to USA down 13 cents last week (although prices remain relatively high) . China to Europe Calender 2021 is priced 25 cents high on the back of an aggressive $3.50/kg offer for the full year.

Market Comment

curve upwards, whilst trans-Atlantic prices continue to dip. As we move further into a grey-zone where fresh demand meets changeable capacity.

We would see that this could create a bit of persistence on the carrier side of the market in holding on to spot pricing, creating a bit of instability in forecasting considering the lack of more than month-long fixed-price contracts.

Near-term volatility has created an action point for businesses wishing to hedge current spot market purchasing. Meanwhile, rising fuel prices (jet kerosene average prices are up 10.8% since last month) will potentially squeeze the margin's of passenger freighter and full freighter operators alike, until these costs are either hedged or passed on to the customer.

Similar Stories

SmartLynx Airlines appoints Jan as Director Flight Operations

View Article

Menzies Aviation extends MACH roll-out to 28 new locations

View ArticleIBA reports airlines surpassing pre-pandemic capacity as revenues and yield stabilize in 2024

IBA, the leading aviation market intelligence and advisory company, reports that the airline industry has recovered from the pandemic, with the outlook for 2024 showing all regions surpassing 2019 capacity…

View Article

TAP Air Portugal has resumed services to Manaus

View Article

Lufthansa Technik Logistik Services enhances visibility and improves customer satisfaction through CHAMP Cargosystems’ Shipply.Vision Truck

View Article

Pacific Air Cargo expands to Sydney, Guam and is eyeing Mexico

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!