Early 2020 drop in crude oil prices led to write-downs of U.S. oil producers assets

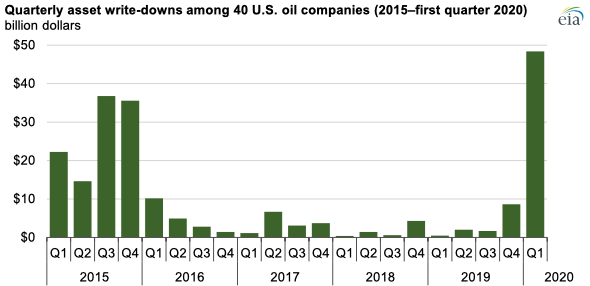

Jul 27, 2020According to publicly filed financial statements, 40 U.S. oil producers collectively wrote down $48 billion worth of assets in the first quarter of 2020, the largest quarterly adjustment since at least 2015. Low crude oil prices contributed to significant declines in revenue and the value of these companies’ proved reserves. Write-downs reflect negative adjustments in asset values, for example, when a producer acknowledges the value of an oil property has declined to less than the cost of developing it and the company updates its estimate of the property's value.

The U.S. Energy Information Administration’s (EIA) analysis presented here uses published financial reports of 40 publicly traded U.S. oil companies, as compiled by Evaluate Energy. The observations do not necessarily represent the sector as a whole because the analysis does not include private companies that do not publish financial reports. In the first quarter of 2020, the 40 publicly traded companies included in this analysis collectively produced 6.1 million barrels per day of crude oil and other liquids in the United States, or about 30% of all the U.S. liquids production for the quarter.

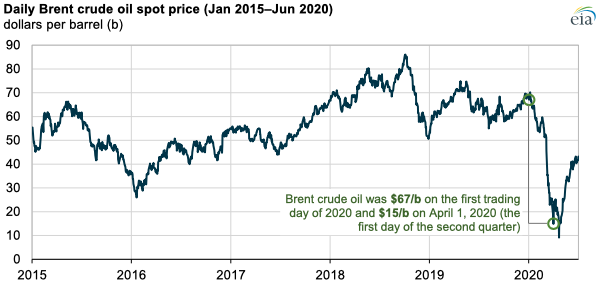

Proved reserves are estimates of oil that are recoverable under existing technological and economic conditions. As economic conditions change—especially the price of crude oil—the value of extracting these reserves changes. The price of Brent crude oil, a global benchmark, fell from $67 per barrel (b) on the first trading day of the first quarter to $15/b on April 1, the first day of the second quarter.

The $48 billion in write-downs in the first quarter of 2020 represented the largest decline in value recognized by these companies since at least 2015. Although companies will not have to value their 2020 proved reserves until the end of the year, these first-quarter adjustments, combined with crude oil prices that have remained much lower than 2019 levels during the second quarter of 2020, indicate that the net present value of proved reserves could continue to decline.

The U.S. Securities and Exchange Commission (SEC) requires public companies to report a standardized measure of the net present value of proved reserves in their annual financial reports. Companies determine an estimate of future production from their assets, then estimate revenue using the average of crude oil prices from the first trading day of each month of the previous year. These estimates of proved reserves are limited by the uncertainties inherent in any estimate, and although the SEC guidelines are standardized, estimates of production potential, technology, and asset quality are likely to vary by company.

Second-quarter 2020 financial results for these 40 companies will be released in August. Some producers announced shutting in and curtailing a number of oil wells during the quarter. Two companies in this set, Whiting Petroleum Corporation and Extraction Oil & Gas, Inc., announced bankruptcy in the second quarter of 2020, which could affect the publication of their financial statements.

Principal contributor: Jeff Barron

Similar Stories

PIL accelerates fleet renewal with order for five more LNG dual-fuel vessels

View Article

Cadeler signs firm contracts with ScottishPower Renewables for East Anglia TWO foundation and turbine T&I

View Article

Final topside load-in completed for Brent field decommissioning project

View Article

U.S. summer nuclear outages declined in 2024, returning to 2022 levels

View Article

Chevron expands supply of marine lubricants to include Port Elizabeth, South Africa

View Article

Don’t EU worry. Compliance without the complexity

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!