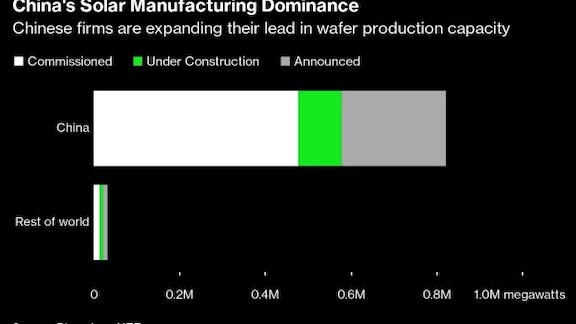

China mulls protecting solar tech dominance with export ban

China is considering an export ban that would help the nation maintain its substantial dominance in solar manufacturing just as other countries are trying to strengthen their industries.

China’s Ministry of Commerce and Ministry of Science and Technology are seeking public comment on adding some manufacturing methods key to producing advanced solar wafers on to its list of technologies it prohibits exporting. Wafers are ultra-thin silicon squares that are pieced together into solar panels, and China accounts for 97% of global output.

The move underscores the growing strategic importance governments are placing on solar manufacturing as the technology becomes the planet’s biggest source of new energy. Countries from the US to India are trying to develop domestic supply chains to chip away at China’s advantage.

“Beijing and the market leaders in China’s solar industry are undoubtedly worried about efforts from the US, EU, and India to develop homegrown solar manufacturing industries, so these recent tech export controls may very well be a response,” said Cosimo Ries, an analyst with Trivium China. “Beijing is looking to slow down the speed at which its competitors can develop their own supply chains.”

The move is still in the public consultation phase and no decisions have been made yet. Still, it’s coming just months after the US passed the Inflation Reduction Act, which includes subsidies for clean-tech manufacturing and has spurred a spate of announcements for new factories.

Chinese firms have spent the past decade developing cutting-edge technology to produce bigger, thinner wafers that have played a big part in reducing the cost of solar power by more than 90%. If foreign manufacturers have to use older wafers, it will diminish the cost competitiveness of their panels, Ries said.

Considering China’s dominant position in wafers and the segment’s relatively high barriers for entry, it’s reasonable for China to consider the ban to avoid leaking technology to overseas players, Daiwa Capital Markets analysts said in a research note Thursday.

Similar Stories

Mexico trade surplus soars as slowing demand damps imports

Mexico’s trade surplus was four times as large as economists had forecast in March as slowing demand damped imports.

View ArticleBritons finally taste full Brexit as costly border checks begin

EU food imports to the UK are about to get more expensive and complicated as the British government implements the Brexit deal.

View Article

Xi warns Blinken against ‘vicious competition’ between US, China

View Article

Sanctioned tankers giant passage to India is test case for oil

View ArticleNCBFAA elects new officers and board members for 2024-2026

The National Customs Brokers and Forwarders Association of America (NCBFAA), following its 51st Annual Conference in Fort Lauderdale, Florida, on April 14-17, finalized its election today of a new slate…

View ArticleAdnoc buys Iraqi oil in plan to export its own more pricey crude

United Arab Emirates oil giant Abu Dhabi National Oil Co. imported a crude oil cargo in a rare move after upgrading its only refinery, which will allow it to sell…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!