WorldACD weekly air cargo trends (week 23):

Jun 16, 2023Despite a small uptick in global air cargo tonnages week on week, figures for the last two weeks combined point towards the downward trend in tonnages continuing in June, with average rates also continuing the year-long pattern of slow year-on-year (YoY) decline, along with progressive increases in capacity, according to the latest weekly figures from WorldACD Market Data.

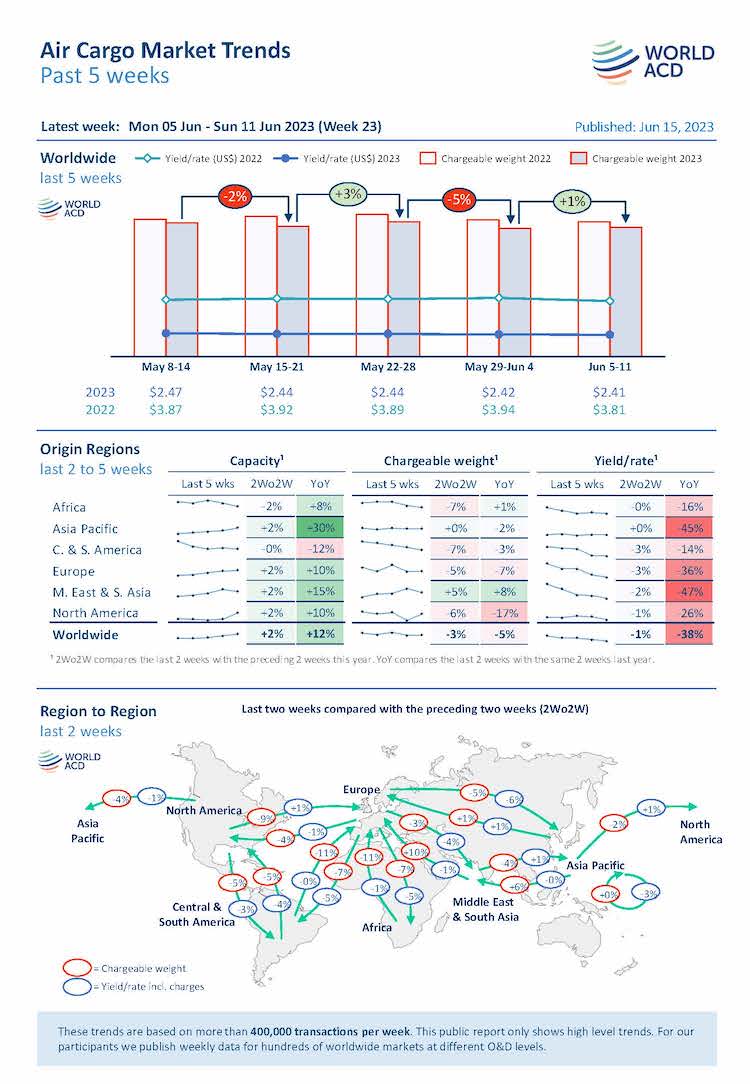

Figures for week 23 (5 to 11 June) show a slight increase of +1% in tonnages and almost stable average global air cargo prices, week on week (WoW), after tonnages dropped by -5% at the end of May and the beginning of June – based on the more than 400,000 weekly transactions covered by WorldACD’s data.

Comparing weeks 22 and 23 with the preceding two weeks (2Wo2W), overall tonnages decreased by -3% versus their combined total in weeks 20 and 21, with capacity up +2% and average worldwide rates slightly falling (-1%).

At a regional level, all origin regions showed a downward trend in tonnages on a 2Wo2W basis, except ex-Middle East & South Asia (+5%) and ex-Asia Pacific (flat).

Region to region, notable decreases can be observed between Europe and Central & South America (northbound -11%, southbound -7%), between North America and Europe (eastbound -9%, westbound -4%), between North America and Central & South America (both directions -5%), and between Europe and Africa (northbound -11%, southbound -7%). Ex-Europe to Asia Pacific is also on a downward trend (-5%), while Middle East & South Asia to Europe (+10%) and outbound Asia Pacific to Middle East & South Asia (+6%) continue to record growth, similar to last week’s report.

On the pricing side, although average yields ex-Asia Pacific and ex-Africa remained more or less stable, on a 2Wo2W basis, pricing was down from all the other main origin regions, with rates ex-Europe to Asia Pacific showing the most notable decrease (-6%), followed by ex-Europe to Africa (-5%) and to Central & South America (-5%).

Year-on-Year perspective

Comparing the overall global market with this time last year, chargeable weight in weeks 22 and 23 was down -5% compared with the equivalent period last year. The most notable changes include a double-digit percent decrease in year-on-year (YoY) tonnages ex-North America (-17%) and ex-Europe (-7%), while traffic ex-Middle East & South Asia was up +8%, YoY.

Overall capacity has increased by +12% compared with the previous year, with double-digit percentage increases from all regions except Africa (+8%) and Central & South America (-12%). The most notable increase was ex-Asia Pacific (+30%).

Worldwide average rates are currently -38% below their levels this time last year, at an average of US$2.41 per kilo in week 23, although they remain significantly above pre-Covid levels (+36% compared to June 2019).

Similar Stories

American Airlines becomes only carrier to fly nonstop between Washington, D.C., and San Antonio

View ArticleOpen Skies agreement with the Dominican Republic enters into force

The U.S.-Dominican Republic Air Transport Agreement entered into force on December 19. This bilateral agreement establishes a modern civil aviation relationship with the Dominican Republic consistent with U.S. Open Skies…

View Article

WorldACD Weekly Air Cargo Trends (week 50) - 2024

View Article

Aeromexico now connects Miami with Cancun

View Article

EUROCONTROL Aviation long term outlook expects aviation to reach 15.4 million flights in 2050

View Article

Etihad Cargo adds Paris to freighter network with new weekly service

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!