When Europe’s proposed carbon rules hit oil guzzling industries

The EU’s sweeping proposals to curb greenhouse emissions are likely to upend the continent’s oil demand over the years and decades to come. Here’s a run through the plans—and key timings—for aviation, shipping and makers of road-fuel.

It’s important to remember that the proposals come from the European Commission and still require endorsement from both EU member states—like France and Germany—and the European Parliament to become laws. The whole process usually takes about two years, sometimes longer.

Aviation

The EU is planning to toughen greenhouse-gas emission rules for airlines. While flights within the bloc have already been included in its carbon market since 2012, the European Commission has now proposed phasing out free permits that carriers currently receive to cover their pollution.

- The number of such allowances will be gradually reduced to zero by the end of 2026, according to a proposal to reform the EU Emissions Trading System.

- The EU is hoping that will help cut greenhouse gases by the industry after aviation emissions increased 5% year-on-year between 2013 and 2018. The pollution levels dropped recently because of the pandemic, but they are forecast to grow further in the coming years.

- The EU’s measures also include requirements for airlines to increase the amount of sustainable aviation fuel, or SAF, blended in with kerosene on flights. The EU will mandate a 2% blend from 2025, rising ultimately to 63% by 2050. Currently, SAF amounts to less than 1% of total jet fuel, with cost and lack of supply the biggest hurdles.

- In addition, the EU is going to implement the international offsetting system, known as CORSIA, for flights into and out of the European Economic Area. When emissions from flights outside the EEA reach levels above 2019, they will have to be offset with corresponding carbon credits.

- The Commission wants offsets to be bought by airlines to contribute to emissions reductions in countries that participate in the Paris Agreement and, from 2027, in CORSIA.

Shipping

In 2019, OECD Europe’s oil-derived marine fuel market was 50.6 million tons, according to the International Energy Agency. That’s about 925,000 barrels a day, or, about 1% of global oil demand. As part of its proposals, the EU announced plans to include shipping in its Emissions Trading System, and a FuelEU Maritime initiative that aims to boost uptake of sustainable fuels.

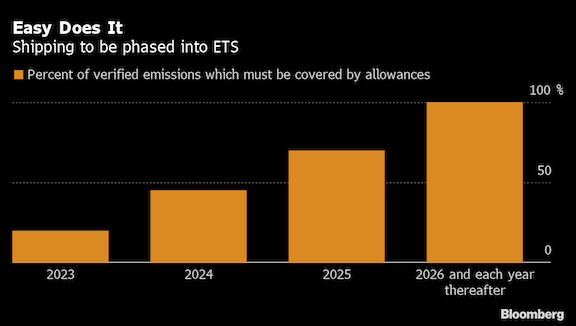

- The ETS proposal would be phased in from 2023. The rules would apply to 100% of emissions for ships sailing to and from EU member states, and 50% of the emissions for ships traveling between the bloc and non-member states.

- The FuelEU Maritime initiative would be phased in from 2025 and ramped up more slowly. It limits the greenhouse gas intensity for energy used on board ships and applies to voyages in the same way as the ETS—100% of the energy used for intra-EU, 50% for journeys between the bloc and non-member states. The required reductions are against a baseline year of 2020.

Road Fuel

The EU is seeking to establish a new emissions-trading program for heating and road transport fuels. The market, adjacent to the existing EU ETS, will regulate fuel suppliers rather than households or car drivers.

- The system will start tp take effect from 2026. To prevent price spikes, the Commission proposed a mechanism that will inject emissions permits into the market from a special reserve if certain cost thresholds are breached.

- Consumers will be purchasing a lot less fuel for new vehicles if the EU succeeds in raising its target for CO2 emissions reduction from cars to 55%, from 37.5%, by the end of the decade.

- Researcher IHS Markit predicts that if the stricter goal is implemented, 55% of vehicles sold in 2030 will be powered entirely by battery. Traditional internal combustion engines will be virtually non-existent by then, with hybrid and plug-in hybrid powertrains making up the rest of the auto market.

Similar Stories

Inauguration of the Fly’in technology center: Daher paves the way for the future of decarbonized aviation

View Article

LNG powers unprecedented year for orders of alternative-fueled vessels

View ArticleHorizon Aircraft signs Letter of Intent with Discovery Air Chile Ltda., expanding global presence of Cavorite X7 Hybrid eVTOLs

New Horizon Aircraft Ltd. (NASDAQ: HOVR), doing business as Horizon Aircraft (“Horizon Aircraft” or the “Company”), a leading hybrid electric Vertical Take-Off and Landing (“eVTOL”) aircraft developer, announced today it…

View Article

Since the 2011 Fukushima accident, Japan has restarted 14 nuclear reactors

View Article

WorldACD Weekly Air Cargo Trends (week 1) - 2025

View Article

Castor Marine becomes part of the Navarino Group

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!