Up to 3 million bpd of extra oil can hit the market from April, more coming in May - Rystad Energy

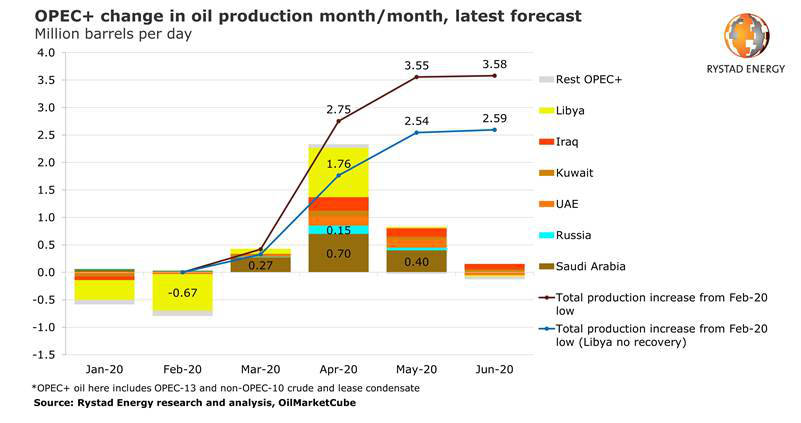

Mar 18, 2020rysThe extra oil coming into the global market from April will be as much as 3 million barrels per day (bpd), Rystad Energy estimates. Two million bpd is what OPEC+ countries are realistically able to add next month based on their storage, spare capacity and ramp up capabilities. Another million bpd could come if a cease-fire is agreed upon in Libya and the country reaches pre-shut-in levels.

The additional product comes at a time when there is an existing global supply surplus. Before the OPEC+ meeting earlier this month, Rystad Energy had calculated that cuts of about 2 million bpd were needed to balance the market.

Since then, the world’s global demand has also seen a steep decline as flight cancellations, industrial shutdowns, quarantines and travel bans have further reduced the need for oil consumption by many more millions of bpd, widening the imbalance that already existed before the OPEC+ meeting.

The oil price is soon expected to slide even lower once the extra supply becomes available from April. But that’s not the end of it, as OPEC+ could add another 800,000 barrels of oil from May, ramping up production from its spare capacity even further.

Separately, Libya itself could make use of more of its total production capacity in a cease-fire scenario, which is as high as 2.8 million bpd. The country’s current output is less than 100,000 barrels per day due to the ongoing conflict.

“Any large political power sometimes needs to remind its adversaries and competitors of its might. We believe Saudi Arabia seeks to teach the market a lesson,” says Bjørnar Tonhaugen, Rystad Energy’s Head of Oil Markets.

There is a risk of production shut-ins as the world’s oil storage capabilities will be put to the test, with oil’s spot price subsequently collapsing, Tonhaugen adds, in which case countries with higher break-even prices will be the first to be affected.

Breaking down the additional oil production capability of the OPEC+ countries, Saudi Arabia will be the producer that plans to add the most, reaching total supply capabilities of 12.3 million bpd. We believe their upstream crude production capacity, without any additional drilling, is limited to around 11.5 million bpd in the short term.

For now, we expect the country’s April crude production to rise to between 10.8 million and 11 million bpd from 9.8 million bpd in February, and further to 11.2 million bpd in May. The remaining oil could come from its global storage facilities, in order to meet the 12.3 million bpd target.

We expect that Russia can increase production by at least 300,000 bpd in the next 90 days, according to guidance provided by Energy Minister Alexander Novak, but for now we include a more conservative increase of about 200,000 bpd in our estimates.

We expect UAE production to increase by about 200,000 bpd to 3.20 million bpd in April from February’s 3.04 million bpd, mostly from its flagship Murban onshore field. We acknowledge that the UAE could manage to increase production even higher if it utilizes its entire spare capacity.

A 110,000-bpd increase is also expected from Kuwait in April, raising its total production to 2.80 million bpd, with less upside risk than for UAE, Russia and Saudi Arabia.

The last major country with ample available spare capacity to potentially bring to the market in April is Iraq. Based on our analysis, Iraq will ramp-up production by 250,000 bpd to nearly 4.9 million bpd in April. If Iraq finds buyers for this additional crude, its total spare capacity of 480,000 bpd could be back online by June.

Similar Stories

Change of Ørsted Region Americas CEO

View ArticleElkem reaches major milestone in advancing the circular economy for silicones

View Article

Strategic Marine delivers first purpose new build IMO Tier III CTV For Poland’s Offshore Wind Sector

View Article

U.S. Department of Energy: $20.2 million in projects to advance development of mixed algae for biofuels and bioproducts

View Article

New funding propels Pier Wind at Port of Long Beach

View Article

Most U.S. petroleum coke is exported

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!