Truckload freight recovery picks up speed heading into June

Jun 04, 2020Spot truckload freight markets continued to gather momentum last week as load-to-truck ratios increased for dry van, refrigerated, and flatbed freight, said DAT Solutions, which operates the industry’s largest load board network. Truckload rates followed suit, rising on most lanes just in time for June, typically a peak month for the spot market.

The number of posted loads on the DAT network jumped nearly 10% during the week ending May 31, which had one fewer workday because of Memorial Day.

Compared to April, load-posting activity on the spot market increased 79.6% in May while truck posts declined 15.7%.

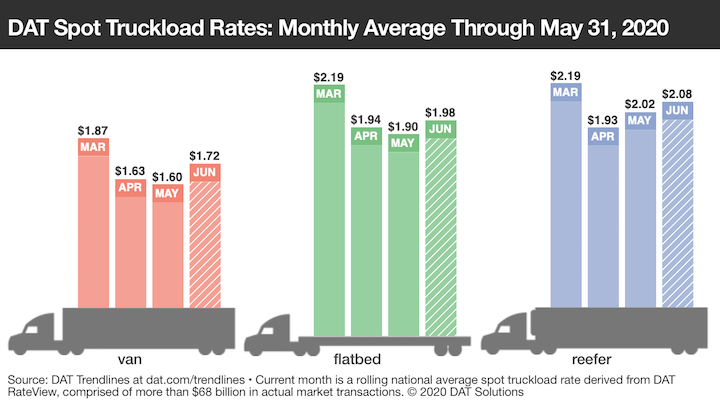

National Average Spot Rates Through May 31

- Van: $1.60 per mile, 3 cents lower than the April average

- Flatbed: $1.90 per mile, 4 cents lower than April

- Reefer: $2.02 per mile, 9 cents higher than April

Those are rolling averages for the month and current rates are higher. On June 1, the van spot rate averaged $1.72 a mile, the flatbed rate was $1.98, and the reefer rate was $2.08

Trendlines

Van activity at 2019 levels: At 2.8 loads per truck, the national average van load-to-truck ratio is tracking closely to the same period in 2019, a soft year for spot freight but an improvement compared to the last five weeks.

Spot rates were higher on 79 of DAT’s top 100 van lanes by volume compared to the previous week. The number of loads moved on those 100 lanes was lower by an average of 18%, in line with expectations for a holiday-shortened work week.

Retail hubs make gains: Outbound rates increased in several retail freight markets. Los Angeles averaged $2.32 per mile, up 12 cents compared to the previous week, while Stockton, Calif., averaged $2.09 per mile, up 15 cents.

Rates from Atlanta ($1.80, up 9 cents), Charlotte, N.C. ($1.82, up 14 cents), and Columbus, Ohio ($1.85, up 14 cents) also made strong gains.

Flatbeds improve: The national average flatbed spot rate is less than $2 a mile on a 19.2 load-to-truck ratio but several lanes are reflecting increased demand for trucks. Among them:

- Birmingham, Ala., to Chicago jumped 21 cents to an average of $2.09 per mile

- Roanoke, Va., to Baltimore rose 17 cents to 2.52 a mile

Produce season swings higher: The national average reefer load-to-truck ratio was 3.7 last week, a half-point higher than the previous week.

Rates increased on 42 of the top 72 reefer lanes by volume. Fourteen lanes had lower rates compared to the previous week and half of those were out of Florida. In a one-week period, Miami to Atlanta went from an average of $1.87 to $1.68.

Cross-border reefer freight peaking: Peak shipping season for Mexican produce is driving demand for trucks in Nogales, Ariz., McAllen, Texas, and Ontario, Calif. Examples:

- Nogales to Dallas increased 29 cents to an average of $2.89 per mile. That lane averaged $1.88 a month ago

- Nogales to Chicago shot up 23 cents to $2.41, an increase of 69 cents over the last four weeks

This summary’s month-to-date national average rates were generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $68 billion in freight payments. Actual spot rates are negotiated between the carrier and the broker.

Similar Stories

Biden-Harris Administration announce nearly $1.5 billion in additional upgrades to America’s busiest rail corridor

View Article

Schneider recognized as a Top Company for Women to Work in Transportation for sixth consecutive year

View Article

NCCC announces tentative national agreement with SMART-MD

View Article

Savannah container volumes up 10 percent in October

View ArticleNorfolk Southern to add new independent director to board via cooperation agreement with shareholder Ancora

Norfolk Southern Corporation ("Norfolk Southern" or the "Company") today announced that it has entered into a cooperation agreement with Ancora Holdings Group, LLC (together with certain of its affiliates, "Ancora")…

View Article

NationaLease salutes outstanding achievement and service at the 2024 Canadian Leadership Summit

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!