The United States exported a record volume of natural gas in 2023

Apr 15, 2024

Data source: U.S. Energy Information Administration, Natural Gas Monthly

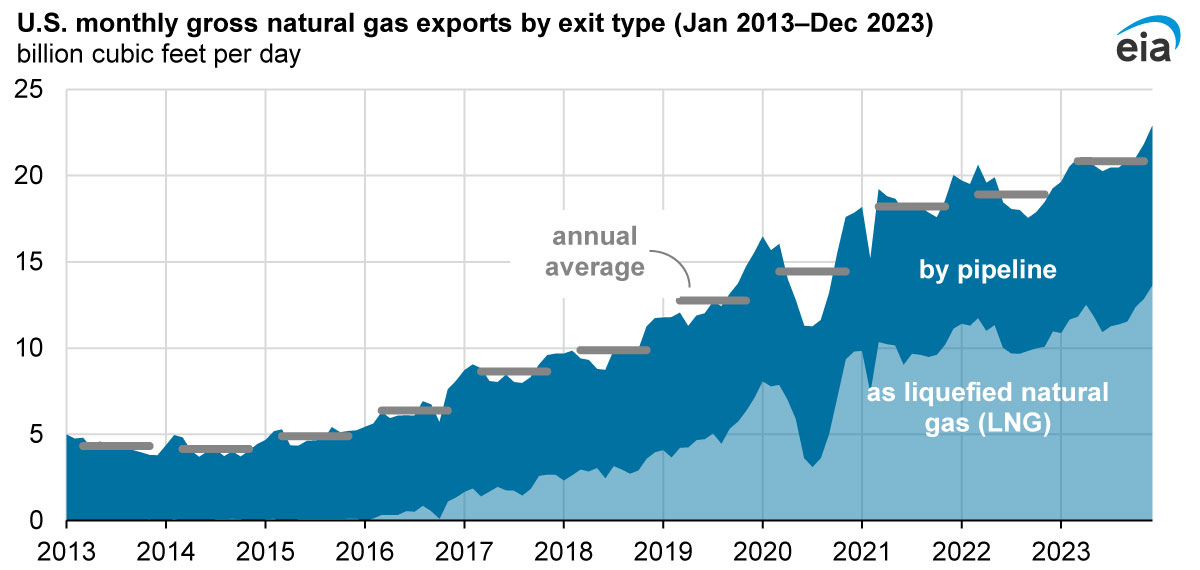

The United States exported 10% more natural gas in 2023 than in 2022, a record of 20.9 billion cubic feet per day (Bcf/d), according to our Natural Gas Monthly. U.S. liquefied natural gas (LNG) exports accounted for more than half of all U.S. natural gas exports, and natural gas exports by pipeline to Canada and Mexico accounted for the remainder.

LNG exports: LNG exports continued to drive the growth in total U.S. natural gas exports last year, increasing 12% (1.3 Bcf/d) from 2022. U.S. LNG exports averaged a record 13.6 Bcf/d in December 2023. The United States began exporting LNG from the Lower 48 states in 2016 when Sabine Pass LNG—the first LNG export terminal in the Lower 48 states—began operations. The United States supplied nearly half of Europe’s LNG imports last year.

Exports by pipeline: U.S. natural gas exports by pipeline also increased last year. Exports to Canada increased 7% to 2.8 Bcf/d, and exports to Mexico increased 8% to 6.1 Bcf/d. In 2023, natural gas exports from the Northeast rose by more than 15% (0.2 Bcf/d), accounting for most of the increase in total natural gas exports to Canada. Most pipeline exports from the United States to Canada exit through New York in the Northeast and Michigan in the Midwest.

Pipeline exports to Mexico from Texas increased 9% to 5.6 Bcf/d in 2023, with most of the growth coming from exports from West Texas, which increased by 20% (1.6 Bcf/d) compared with 2022. Natural gas pipeline exports from West Texas to Mexico have grown steadily since 2017 as more connecting pipelines in Central and Southwest Mexico have entered service.

Since 2017, the United States has exported more natural gas than it has imported. Prior to 2017, the last time U.S. natural gas exports exceeded natural gas imports was in 1956. Even as a net natural gas exporter in 2023, the United States imported 8.0 Bcf/d of natural gas, primarily by pipeline from Canada.

Data source: U.S. Energy Information Administration, Natural Gas Monthly

Note: LNG=liquefied natural gas

Imports by pipeline: U.S. natural gas imports by pipeline, which come primarily from Canada, decreased by 3% last year compared with 2022 to 8.0 Bcf/d. Natural gas imports from Canada, which exceed U.S. natural gas exports to Canada, help support seasonal fluctuations in natural gas consumption in the United States and generally peak in January or February. Imports from Canada in January and February 2023 fell by 6% from the same period in 2022, in part because of milder winter weather and less natural gas consumption in the U.S. residential and commercial sectors. Wildfires in western Canada in April and May 2023 also disrupted deliveries from Canada, and imports from Canada in those months averaged 9% less than in the same period in 2022.

LNG imports: U.S. LNG imports are much smaller than natural gas imports by pipeline, and the United States imported less than 0.1 Bcf/d of LNG during the last two years. Almost all LNG imports are delivered to the New England market, where natural gas imports have been an important source of supply during periods of high demand, particularly in the winter. Warmer-than-average temperatures in the Northeast at the beginning and end of 2023 reduced natural gas demand, resulting in lower LNG imports compared with 2022.

The United States exported 10% more natural gas in 2023 than in 2022, a record of 20.9 billion cubic feet per day (Bcf/d), according to our Natural Gas Monthly. U.S. liquefied natural gas (LNG) exports accounted for more than half of all U.S. natural gas exports, and natural gas exports by pipeline to Canada and Mexico accounted for the remainder.

LNG exports: LNG exports continued to drive the growth in total U.S. natural gas exports last year, increasing 12% (1.3 Bcf/d) from 2022. U.S. LNG exports averaged a record 13.6 Bcf/d in December 2023. The United States began exporting LNG from the Lower 48 states in 2016 when Sabine Pass LNG—the first LNG export terminal in the Lower 48 states—began operations. The United States supplied nearly half of Europe’s LNG imports last year.

Exports by pipeline: U.S. natural gas exports by pipeline also increased last year. Exports to Canada increased 7% to 2.8 Bcf/d, and exports to Mexico increased 8% to 6.1 Bcf/d. In 2023, natural gas exports from the Northeast rose by more than 15% (0.2 Bcf/d), accounting for most of the increase in total natural gas exports to Canada. Most pipeline exports from the United States to Canada exit through New York in the Northeast and Michigan in the Midwest.

Pipeline exports to Mexico from Texas increased 9% to 5.6 Bcf/d in 2023, with most of the growth coming from exports from West Texas, which increased by 20% (1.6 Bcf/d) compared with 2022. Natural gas pipeline exports from West Texas to Mexico have grown steadily since 2017 as more connecting pipelines in Central and Southwest Mexico have entered service.

Since 2017, the United States has exported more natural gas than it has imported. Prior to 2017, the last time U.S. natural gas exports exceeded natural gas imports was in 1956. Even as a net natural gas exporter in 2023, the United States imported 8.0 Bcf/d of natural gas, primarily by pipeline from Canada.

Similar Stories

Brin-backed carbon removal startup nears firing up its new plant

View Article

Skanska awarded contract to develop offshore wind port at South Brooklyn Marine Terminal

View Article

Deal time: Global upstream opportunities valued at $150 billion expected to fuel M&A activity in 2024 /Rystad Energy

View Article

U.S. energy-related CO2 emissions decreased by 3% in 2023

View ArticleKey insurer says Russia oil price cap increasingly unenforceable

A Group of Seven-imposed cap on the price of Russia oil is becoming increasingly unenforceable, an organization at the heart of the global insurance industry said, offering one of the…

View ArticlePetroChina profit rises as economic recovery remains uneven

PetroChina Co. recorded its highest first-quarter profit amid steady global oil prices and even as China’s economic rebound struggles to gain traction.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!