The US is set to experience yet a new energy revolution: Offshore Wind

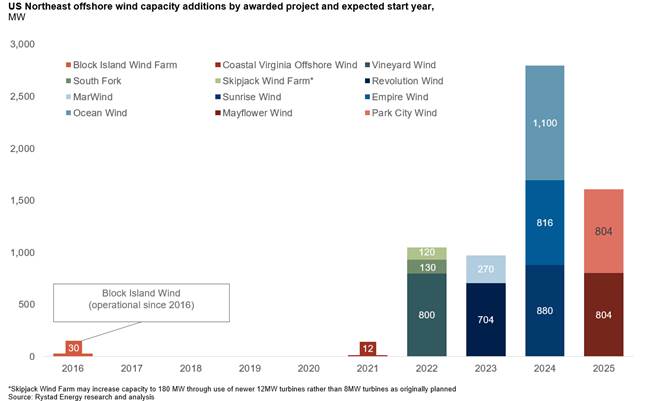

Jan 21, 2020According to fresh research by Rystad Energy, installed offshore wind capacity in US waters could reach 20 gigawatts (GW) by 2030 and annual investments in the sector could surpass $15 billion by the mid-2020s. Such a trajectory means capital expenditure in US offshore wind will likely exceed those in US offshore oil and gas within the next five years – a truly remarkable development.

“There are currently 6 GW of offshore wind projects in the US that have been sanctioned for development, requiring collective investments of more than $20 billion over the next five years. Assuming continued support from the regulators, many more projects will be sanctioned in the coming years and we expect to see yearly investments in the sector exceed $15 billion by the middle of the decade,” says Tim Bjerkelund, Head of Consulting New York at Rystad Energy. “That would certainly signal an energy revolution and offshore suppliers should take note.”

By comparison, Rystad Energy expects annual expenditure on US offshore oil and gas projects to average $14.8 billion between 2020 and 2025.

The US Northeast has for decades been dependent on importing energy, either from other states or from other countries. Renewable energy could offer a remedy but wind and solar projects are typically land-intensive, which poses problems in areas of high population density such as the US Northeast.

“This is reminiscent of problems faced by European countries, and the states in the Northeast have wisely picked up the same playbook. Benefiting from the technological developments and cost efficiencies introduced in the North Sea, these states are adopting the lessons learned and are rapidly rolling out targets for a much higher share of renewables in their power mix,” Bjerkelund says.

Projects such as Vineyard Wind are expected to see costs close to the levels of European projects. This bodes well for an industry that is still in its infancy. According to the Energy Information Administration, the potential for offshore wind in the US is 7200 TWh. If all of this were to be realized, it would equal hundreds of projects similar to the ones already sanctioned, with each requiring investments of around $3 billion on average.

“The emergence of offshore wind as an industry in the US is truly exciting. The energy transition is taking place now – not through small test projects, but through utility scale projects that each require billions of dollars in investment. US suppliers should take note – this new industry could outgrow offshore oil and gas in only a few years’ time, providing lots of new opportunities,” Bjerkelund concludes.

Similar Stories

Container vessel orders up by over 50% in 2024

View Article

HT PEM fuel cell veteran joins Blue World Technologies

View Article

WorldACD Weekly Air Cargo Trends (week 44) - 2024

View Article

Greater New Orleans, Inc. celebrates passage of Constitutional Amendment 1

View Article

AVAT and KBB are going to cooperate in the digitalization of turbochargers

View Article

Drought conditions reduce hydropower generation, particularly in the Pacific Northwest

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!