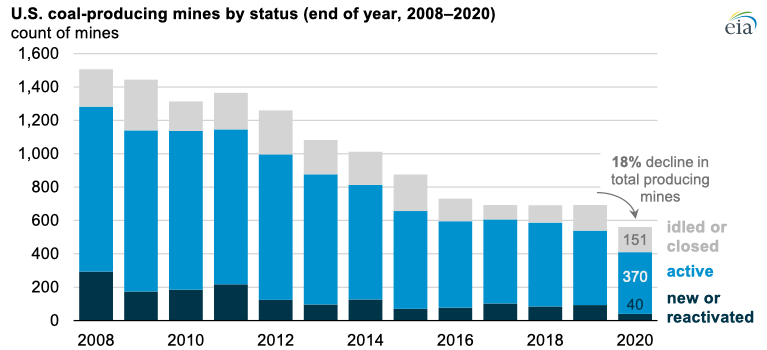

The number of producing U.S. coal mines fell in 2020

Jul 30, 2021By the end of 2020, the number of producing coal mines in the United States fell to 551 mines, the lowest number since U.S. coal production peaked in 2008. In 2020, 40 coal mines were opened or reactivated, and 151 mines were idled or closed. This overall decrease resulted in an 18% annual decline in the total number of producing coal mines from 2019 and a 62% decline since 2008. Shutting down less efficient mines while adding relatively few new mines and reactivating few idled mines resulted in the reduction in 2020.

A comparable drop in producing U.S. coal mines (17%) happened in 2016, when coal producers faced challenging market conditions that resulted in numerous bankruptcies and industry consolidation. The declining number of new mines in recent years reflects reduced investment in the coal industry in the United States, less demand for coal internationally, and less demand for coal in the U.S. electric power sector.

Lower natural gas prices in 2020 made coal less competitive than natural gas for power generation. Because natural gas was cheaper than coal and electricity consumption in general dropped in 2020, U.S. coal-fired generation fell 20% from 2019.

As the U.S. coal market contracted after 2008, smaller, less efficient mines were the first to close, and the majority of mine closures occurred in the Appalachia region. The Appalachia region still has the most coal mines in the country, even though more than half of its mines have closed since 2008. As of 2020, the Appalachia region had 285 surface mines and 164 underground mines. Although the Appalachia region has fewer underground mines than surface mines, more than 80% of its coal production in 2020 came from underground mines.

The Western coal region has fewer mines than the Interior or Appalachia regions, but Western mines collectively provide the majority of the coal produced in the country. Coal production in the Western region primarily comes from large surface mines in the Powder River Basin. Since 2008, the number of coal mines in the Western region has declined from 58 mines to 45 mines—only 1 of those 13 closures was in the Powder River Basin.

So far in 2021, U.S. coal production has increased from 2020 levels. We expect increased U.S. coal production to continue for the remainder of 2021. In our latest Short-Term Energy Outlook, we forecast U.S. coal production will increase by 15% in 2021 from 2020 levels. Increased production could result in some idled U.S. coal mines reopening in 2021.

Principal contributor: Rosalyn Berry

Similar Stories

IAG Cargo transitions 160-truck fleet at London Heathrow to hydrotreated vegetable oil

View Article

Ørsted inaugurates the Asia-Pacific region’s largest offshore wind farms

View Article

Mild bullish skew as northern summer approaches - Rystad Energy’s Gas and LNG Market Update

View ArticleChina pays less for Venezuelan oil after US reimposes sanctions

Chinese refiners are paying a little less for Venezuelan oil after the US reimposed sanctions on the South American producer.

View Article

Asahi Kasei to construct a lithiumion battery separator plant in Canada

View Article

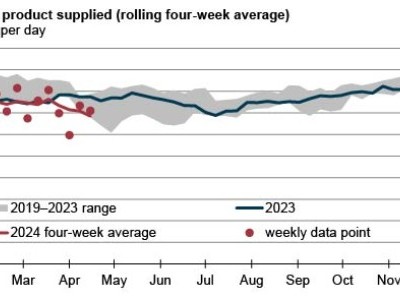

Low U.S. distillate consumption reflects slow economic activity and biofuel substitution

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!