Strong investment in cargo facilities at Schiphol despite global airfreight volume dip

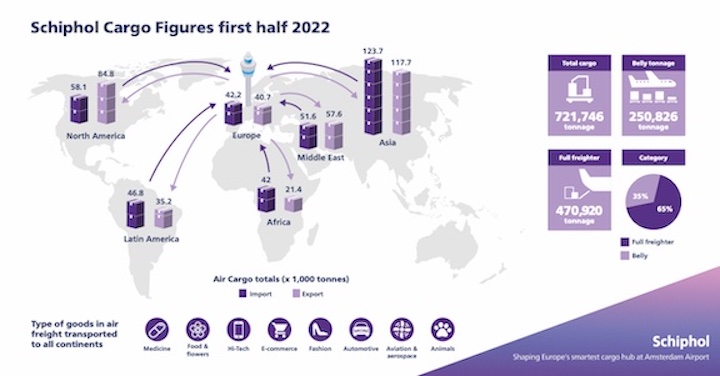

Sep 08, 2022Amsterdam Airport Schiphol’s total cargo volume for the first six months of 2022 decreased by -13.8% to 721,746 tonnes compared to the first six months of 2021, in line with global cargo trends.

Half year cargo 2022 figures show decreased throughput year-on-year, with inbound cargo volumes decreased by -17.5% to 364,376 tonnes, and outbound cargo volumes also decreased by -9.7% to 357,369 tonnes during the same period in 2021.

The top three destinations for cargo by tonnage were Shanghai, China; Dubai, United Arab Emirates; and Chicago, USA.

Freight volumes were shipped in two categories of flights: full freighters, which accounted for 65% of total volumes, and passenger flights at 35% of total volumes.

Market development

Outbound cargo to the Asian region from Schiphol decreased by -10.3% to 117,694 tonnes, while inbound traffic from the region also went down by -14.6% to 123,704 tonnes.

The outbound North American market decreased by -9.1% to 84,786 tonnes, with inbound traffic from here declining by -10.5% to 58,101 tonnes.

Cargo inbound from Latin America decreased by -22.3% to 46,827 tonnes and outbound traffic to the region went down by -14.6 % to 35,242 tonnes.

For the Middle East market, inbound cargo from the region decreased by -12.0% to 51,624 tonnes, and outbound cargo decreased by -5.7% to 57,567 tonnes.

The figures for European outbound traffic decreased by -13.2% to 40,670 tonnes, while inbound cargo decreased -35.7% to 42,153 tonnes.

Outbound traffic to Africa decreased by -3.0% to 21,411 tonnes, with inbound traffic decreasing -12.0% to 41,962 tonnes.

Schiphol remains attractive cargo hub

The main factors attributable to the decrease observed in 2022 were the global decrease of volumes transported and the loss of volumes from a large carrier operating from Russia.

The decrease follows a worldwide trend, with growing capacity on passenger flights, concerns about economic development worldwide, production and transport issues in Asia, and the war in Ukraine.

“The 2021 and 2022 figures have shown that Amsterdam Airport Schiphol is still the airport of choice for logistic companies and their customers. Now that demand for passenger flights has increased, the available airport capacity needs to be shared,” said Anne Marie van Hemert, Head of Aviation Business Development, Schiphol Airport.

“In the first half-year, innovation through our Smart Cargo Mainport Program has continued. Automated Nomination has been introduced as the new standard procedure for inbound cargo, which informs customers about incoming shipments before arrival. Going forward, additional measures will be implemented for secure cargo handovers.”

At the start of 2022, dnata announced over €200 million investment in Amsterdam to operate one of world’s largest, most advanced cargo facilities at Schiphol Airport.

The new facility is located in the South-East cargo area and investments will be made here to implement seamless cargo processes with zero-emission ground operations by 2030.

“Schiphol looks forward to remaining an attractive hub and being the most sustainable airport with an efficient cargo flow,” said van Hemert.

“Together with our cargo community, we want to shape Europe’s smartest cargo hub.”

Similar Stories

Lufthansa Cargo exhibiting at Fruit Logistica 2025

View Article

A flying start to 2025 but after 14 months of double-digit demand growth, air cargo stakeholders remain cautious

View ArticlePharma.Aero expands global network with six key new members

CEVA Logistics, Skandi Network, SCL Cold Chain, Shipex NV, Pharming Group, and ARTBIO join the life sciences logistics collaborative platform

View Article

Chapman Freeborn appoints Bolton-Wilson VP Humanitarian and Government

View Article

Alleima supplies Preem in the green transition of the aviation industry

View Article

Airforwarders Association new board member King elected

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!