Red Sea disruption pushing up container values and rates

Apr 18, 2024

20 year old Handy Containers of 1,750 TEU up by as much as 43% since the new year from USD 6.99 million to USD 8.6 million.

Container values have risen significantly across almost all sectors and age categories since the start of the year. Following an extended period of declines, where values fell steadily for this sector after reaching a record peak during the Container boom at the end of Q1 2022. However, since January 2024, values have taken a turn in the opposite direction and older vessels have shown the most strength, with values for 20 year old Handy Containers of 1,750 TEU up by as much as 43% since the new year from USD 6.99 mil to USD 8.6 mil.

The increase in values has been supported by climbing earnings since the start of the year. For example, in the Handysize sector period earnings for one-year have jumped by c.39.4% from 9,280 USD/Day on the first of January 2024 to 12,940 USD/Day today.

This is largely due to the ongoing disruption in the Red Sea. By rerouting around the Cape of Good Hope, vessels are travelling longer distances, reducing available vessels and therefore pushing up rates. According to VesselsValue trade data, Container journeys transiting around the Cape of Good Hope have increased by nearly 200% in Q1 2024 vs. Q1 2023.

However, the latest forecast from Veson's Market Outlook predicts that, despite the ongoing conflict, as more and more Container newbuildings hit the water, vessel supply will continue to outpace demand and going forward this will put pressure on rates.

MSC show no signs of slowing down with their Container buying spree of the last few years, accounting for almost a quarter of all Container sales reported so far this year. Notable benchmark sales include the Post Panamaxes Buxcoast (6,892 TEU, Aug 2001, Daewoo) and the Buxcliff (6,892 TEU, Jun 2001, Daewoo) which sold for USD 22.5 mil each in an en bloc deal, VV value USD 20.01 and USD 19.95 mil respectively. Also in March the sub Panamax Odysseus (2,824 TEU, 2006, Hyundai Mipo) also sold to MSC for USD 15.9 mil, VV value USD 13.61 mil.

Similar Stories

Crowley and Teamsters Union Local 901 reach new agreement in Puerto Rico

View Article

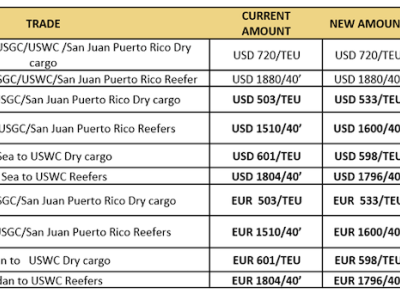

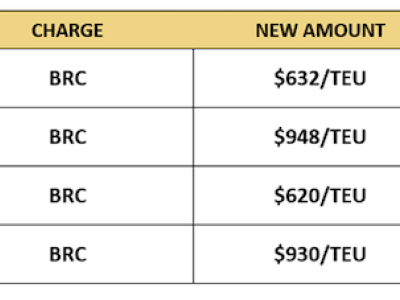

MSC BRC - scope: East Africa and Red Sea to USA and San Juan Puerto Rico

View Article

MSC GRI cancelled scope: USA & Puerto Rico to Middle East and Gulf

View Article

MSC BRC - scope: Australia, New Zealand, Fiji, Noumea & Bell Bay ports to USA

View Article

MSC BRC - scope: Import Mexico and Canada to USA & Puerto Rico

View Article

Tanker orders increase 32% year-on-year

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!