One of China’s most ambitious projects becomes a corridor to nowhere

The four-times-a-week propeller plane from Karachi whips up a cloud of dust as it lands on an arid airstrip. Passengers cross the tarmac in the scorching sun and enter an arrivals terminal not much larger than a tractor-trailer. Outside, soldiers carrying AK-47s are waiting. This is Gwadar, a remote scratch of land on Pakistan’s southwest coast. Its port is the last stop on a planned $62 billion corridor connecting China’s landlocked westernmost province to the Arabian Sea, the crown jewel of President Xi Jinping’s Belt and Road Initiative, designed to build infrastructure and influence around the world.

Plans originally called for a seaport, roads, railways, pipelines, dozens of factories and the largest airport in Pakistan. But, almost seven years after the China-Pakistan Economic Corridor was established, there’s little evidence of that vision being realized. The site of the new airport, which was supposed to have been completed with Chinese funding more than three years ago, is a fenced-off area of scrub and dun-colored sand. Specks of mica in the dirt are the only things that glitter. The factories have yet to materialize on a stretch of beach along the bay south of the airport. And traffic at Gwadar’s tiny, three-berth port is sparse. A Pakistan Navy frigate is the only ship docked there during a recent visit, and there’s no sign of the sole scheduled weekly cargo run from Karachi.

Less than one-third of announced CPEC projects have been completed, totaling about $19 billion, according to government statements. Pakistan bears much of the blame. It has repeatedly missed construction targets as it ran out of money; it got a $6 billion bailout from the International Monetary Fund last year, the country’s 13th since the late 1980s. Two successive prime ministers have been jailed on corruption charges. And the Baloch Liberation Army’s desire for a separate homeland in Balochistan province, where Gwadar is located, has made life there uneasy. In May, militants stormed the city’s only luxury hotel, shooting up the white-marbled lobby and killing five people.

But setbacks in Gwadar point to larger problems along the Belt and Road. China is scaling back its ambitions, not just in Pakistan but around the world. Its economic growth has slowed to the lowest rate in three decades, inflation is rising and the country has been feeling the effects of a trade war with the U.S. The picture is getting even darker as a coronavirus epidemic that originated in central China threatens to cause further delays and cutbacks. “The biggest constraint for China now is its own economy,” says Jonathan Hillman, a senior fellow at the Center for Strategic and International Studies in Washington.

In a number of countries, projects have been canceled, downsized or scrutinized. Malaysia renegotiated the terms of a rail link being built by China and scrapped $3 billion of planned pipelines. In Kenya, a court halted construction last year on a $2 billion power plant financed by China. And in Sri Lanka, new leaders said they want to regain control of a port in Hambantota that was leased to a Chinese company for 99 years when the previous government couldn’t pay back a loan. That takeover sparked concern in many Belt and Road countries that China’s largesse comes with the risk of ceding critical infrastructure. And it has increased wariness about the price of indebtedness to China, which the Washington-based Center for Global Development says puts at least eight nations, including Pakistan, at high risk of debt distress.

All that could result in shaving hundreds of billions of dollars off an estimated $1 trillion of planned Belt and Road spending, according to a September report by law firm Baker McKenzie. While the value of signed projects increased last year, data from China’s Ministry of Commerce show actual spending stalled at $75 billion in 2019 after falling 14% the previous year. Total spending from the beginning of 2014, shortly after President Xi announced the initiative, through November 2019 is $337 billion, government figures show, far short of China’s ambitious goals.

Pakistan may be a harbinger of bigger problems, according to Hillman, who directs Reconnecting Asia, a project that tracks Belt and Road progress. “That is generally where the rest of the Belt and Road seems to be going,” he says. “It’s not dead in the water, but I’m skeptical whether China is going to be able to achieve what it set out to do.”

Gwadar is shaped like a barbell dangling from Pakistan’s coastline. A strip of sandbar and rocks less than 1 kilometer wide at its narrowest connects to a rocky outcrop where the luxury Zaver Pearl-Continental hotel sits like fortress. The city of 140,000 is closer to the Iranian border than to Karachi, a 10-hour drive, in an area so remote it was part of the Sultanate of Oman until 1958.

Just getting around is a challenge. Foreign visitors must be accompanied by an entourage of 10 Pakistani soldiers in flatbed trucks. At the deep-water port on the eastern side of the barbell, there’s little sign of commerce on a hot October day. The only cargo ship that calls in Gwadar, operated by China’s Cosco Shipping Holdings Co., delivers construction materials and sometimes departs with seafood. Occasionally, it doesn’t arrive at all. A manager who answers Cosco’s phone in Karachi, where the weekly run originates, says the line is operational, but it’s up to the captain whether he wants to stop in Gwadar or go directly to Oman. The captain recently had a cold and didn’t want to stop, the manager says.

Yet Naseer Khan Kashani, chairman of the Gwadar Port Authority, maintains that all is well. Cosco was frustrated by problems with a web-based customs system, but it has been sorted out, he says, sitting in his office at the port. He declines to give figures for cargo volume. “Everything is going to be fine,” Kashani says. “The volume of trade is going to increase tremendously.”

That view is echoed by Zhang Baozhong, chairman of China Overseas Ports Holding Co., which operates Gwadar’s port and free-trade zone. He dismisses the apparent inactivity with a wave of his hand, comparing it to four years earlier when he first arrived. Then, there was only one flight a week to Gwadar, with a handful of people on it. “My impression was that this place was completely neglected by the whole world,” Zhang says. “I felt this was a mission impossible.”

Now, he says, there’s progress—$250 million in port renovations, including new cranes for unloading cargo, a business center, a desalination plant and sewage disposal. “This port is now becoming a node in international shipping,” he says. “Of course, the quantity is not big enough, but it takes time. By 2030, we believe Gwadar will be a new economic hub of Pakistan and will be the highest GDP contributor to Pakistan’s economy.”

A free-trade zone was established in Gwadar in 2015, and officials say nine or 10 companies, including a Chinese steelmaker and a Pakistani producer of edible oils, have signed up. But there are no signs of any factories operating. An additional 30 are targeted for the Free Zone’s Phase II, closer to the site of the new airport, officials say, and $400 million has been invested so far. Zhang says twice that number of companies applied, including some from European countries. “It’s going to be established in the near future,” says Kashani. “They talk about CPEC slowing down, but nothing is slowing down.”

The zones still need critical infrastructure, including water and power, according to CPEC’s website. Construction began in November on a 300-megawatt, $542 million plant, which will run on imported coal and is expected to reduce the frequency of power cuts. An acute scarcity of water, with annual rainfall less than 4 inches, was alleviated by freak rains in 2018 that temporarily filled reservoirs, according to Shahzeb Kakar, director general of the Gwadar Development Authority. He says the city will meet future needs by building desalination plants. A plan for a “safe city” project with surveillance cameras may reduce the need for Gwadar to feel like it’s under military occupation. “We have three basic issues—power, water and security,” Kakar says. “All three of these issues have now been taken care of. Now things are moving in the right direction.”

Not everyone is so upbeat. Mariyam Suleman, the Gwadar-based editor of the Balochistan Review, says life for people in the area hasn’t improved much after five years of planned developments. “Their neighborhoods are still without good infrastructure; there’s a sewage issue; there isn’t electricity for long hours, especially in summer; and the water crisis has always been an issue,” she says.

Even if Gwadar weren’t under threat of violence and had sufficient power and water to build and operate 40 factories, it doesn’t have enough people to work in them. The city’s population, mostly fishermen and their families, is about one-fifth that of Washington’s. A proposal for a project called China-Pak Hills envisages a gated community with a “Hong Kong financial district” and luxury housing for 500,000 Chinese professionals who could move to Gwadar and provide a labor force by 2022—an influx that wouldn’t sit well with either Baloch separatists or the Pakistani government, according to Asad Sayeed, an economist at the Collective for Social Science Research in Karachi.

It’s also hard to imagine how Gwadar would need Pakistan’s largest airport, with capacity for Airbus A300 jets and 30,000 tons of cargo annually. Yet that’s the plan for the 4,300-acre area demarcated by razor-wire fence on the outskirts of town. Announced in 2014, the new airport was supposed to have been built by China Communications Construction Co., the largest builder of projects along the Belt and Road, with a $230 million loan from China and a grant from Oman. But construction never started. The following year, the Chinese government said it would convert the loan to a grant, and Pakistani officials said the airport would be completed by the end of 2016, then by October 2017. Still nothing.

Last year, Prime Minister Imran Khan traveled to Gwadar and broke ground on a new airport site. And a new contractor was announced to take over from CCCC: a branch of state-owned China Railway Engineering Corp. that would also build schools and a hospital. Completion is now scheduled for 2022.

During a visit in October, a tractor started up and began driving around the empty, dusty stretch of land without evident purpose. “They are doing as much as they can at the moment to show it is still happening,” says Andrew Small, author of the 2015 book “The China-Pakistan Axis” and a senior fellow at the Washington-based German Marshall Fund. Small says Khan’s government is simply trying to complete about $20 billion worth of CPEC projects already in the works, mostly power plants, under pressure from China. “The full-scale version is not really in the cards,” he says. “It’s going to land in a far more modest place than envisaged. It’s not going to be a game changer.”

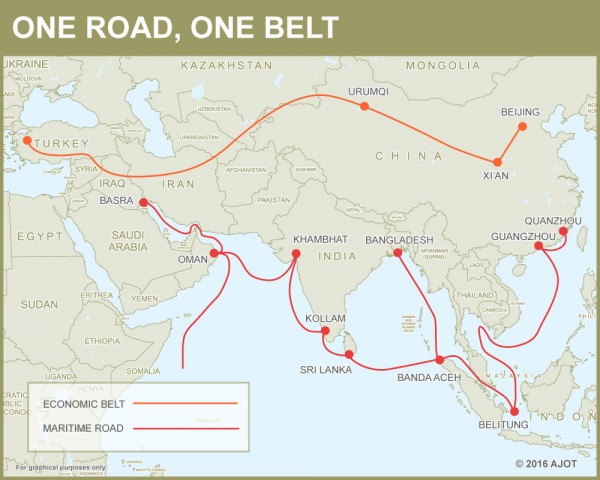

The CPEC project was intended to reduce oil and gas routes from the Middle East by thousands of miles, a way to cut overland into western China instead of going thousands of miles around South Asia and Southeast Asia by ship. Pakistan was supposed to get 2.3 million jobs and a 2.5 percentage-point boost to its gross domestic product. The deal, negotiated by former Prime Minister Nawaz Sharif and touted in a 2017 communique by his successor Shahid Khaqan Abbasi after Sharif was jailed on corruption charges, called for the corridor to start taking shape by 2020. It was described as a pilot project, a model for Belt and Road countries around the world.

Pakistan, long allied with China to counter the regional weight of India, wanted help developing its mineral-rich but poorest and most restive province. It also wanted to quell separatists in the Baloch Liberation Army who not only attacked the Pearl-Continental last year but also killed four people at the Chinese consulate in Karachi in 2018. The militant group was seeking to halt plans they believed would enable Pakistan’s government to take more resources from the area, rather than aid residents. Further attacks in recent months have killed more than a dozen Pakistani soldiers and security personnel.

China may have objectives besides better oil and gas routes. Western governments have long been concerned that Belt and Road spending is helping China develop what’s known as a “string of pearls”—ports that can be used by its navy, from the South China Sea across the Arabian Sea and on to Africa. Though China and Pakistan both deny any military intentions, Gwadar could be a stopping point on the way from Sri Lanka through the Maldives to Djibouti, where China has built its first military base on the Horn of Africa. China’s plans for the Pakistan corridor also include development in Xinjiang province, where it has attempted to curb unrest. The United Nations has estimated that 1 million Uighur people were being held in camps there, which the Chinese government has said was for reeducation and training.

If China’s interests were purely economic, says economist Sayeed, it could have helped expand the port of Karachi, already connected to the highway from China, instead of seeking to build new roads through desolate, dusty and dangerous Balochistan.

Whatever their ambitions, China and Pakistan have had to scale them back. Khan, the former cricketer who was elected in 2018 on an anti-corruption platform and who had criticized expensive infrastructure deals signed with China by previous governments, inherited an economic disaster. To address its current account deficit, his administration has cut imports, depreciated the rupee, slashed spending and raised taxes. GDP growth fell to an estimated 2.4% last year, from 5.8% in 2018, as manufacturing experienced double-digit declines and exports remained flat.

As for China, which has become the world’s largest creditor, it is refocusing on smaller projects crafted for the needs of recipient countries. Winning hearts and minds has become more important than announcements of gargantuan airports. Instead, according to guidelines issued by President Xi in late 2018, people-to-people exchanges in education, science and technology, culture, and tourism will help make Belt and Road projects “deeply rooted in the hearts of the people.”

All this seeks to downplay the more strategic aspects of what China has sought to achieve, says Nadege Rolland, senior fellow at the Washington-based National Bureau of Asian Research. “My hunch is there won’t be big splashes of money anymore,” she says. “The investments were only an incentive.” China’s ultimate objective, she says, “is not to build connectivity but to increase Beijing’s political and strategic influence.”

This means that even if Belt and Road spending ends up being a third of what was originally forecast, China may still have gotten its money’s worth. It will have broadened its influence in countries that are potential providers of natural resources, as well as future markets, and gained allies in international arenas such as the United Nations at a time when the U.S. is pulling back.

In Pakistan, an oil refinery in Gwadar and a railway and oil pipeline to China are among projects that have yet to materialize. An expressway connecting the new airport to Gwadar was supposed to have been completed by CCCC in 2018 for $168 million. It’s now scheduled to open later this year. In October, dump trucks with piles of rocks were parked on the edge of the existing roadway nearby, but no work was being done. The Chinese site manager says he’s too busy to speak. His assistant explains there’s no need for an interview, as all information about CCCC’s work can be found on the internet.

On a visit to Beijing in October, Khan assured Chinese officials that CPEC plans are proceeding. But with Pakistan’s budget maxed out and austerity imposed by the International Monetary Fund, it is clear there won’t be any big, new projects and unclear how many of the current ones can be finished, says CSIS’s Hillman. Still, both Pakistan and China pledged during Khan’s visit “to speedily execute the CPEC so that its growth potential can be fully realized,” according to an official communique.

Full realization may mean figuring out how much can be built to save face, provide some benefit to both sides and declare success. An update on the project from Pakistan’s ambassador to Beijing, published in Chinese state media last year, said 11 projects had been completed in the past five years and another 11 were underway, with total spending of $18.9 billion. It said an additional 20 were planned, without giving amounts, details or a time frame. There’s no longer any mention of the original $62 billion pledged.

Adding to Gwadar’s development challenges, other parts of Pakistan such as Karachi have started their own special economic zones. Even if the corridor to Gwadar could be developed and security issues resolved, there’s only the Karakoram Highway, an inhospitable, two-lane route through the treacherous mountains separating China and Pakistan. It is prone to landslides and threatened by attacks, and has yet to be connected to roads leading to Gwadar, says Alyssa Ayres, Washington-based senior fellow for India, Pakistan and South Asia at the Council on Foreign Relations. “It’s hard to imagine this as a viable freight corridor,” she says.

Hillman has come to a similar conclusion, though one with wider implications. “The Chinese are having some regret about making Pakistan the flagship,” he says. “There’s a lot more caution on all sides.”

Similar Stories

CBP Senior Official performing duties of Commissioner delivers trade advisory committee opening remarks

The Commercial Customs Operations Advisory Committee (COAC) held the fourth public meeting of its’17th Term Dec. 11 in Washington, DC. Troy A. Miller, U.S. Customs and Border Protection (CBP) Senior…

View Article

Innovative thinking from the seasoned team at Belorg Shipping

View ArticlePreliminary U.S. imports for consumption of steel products November 2024

The U.S. Census Bureau announced today that preliminary November steel imports were $2.3 billion (1.9 million metric tons) compared to the preliminary October totals of $2.5 billion (2.2 million metric…

View ArticleS&P Global: Triborough Bridge and Tunnel Authority, NY Series 2025A revenue bonds assigned ‘A+’ rating; outlook stable

S&P Global Ratings assigned its 'A+' long-term rating to the Triborough Bridge and Tunnel Authority (TBTA), N.Y.'s proposed $1.3 billion (Metropolitan Transportation Authority [MTA] Bridges and Tunnels) real estate transfer…

View Article

Wilson Sons starts unloading wind turbine blades at Rio Grande Container Terminal

View ArticleBiden-Harris Administration Announces CHIPS Incentives Award with SK hynix

CHIPS investment establishes a research hub in Indiana and brings next generation HBM and advanced packaging R&D to the U.S.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!