Oil hits one-year high with market eyeing tight global supplies

Oil surged to the highest in more than a year as the market looks ahead toward an accelerating decline in global inventories and a comeback in demand.

Futures in New York climbed 2.5% Wednesday, rising to the highest since January 2020. Energy Information Administration data showed crude output fell to 9.7 million barrels a day last week amid an unprecedented polar blast, tying for the low reached last summer when Hurricane Laura sent production plummeting.

Globally, supplies are declining with stockpiles at a major European storage hub falling to their lowest level since September. Key players in the oil market have been talking up the rising prices in the coming months, with some even floating the prospect of $100 crude in the next year or two as the global economy recovers from the pandemic.

“All indications are that we’re going to see better demand,” said Rob Thummel, a portfolio manager at Tortoise, a firm that manages roughly $8 billion in energy-related assets. “Inventories are going to continue to fall, both in the U.S. and globally. Big picture, that’s going to be positive for prices moving higher.”

Still, the report showed crude inventories climbed by 1.29 million barrels last week as the cold weather shut most Texas refineries, while stockpiles at a key U.S. storage hub rose for the first time in six weeks. Despite the U.S. build, confidence that a meaningful demand rebound will accompany widening vaccination availability by this summer has supported prices.

The underlying market structure for global benchmark Brent futures remains in backwardation, where nearer contracts trade at a premium to following months, indicating tightening supplies as OPEC+ maintains production curbs. Market movements in the coming weeks are likely to be driven by the legacy of the U.S. cold weather, an upcoming OPEC+ meeting and the ongoing reflation trade across global markets.

“Stockpiles are going to continue to fall, and everyone has that OPEC meeting circled on their calendar,” said Edward Moya, senior market analyst at Oanda Corp. “That’s going to be the next big thing for crude, there’s not much else besides the short-term trajectory of Covid cases that will really dictate the next path.”

U.S. drillers in the Permian Basin have already restored about 80% of crude output after the big freeze, although refiners are finding a return to normal more tricky. Impacts from the cold blast have also hit Asia, where plastic makers are facing surging prices for key feedstocks after American processors were shuttered.

The EIA report also showed inventories at nation’s largest storage hub in Cushing, Oklahoma, rose for the first time in six weeks. However, distillate inventories fell by roughly 5 million barrels last week, helping lead a decline in total petroleum stockpiles and U.S. crude imports fell to 4.6 million barrels a day, the lowest since February 1996.

Similar Stories

Solar groups lobby Biden to head off sector-roiling trade case

View Article

Neste and New Jersey Natural Gas target reducing greenhouse gas emissions with Neste MY Renewable Diesel

View ArticleOil poses more risks for yen as Japan depends on imports

As if the yen doesn’t have enough reasons to weaken, risks are emerging that higher oil prices will hit energy import-dependent Japan and its currency.

View ArticlePop-up Russian oil traders emerge as US tightens sanctions

As the US intensifies sanctions pressure on Moscow, Russia’s crude trade with India has begun to resemble a game of oil whack-a-mole. Just as one trader begins to lose prominence,…

View Article

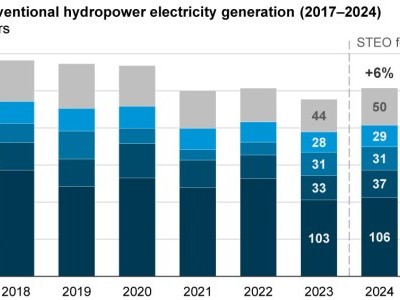

Today in Energy: U.S. hydropower generation expected to increase by 6% in 2024 following last year’s lows

View Article

CIRRO partners with GoodZero in carbon offsetting and CSR efforts

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!