No clear sign that worst is over for global trade, Asian data shows

Asian data laid bare the extent of damage to global trade with no clear sign that the worst is over even as the world takes tentative steps toward reopening.

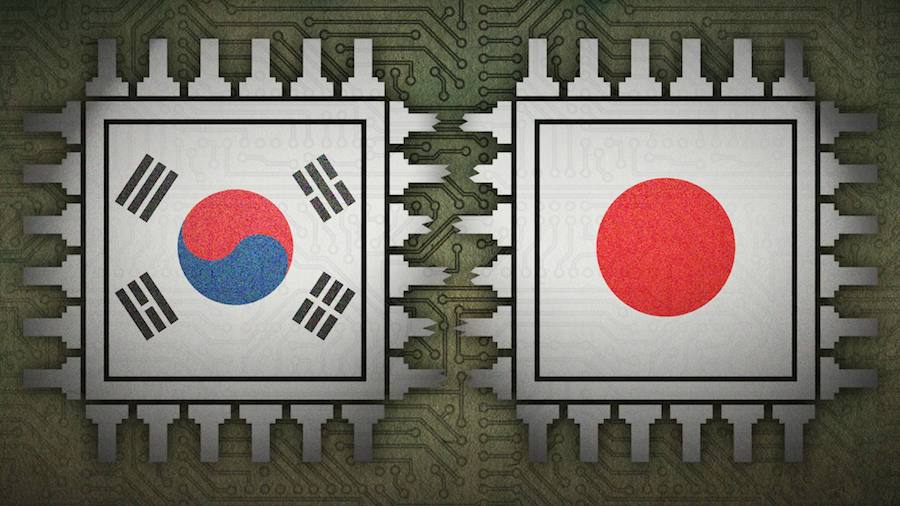

An early trade report from South Korea, a bellwether for global commerce, showed exports may be set to drop more than 20% in May for a second month. Meanwhile, Japan’s overseas shipments also plunged by more than a fifth in April and a purchasing managers index showed manufacturing activity weakening further in May.

The data showed plunging exports of cars and auto parts to be the biggest drag on trade as the pandemic hobbles vehicle demand in the U.S. and Europe. Still, the value of semiconductor shipments from both Japan and Korea increased, and falls in exports to China moderated.

”We have yet to confirm the bottom with economic data, but the global economy is heading for bottoming out with lockdowns being lifted,” said economist Masaki Kuwahara at Nomura Securities in Tokyo. “Economic activity is resuming bit by bit.”

To be sure, Thursday’s data showed Japan’s PMI for the services sector ticking up, albeit from a record low, with government last week lifting its state of emergency for most of the country’s rural prefectures, where there have been few new infections in recent days.

“The dynamics in the economy are clearly evolving,” said economist Joe Hayes at IHS Markit, which compiles the au Jibun Bank Japan PMI survey. “As Japan eases the state of emergency measures, the services economy can begin its gradual recovery.”

But manufacturing and trade data from the region suggests the worst is not over for the global slump.

The au Jibun Bank Japan purchasing managers index for manufacturing fell to 38.4 in May, indicating the strongest contraction of activity in the factory sector since March 2009.

A separate report from Japan showed exports fell about 22% in April, with vehicle shipments dropping by half.

Economist Taro Saito at NLI Research Institute in Tokyo said the trade data confirms Japan’s economy is rapidly worsening and he sees the trade slump deepening for another month or two before picking up.

“Make no mistake,” he said. “It will take a long while to get back to where we were before the virus.”

One market showing signs of recovery is China, where the virus’s earliest outbreak has been contained and factories are getting back to work. Thursday’s reports showed both Japanese and South Korean exports to China falling far less than shipments to other key markets, but there’s a risk that collapsing global demand could squash China’s rebound.

South Korea’s advanced trade report showed the overall trade slump deepening in May, even as semiconductor sales rose and shipments to China dropped less than 2% to China.

The value of South Korea’s exports fell 20% in the first 20 days of this month. Declines in average daily shipments widened from 16.8% in April.

“Double-digit exports decline will last for at least a couple more months,” said So Jaeyong, an economist at Shinhan Bank. “The U.S. restarting its economy after China may provide a floor to the trade slump, but there are multiple risks ahead, including a wider second wave of infections.”

Similar Stories

December CNBC/NRF retail monitor results show strong growth boosted by final Thanksgiving weekend days

Retail sales jumped strongly in December, boosted in part by two busy holiday shopping days during Thanksgiving weekend falling in the final month of the year, according to the CNBC/NRF…

View ArticleNAW presents Dirk Van Dongen Lifetime Achievement Award to Bergman, CEO of Henry Schein, Inc.

At the 2025 NAW Executive Summit Gala on January 28 in Washington, D.C.

View Article

St. Louis region’s chemical industry welcomes new investment

View Article

Navigating compliance: Adapting to changing Customs regulations in global supply chains

View Article

December 2024 U.S. Transportation Sector Unemployment (4.3%) Was the Same As the December 2023 Level (4.3%) And Above the Pre-Pandemic December 2019 Level (2.8%)

View ArticleDP World appoints Jason Haith as Vice President of Freight Forwarding for U.S. and Mexico

DP World, a global leader in logistics and supply chain solutions, has announced the appointment of Jason Haith as Vice President, Commercial Freight Forwarding – U.S. and Mexico, effective immediately.…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!