Indian steel mills seek iron ore export ban as China sales jump

Smaller steelmakers in India are pressing for a ban on exports of iron ore, after a surge in sales to Chinese mills pushed up local prices.

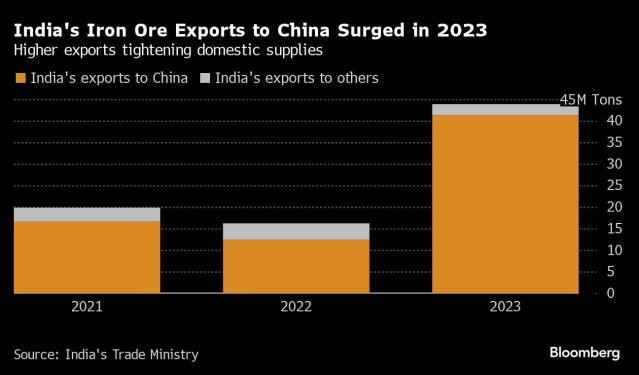

Indian exports jumped 170% to 44 million tons last year — most of which went to China — at a time when domestic demand for the raw material is rising. That’s prompted the worst-affected sections of the industry to seek restrictions from the authorities to protect their margins.

“We have asked the government to ban exports of all forms of iron ore — otherwise China’s steel industry will run and ours will shut,” Anil Nachrani, president of the Chhattisgarh Sponge Iron Manufacturers Association, said in a phone interview this week. “India should be an exporter of steel and not iron ore,” he said.

Nachrani said smaller mills in at least five major manufacturing states have banded together to lobby the steel ministry after many became loss-making. Second-tier producers, which account for about 40% of nationwide output, have been paying almost four times more than bigger operations, he said. India’s top mills can negotiate better prices for inputs like iron ore and coal and often have their own mines.

Any move by India to limit exports could underpin iron ore prices, one of the worst-performing major commodities so far this year. The government has stepped up in the past to safeguard the interest of local producers. In May 2022, it imposed a 50% export tax on all grades of iron ore to reduce costs and improve supply. The measure was withdrawn six months later.

India’s steel ministry didn’t immediately respond to an emailed request for comment.

The growth in capacity at India’s big steelmakers has boosted demand locally and intensified competition for the material at auctions and in the open market. But at the same time, end-user demand for steel remains soft, which is squeezing margins for smaller players.

“Demand has been weak on the one hand, and on the other hand they are not able to compete with major producers who have captive coal and iron ore mines,” said Deependra Kashiva, director general at the Sponge Iron Manufacturers Association, a national body.

Similar Stories

November 2024 Freight Transportation Services Index

View ArticleViet Nam hosts 16th United Nations Conference on Trade and Development In October 2025

UN Trade and Development (UNCTAD) Secretary-General Rebeca Grynspan announced today that the sixteenth session of the United Nations Conference on Trade and Development (UNCTAD 16) will take place in Viet…

View Article

Alleima relaunches high-strength and corrosion-resistant steel for sustainable energy sectors

View ArticleUnited States and Norway issue innovative report creating greater transparency in critical mineral supply chains

Today, the U.S. Department of Commerce and the Norwegian Ministry of Trade, Industry, and Fisheries issued a thorough, innovative report presenting our shared understanding of non-market policies and practices (NMPPs)…

View ArticleDecember CNBC/NRF retail monitor results show strong growth boosted by final Thanksgiving weekend days

Retail sales jumped strongly in December, boosted in part by two busy holiday shopping days during Thanksgiving weekend falling in the final month of the year, according to the CNBC/NRF…

View ArticleNAW presents Dirk Van Dongen Lifetime Achievement Award to Bergman, CEO of Henry Schein, Inc.

At the 2025 NAW Executive Summit Gala on January 28 in Washington, D.C.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!