In the first half of 2020, about 5 Bcf/d of natural gas pipeline capacity entered service

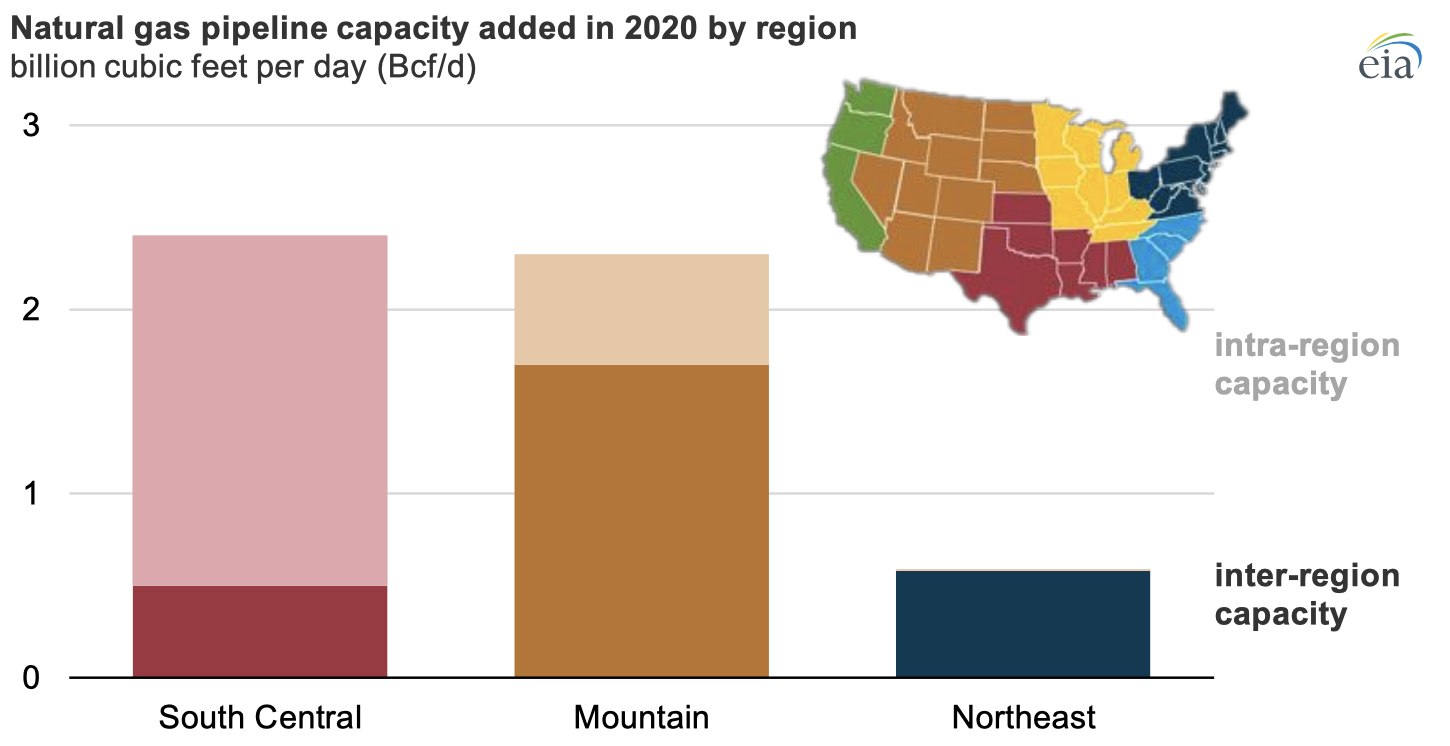

Aug 24, 2020Between January and early July 2020, approximately 5 billion cubic feet per day (Bcf/d) of new pipeline capacity entered service in the United States, according to the U.S. Energy Information Administration’s (EIA) Natural Gas Pipeline Project Tracker. Several of these projects could increase deliverability to growing natural gas demand markets in North America.

Projects that primarily serve to connect additional natural gas supplies to existing infrastructure include the following:

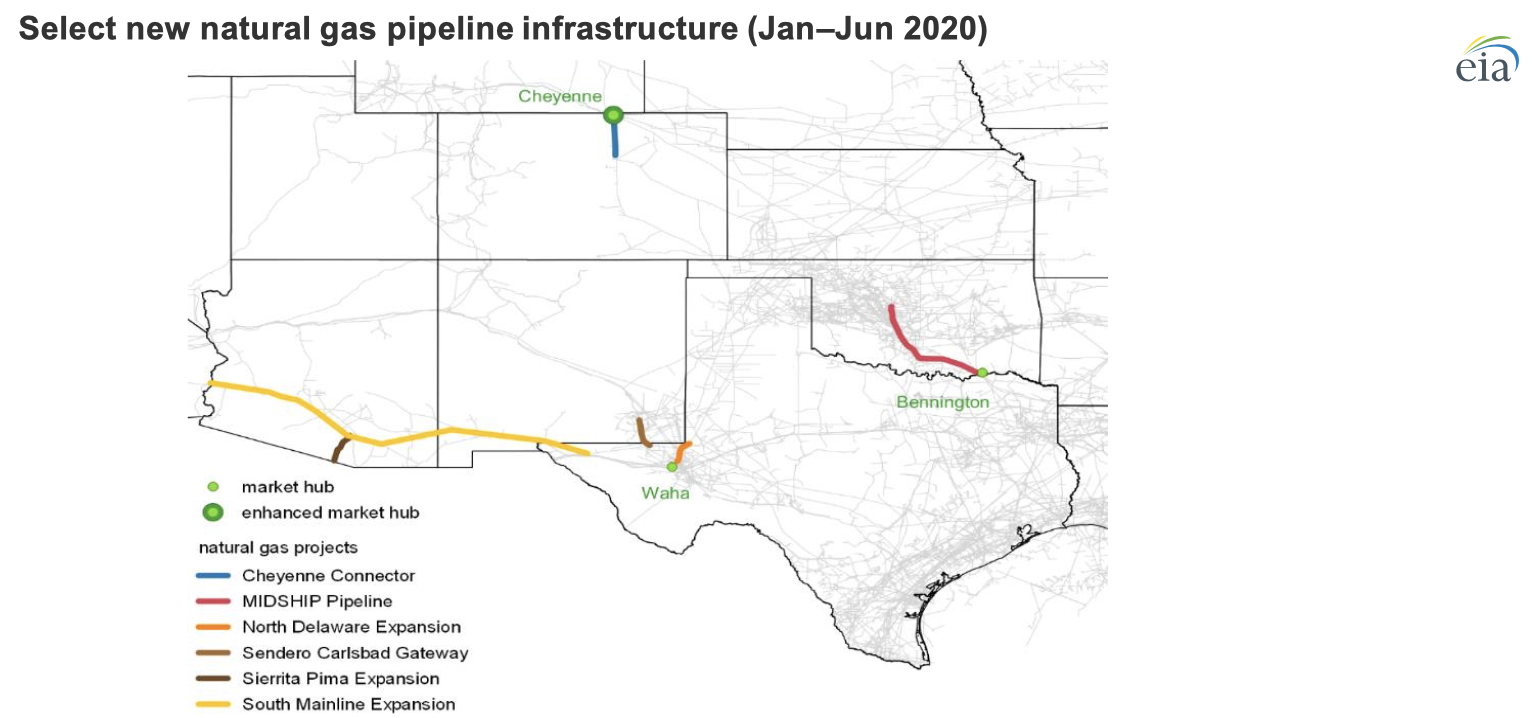

Cheyenne Connector Pipeline and Cheyenne Hub Enhancement Project

These Tallgrass Energy projects, which entered service in late June 2020, added 1.6 Bcf/d of capacity in total. The 0.6 Bcf/d Cheyenne Connector is a 70-mile, 36-inch pipeline that brings natural gas from eastern Colorado into the Cheyenne hub near the Colorado-Wyoming border. The Cheyenne Hub Enhancement Project increases interconnectivity and deliverability between the Rockies Express Pipeline and other interstate transmission systems, allowing natural gas production in the Rockies to access more markets with increased flexibility.

Cheniere MIDSHIP Pipeline

Cheniere’s 233-mile, 36-inch greenfield MIDSHIP Pipeline began operations in April 2020, bringing 1.1 Bcf/d of natural gas produced in the SCOOP-STACK Basin in western Oklahoma to the Bennington hub at the Oklahoma-Texas border. The Bennington hub will allow these natural gas supplies to serve growing southeastern demand markets, including liquefied natural gas (LNG) facilities owned by Cheniere.

Waha hub interconnects

Three projects totaling more than 1 Bcf/d that connect to the Waha hub are located in western Texas near Permian Basin production areas:

Northern Delaware Basin Expansion: Completed in February 2020, this 14-mile, 0.32 Bcf/d expansion of the El Paso Natural Gas Transmission System (EPNG) increased takeaway capacity out of the Delaware Basin.

Sendero Carlsbad Gateway Project: This new pipeline was completed in May 2020 and connects natural gas processing plants in southeastern New Mexico to the Waha hub. The 23-mile, 24-inch pipeline has a capacity of 0.40 Bcf/d.

South Mainline Expansion Project: Another expansion on EPNG, this project entered service in early July 2020. Providing 0.32 Bcf/d of additional westbound capacity out of the Waha Hub, the South Mainline Expansion delivers additional supplies to Arizona and Southern California markets. A related project, the 0.32 Bcf/d Sierrita Pima Expansion, was also completed in early 2020, increasing the capacity on the Sierrita export pipeline from Tucson, Arizona, to the U.S. border with Mexico.

In addition to these projects, which account for most of the new pipeline capacity in the first half of 2020, the second phases of the Sabal Trail Pipeline (0.17 Bcf/d) and the Hillabee Expansion (0.2 Bcf/d) entered service in April, increasing deliverability to Southeast demand markets. The 0.3 Bcf/d Empire North Expansion Project, which increases deliverability to western New York consumers on the Empire Pipeline, entered partial service in late June.

Although approximately 5.0 Bcf/d of new pipeline capacity has entered service in the United States so far in 2020, an estimated 8.7 Bcf/d of pipeline projects have been canceled in 2020. These cancellations include the 1.5 Bcf/d Atlantic Coast Pipeline, which planned to transport natural gas supplies from the Marcellus and Utica plays to electric power consumers in the Southeast, and the 0.65 Bcf/d Constitution Pipeline, which would transport northeastern natural gas production into New England. At the regional level, the South Central region had the most potential added capacity canceled, at 3.5 Bcf/d, with the cancellations of the Permian to Katy Pipeline and the Creole Trail Expansion Project 2.

EIA’s Natural Gas Pipeline Project Tracker is updated quarterly. EIA will publish the next update in October 2020.

Principal contributors: Katie Dyl, Stephen York, Kristen Tsai

Similar Stories

HT PEM fuel cell veteran joins Blue World Technologies

View Article

Greater New Orleans, Inc. celebrates passage of Constitutional Amendment 1

View Article

AVAT and KBB are going to cooperate in the digitalization of turbochargers

View Article

Drought conditions reduce hydropower generation, particularly in the Pacific Northwest

View Article

Milestone achieved: over 10 million tons of CO2 emissions reduced by Corvus Energy marine battery systems

View Article

U.S. fuel ethanol exports rise on strong international demand and low U.S. prices

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!