[Freightos Weekly Update] Ports and warehousing brace as Shanghai lockdown is set to expire

May 26, 2022Key insights:

- Authorities in Shanghai are set to begin the reopening process next week. As manufacturing comes back online export volumes are expected to surge toward already-congested ports like LA/Long Beach.

- Ports are hoping that lessons-learned will mitigate how disruptive the likely surge will be. But retailers importing peak season goods early, or with excess inventory on some big-ticket household items as consumer spending shifts are causing a shortage of warehousing space, which could be another factor that could back up imports at the ports’ container yards.

- A release of pent up demand could put upward pressure on container rates when Shanghai reopens. In the meantime, prices from Asia - the US West Coast are almost 30% below their level just before the lockdown, and Asia - N. Europe rates are just 15% higher than this time last year.

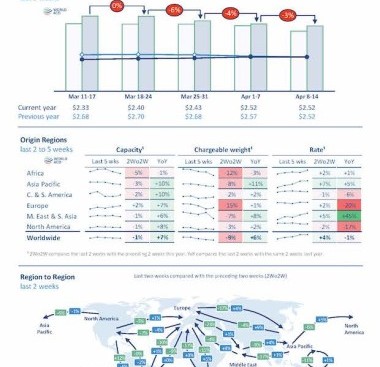

Asia-US rates:

- Asia-US West Coast prices (FBX01 Daily) decreased 18% to $11,455/FEU. This rate is 44% higher than the same time last year.

- Asia-US East Coast prices (FBX03 Daily) fell 9% to $14,570/FEU, and are 99% higher than rates for this week last year.

Analysis

Authorities in Shanghai are set to begin the reopening process on June 1st. In the meantime, with manufacturing still restricted, transpacific ocean rates continued to fall. Asia - US West Coast rates fell 18% this week to $11,455/FEU and are 28% lower than at the start of the lockdown in late March. Asia - North Europe prices are now only 15% higher than this time last year, and about level with prices in June 2021.

Most in the industry are expecting pent up demand to send a surge of ocean exports towards destination ports like LA/Long Beach when manufacturing in Shanghai rebounds. And with about 30 ships currently waiting for a berth, congestion levels at LA/Long Beach – though well below those seen at the start of the year – are already significant.

But authorities at US ports are hopeful that lessons learned and adjustments made over the last two years will make this next possible wave less disruptive. The ports of LA/Long Beach, for example, are reportedly considering implementing a long-threatened penalty on import containers that aren’t moved promptly off the container yards.

With many retailers bringing in peak season goods early to get ahead of possible delays like last year’s, warehousing space is also already scarce in many places.

At the same time, consumers shifting away from big ticket household items like furniture and appliances is leading to excess inventory for some types of goods. This trend is another factor clogging up warehouses and threatening to back up incoming containers to the ports if import volumes spike.

Similar Stories

Galveston Wharves board approves $29 million construction contract for cargo area

View Article

Canaveral Port Authority opens applications for Junior Ambassador Program

View Article

Port of Brownsville awards $1,000 scholarships to high school graduates

View Article

Port of New Orleans announces $7.1 million in federal funding for sustainability infrastructure

View Article

CBP officers continue recovering stolen vehicles at Charleston and Savannah seaports

View ArticleAmerica’s ports will reduce air pollution with $150 million in FHWA grants

Today, the American Association of Port Authorities (AAPA), joined by several port leaders at a White House event, celebrated almost $150 million in grants from the Federal Highway Administration's (FHWA)…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!