FIS Air Freight Report January 13, 2020

Jan 15, 2020Trading Update

All major lanes show negative price movements with China to Europe down 15 cents, China to USA down 14 cents. The Air Index comes back on-line, softening the drop off of all index lanes, down 9 cents.

Shanghai and Hong Kong swap over price dominance with the HKG vs PVG to USA spread into negative territory, PVG ahead 1 cent. Shanghai to Europe maintains significant losses down 14 cents, and Hong Kong to Europe down 16 cents.

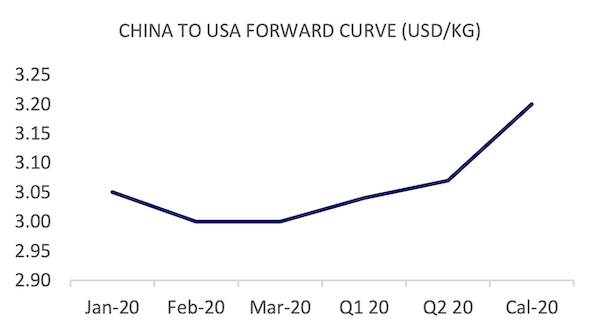

Forward curves see large forward price corrections, China to Europe front month down 5 cents and the full CAL 20 down 1 cent. China to USA shows severe corrections as spot prices slip off of last weeks support, with post-CNY prices dropping up to 22 cents.

Market Comment

Another sea of red, becoming all the more familiar to the air freight market in recent times. Although this is a seasonal norm, the price that core lanes eventually settle on will dictate much of the proposed optimism for the rest of 2020.

Indeed, long term contracts will rely on this eventual Q1 market bottom figure, with none of the support we saw in Q1 2019 holding up prices. In a brutally volatile fashion, much of the illusion of immediate market growth has been smashed. There is however very long term positivism in market fundamentals, much of this is approximate, dare we say wishful thinking. We wouldn't even try to provide an opinion as to when we think the market will bounce, US-China trade deals and the certainty of a few macro-economic events has provided a sense of potential growth. There is however no time-frame, it would seem that even though capacity has been properly adjusted to cargo throughput (finally!), the air freight market will be left to react as it always has, at very short notice.

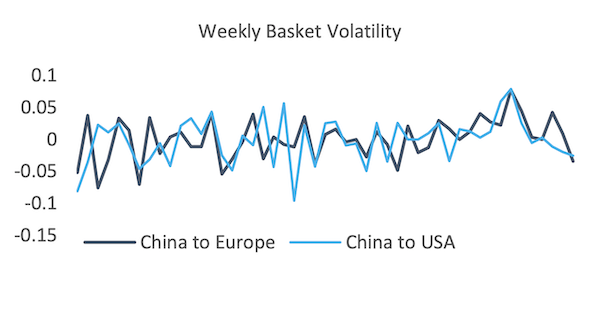

Typically we expect volatility to continue, with any growth in volumes having a disproportionately severe impact on the open market rate. This whilst contract rates are being squeezed down at every level of the market from shippers through to airlines and everything in between. Margin rates are at risk of narrowing, with a gamble being made that market price movements by H2 2020 will help widen margins to survivable levels.

Trading strategies still include Cal 20 contract hedging, following on from market wide aim to offset the unpredictable movement of the forward market in what might be a tumultuous year.

| Basket | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| CHINA - EUR | 2.61 | -0.15 | -5.43% | 2.69 | 18.64% |

| CHINA - USA | 3.03 | -0.14 | -4.42% | 3.10 | 24.13% |

| Blended | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| PVG/EUR | 2.45 | -0.14 | -5.41% | 2.52 | 3.84% |

| HKG/EUR | 2.77 | -0.16 | -5.46% | 2.85 | 38.50% |

| PVG/US | 3.04 | -0.13 | -4.10% | 3.11 | 49.81% |

| HKG/US | 3.03 | -0.14 | -4.42% | 3.10 | 0.52% |

| Global | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| Air Index | 2.11 | -0.09 | -3.30% | 2.15 | 47.17% |

| Airfreight Route (AR) | Description | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| AGR 1 | HKG to LAX & ORD & JFK | 3.14 | -0.09 | -2.78% | 3.19 | 35.18% |

| AGR 2 | HKG to LHR & FRA & AMS | 2.68 | -0.19 | -6.62% | 2.78 | 17.93% |

| AGR 3 | HKG to SIN & BKK & PVG | 1.17 | -0.02 | -1.10% | 1.18 | 22.07% |

| AGR 4 | PVG to AMS & FRA & LHR | 2.47 | -0.14 | -5.38% | 2.54 | 62.10% |

Forward Curve - Indicative Update

| FIS AFFA, CHINA - EUROPE | USD/KG | ||||

| BID | ASK | VALUE | CHANGE | |

| Jan-20 | 2.63 | 2.75 | 2.69 | -0.05 |

| Feb-20 | 2.60 | 2.72 | 2.66 | -0.03 |

| Mar-20 | 2.53 | 2.69 | 2.61 | 0.00 |

| Q1 20 | 2.56 | 2.76 | 2.66 | -0.02 |

| Q2 20 | 2.58 | 2.70 | 2.59 | 0.00 |

| Cal-20 | 2.74 | 3.14 | 2.94 | -0.01 |

| FIS AFFA, CHINA - USA | USD/KG | ||||

| BID | ASK | VALUE | CHANGE | |

| Jan-20 | 3.00 | 3.10 | 3.05 | -0.11 |

| Feb-20 | 2.82 | 3.18 | 3.00 | -0.22 |

| Mar-20 | 3.16 | 3.24 | 3.00 | -0.20 |

| Q1 20 | 2.94 | 3.14 | 3.04 | -0.15 |

| Q2 20 | 3.10 | 3.12 | 3.07 | -0.18 |

| Cal-20 | 3.00 | 3.40 | 3.20 | -0.10 |

Similar Stories

BTS to will begin releasing preliminary estimates of airline passenger travel in 2025

Monthly passenger enplanement numbers are not reported by the carriers and published by BTS for the month until more than a month later. BTS developed a model, which uses a…

View Article

Ambercor Shipping participated in air charter transport from Canada to Australia

View ArticleCass Information Systems acquires AcuAudit Platform from Acuitive Solutions

Cass Information Systems, Inc. (Cass), the leading global provider of freight audit & payment solutions, has acquired AcuAudit, the premier freight audit platform for ocean and international air freight, from…

View ArticleLos Angeles Industrial CRE Market Update – 4th qtr. 2024

TEU and airfreight numbers continue to improve, but excess capacity has muted any genuine change to the state of the leasing market.

View Article

CPaT announces new major partnership with “Saudia Academy”

View Article[Freightos Weekly Update] Mexico increases trade barriers for Chinese imports

Ocean rates out of Asia overall trended up slightly to end the year, but with Lunar New Year approaching and a range of January transpacific GRIs announced, prices could face…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!