FIS Air Freight Report August 3, 2020

Aug 06, 2020Market Comment

Discussions move towards the forward market, with a number of airlines publicly quite bullish for September onwards. August is quiet, except it isn't quiet - a summary of the lack of consensus in the current market.

In fundamental terms we are still looking down the barrel of various airfreight-centric product launches that correlate with a bullish viewpoint. However capacity still remains highly uncertain, linked to passenger traffic inconsistencies.

Meanwhile, the market appears (at least on ex.APAC routes) to pricing about 25% above its 2019 level for the time-being. What is more of a concern for shippers, is a new and persistent requirement to absorb both the higher air freight rates, and direct market volatility.

Price Comment 3rd AUGUST 2020

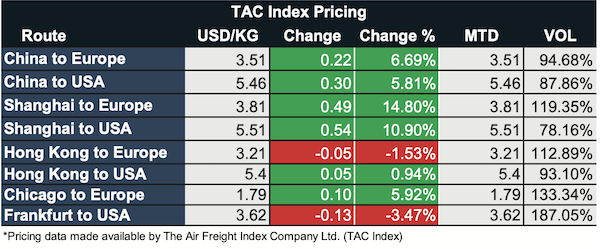

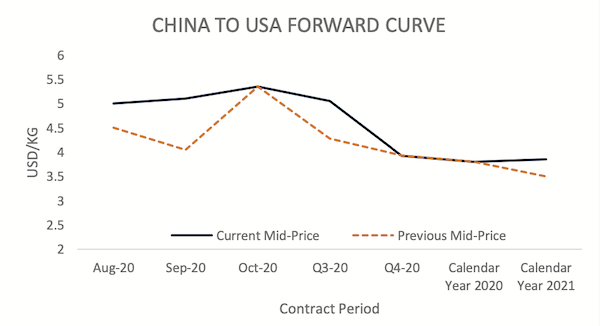

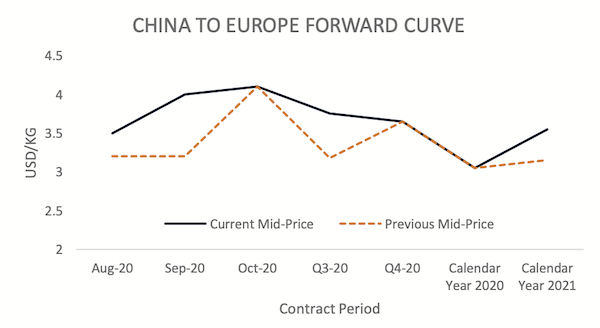

China to Europe and China to USA routes have continued to climb, with September forward pricing mid-value increasing by 0.80$ and 1.05$ respectively. Frankfurt to USA on the other hand has continued to fall leaving an index price at 3.62$ which is still relatively high. Shanghai to Europe and shanghai to USA have seen the biggest changes with both prices increasing by 14.80% and 10.90% respectively this is most likely due to signs of increasing demand as both are seeing their best prices since mid-June.

Similar Stories

Ethiopian Airlines welcomes Africa’s first A350-1000 aircraft

View Article

SATS and WFS unite with a new visual identity

View Article

Air Charter Service’s Brisbane operation growing fast

View Article

Chapman Freeborn negotiate makeshift helipad to fulfil urgent delivery deadline

View ArticleFreightos Weekly Update

Trump’s victory in the US presidential election yesterday may start impacting the ocean freight market even before his January inauguration.

View Article

Ortega takes charge of ECS Group’s expansion in the Americas

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!