[FBX Weekly] China stepping in to stop China-US ocean rate climb?

Sep 15, 2020Key insights:

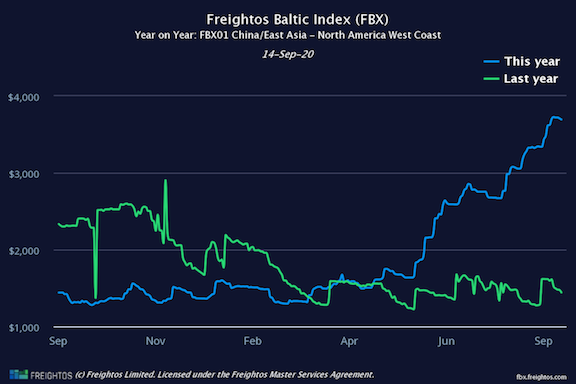

- With a mid-month GRI expected to increase rates that are already 158% higher than last year, reports have China’s Ministry of Transport considering banning rate increases (COSCO already is likely to cancel its GRI) and prohibiting cancelled sailings on China-US lanes to let rates drop along with (an eventual drop in) demand.

- Carrier capacity management allowed them to stem losses and keep rates even year-on-year in the first five months of the pandemic, before June’s demand surge sent rates spiking.

- Questions remain about what (if any) interventions will be made, and whether other carriers will follow COSCO’s lead. But whatever the outcome, the threat of intervention will likely serve as a warning to carriers to use their controls wisely.

China-US rates:

Analysis As you’ve heard over and over since June, ocean rates from China to the US have been climbing – with China to US East Coast rates approaching $4,500 per FEU and West Coast rate up nearly 160% over last year. Though rates went largely unchanged this week, indications are that as peak volumes continue to outpace the full and even extra capacity in the water, carriers will introduce a mid-month General Rate Increase (GRI). This move would push rates up again and mark the seventh GRI since June 1st. But late last week, initial reports surfaced that China’s Ministry of Transport (MOT) was considering a ban on China-US rate increases, with state-owned COSCO expected to cancel its GRI, and Maersk following suit. And to ensure rates fall once demand eventually drops, the MOT may prevent carriers from cancelling sailings – a move that would reduce supply and prop up rates – starting after the early-October Golden Week. The latest projections by the National Retail Federation have import volumes declining through October (though up year over year), so this rule may be tested sooner rather than later. Whether more carriers follow COSCO’s lead, and the actual extent of the MOT discussion remains to be seen. But the US FMC and other industry groups are set to investigate soon as well. Whatever the final rulings, the consideration of interventions shows just how extreme the last few months have been. Capacity management is regulated, and is meant to prevent carrier losses when demand is low. During the pandemic it allowed carriers to keep rates even, up until the unexpected demand surge in June.  |

Similar Stories

AGLPA Issue Update - Nov 2024

Today the Maritime Administration (MARAD) awarded nearly $580 million to 31 recipient ports in 15 states and territories. These grants are from the agency's Port Infrastructure Development Program (PIDP). Five…

View Article

Viking Line named Finnish security organization of the Year

View Article

Ocean Network Express and Seaspan Corporation jointly announce the establishment of ONESEA Solutions

View Article

MSC Customer Advisory

View Article

ZIM launches its USA Employer Brand Campaign to attract top talent

View Article

Hapag-Lloyd achieves good result in first three quarters of 2024

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!