EIA: More gasoline expected to be consumed this summer than last, but not more than in 2019

Apr 09, 2021In EIA’s April Short-Term Energy Outlook (STEO), we expect vaccinations and fiscal stimulus to support continuing economic recovery and drive demand growth for petroleum products in the United States. We also expect gasoline and distillate fuel consumption to increase from last summer (April through September) but remain less than in 2019.

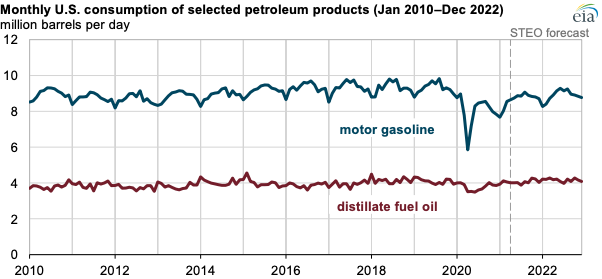

As some of the economic and behavioral effects of COVID-19 subside over the next year, we forecast that U.S. demand for transportation fuels will increase. We forecast that gasoline consumption in 2021 will peak in August at 9.1 million barrels per day (b/d), more than the 8.5 million b/d we saw in August 2020 but less than the 9.8 million b/d in August 2019. We forecast that gasoline consumption during the summer of 2021 will average 8.8 million b/d, a 1.0 million b/d (13%) increase from summer 2020 but a 0.7 million b/d (7%) decrease from 2019.

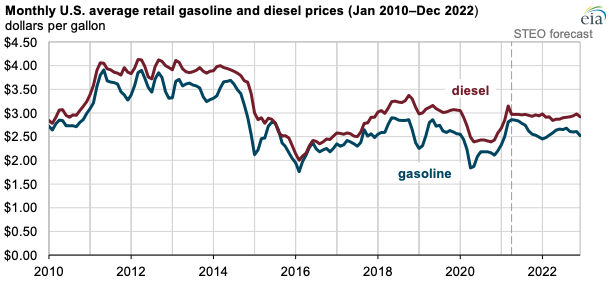

We forecast the retail price of regular-grade gasoline in the United States will average $2.78 per gallon (gal) during summer 2021, 72 cents/gal more than last summer’s average of $2.06/gal. Our forecast of significantly more global economic activity this summer compared with last summer contributes to higher crude oil prices, which are the largest determining factor in U.S. gasoline prices.

The response to the COVID-19 pandemic has not affected U.S. diesel fuel demand as much as it has affected gasoline demand. We forecast that consumption of distillate fuel, which includes diesel fuel and heating oil, will average 4.0 million b/d this summer, an 11% increase (400,000 b/d) from last summer when distillate consumption levels reached their lowest point for the summer in the United States since 2009. However, we expect distillate consumption to be nearly equal to 2019 levels (down less than 1%).

We forecast retail prices for diesel fuel will average $2.96/gal this summer, which is up from an average of $2.43/gal last summer. However, this forecast is subject to many of the same uncertainties as our gasoline price forecast, particularly uncertainties related to crude oil prices.

Similar Stories

IAG Cargo transitions 160-truck fleet at London Heathrow to hydrotreated vegetable oil

View Article

Ørsted inaugurates the Asia-Pacific region’s largest offshore wind farms

View Article

Mild bullish skew as northern summer approaches - Rystad Energy’s Gas and LNG Market Update

View ArticleChina pays less for Venezuelan oil after US reimposes sanctions

Chinese refiners are paying a little less for Venezuelan oil after the US reimposed sanctions on the South American producer.

View Article

Asahi Kasei to construct a lithiumion battery separator plant in Canada

View Article

Low U.S. distillate consumption reflects slow economic activity and biofuel substitution

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!