Egypt mulls LNG imports to avoid shortages during summer heat

Egypt is looking at buying liquefied natural gas to stave off fuel shortages this summer, but violence in the Red Sea region is posing a challenge.

The nation has inquired about LNG for delivery as early as next month and through the summer, according to people with knowledge of the matter. It would be routed through an existing facility in Jordan, although Egypt is seeking its own floating terminal, they said, declining to be identified because the plans haven’t been made public.

The move would be a huge shift for Egypt, which largely stopped importing LNG in 2018, when the massive Zohr field boosted domestic production, turning the country into an exporter of the fuel. Risks from climate change have now upended that scenario, just as geopolitical tensions make it harder to import supplies.

Officials from state-run Egyptian Natural Gas Holding Co., known as EGAS, didn’t immediately respond to requests for comment.

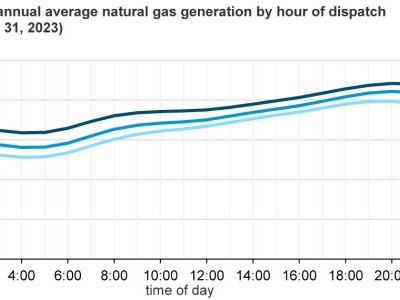

Egypt — which uses gas for cooling to escape extreme heat — wants to secure LNG to avoid the chronic power outages of last summer, according to one of the people. That’s when temperatures over 35C (95F) caused power interruptions for an hour or two per day. Last year was the hottest on record, and experts are predicting 2024 could be even worse.

The country halted LNG exports during the hottest months last year. While those shipments resumed this past winter, they have lagged typical levels for the season, ship-tracking data compiled by Bloomberg show. Besides use in power, Egypt needs gas to feed energy-intensive industries such as fertilizer producers.

Energy Minister Tarek el-Molla said in October that exports would continue until March or April before using the fuel domestically during the summer. The country has imported just four cargoes since 2019, ship-tracking data show.

The floating storage and regasification unit BW Singapore left Egypt’s Ain Sukhna import terminal in November after a charter deal ended, leaving the nation without an asset that ensures security of supply. Last June, Egypt signed a deal with Jordan to jointly use an existing floating LNG import facility in Aqaba, in case of emergency.

Suez Challenges

Resuming imports could prove difficult, however. Shippers have avoided the Red Sea — and by extension, the Suez Canal — for months following Houthi militant attacks on vessels and US-led strikes that have so far done little to bring peace to the region.

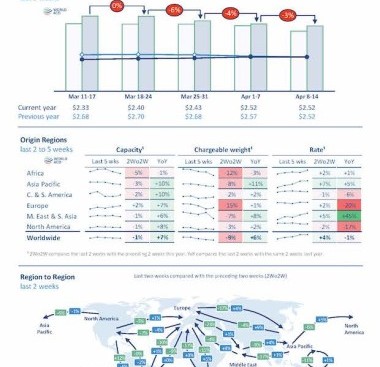

As a result, most ships have been traveling longer routes around Africa, adding days and freight costs onto journeys, while insurance premiums for venturing into the Red Sea have soared.

Egypt has already lost out on revenues from Suez Canal fees. Renewing LNG imports would be an additional cost just as the nation has secured more than $50 billion in international aid due to a broader economic crisis.

Similar Stories

Sanctioned tankers giant passage to India is test case for oil

View ArticleAdnoc buys Iraqi oil in plan to export its own more pricey crude

United Arab Emirates oil giant Abu Dhabi National Oil Co. imported a crude oil cargo in a rare move after upgrading its only refinery, which will allow it to sell…

View Article

Today in Energy: U.S. natural gas-fired electricity generation consistently increased in 2022 and 2023

View ArticleSurveying the world’s path from fossil fuels to clean energy

Energy executives warn that it will be a long and costly journey, while activists and analysts say there are significant rewards and little time to waste.

View Article

IAG Cargo transitions 160-truck fleet at London Heathrow to hydrotreated vegetable oil

View Article

Ørsted inaugurates the Asia-Pacific region’s largest offshore wind farms

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!