Copper supply deficit of 6 million tons by 2030 threatens renewables, EVs, as investment lags demand

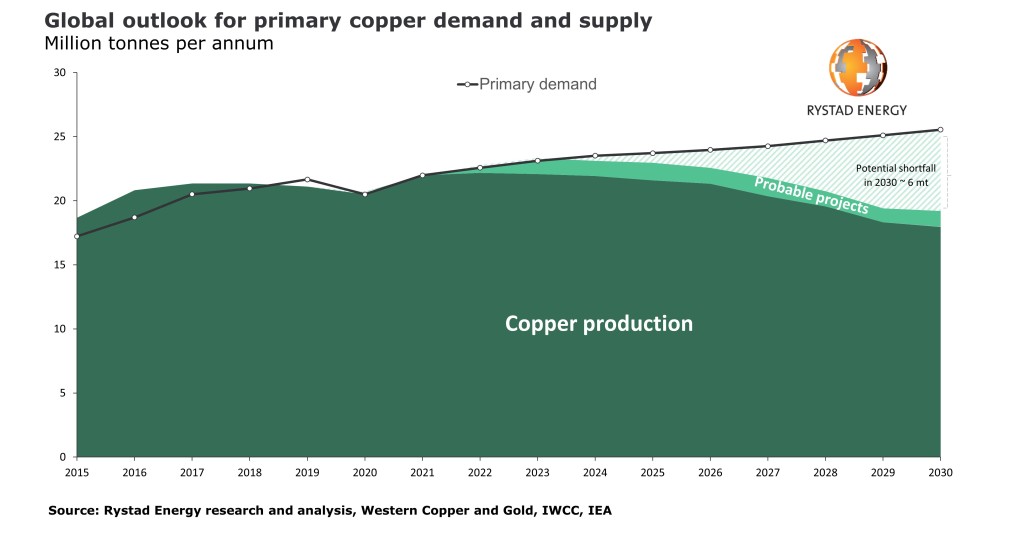

Jan 14, 2022Global demand for copper, an essential component in manufacturing electric vehicles (EVs) and consumer electronics, will outstrip supply by more than six million tonnes by 2030, Rystad Energy projects. A deficit of this magnitude would have wide-reaching ramifications for the energy transition as there is currently no substitute for copper in electrical applications. Significant investment in copper mining is required to avoid the shortfall.

Copper demand is projected to rise 16% by the end of the decade, reaching 25.5 million tonnes per annum (tpa) by 2030, compared with a supply forecast showing a 12% decrease versus 2021 levels. Estimates based on current and expected projects show supply will clock in at 19.1 million tpa, falling well short of the quantity needed to meet demand.

Investment in copper mining is risky as current operations are near peak capacity due to ore quality and reserves exhaustion, exerting upward pressure on production costs and emissions. However, copper prices are currently high, which could encourage investors to accept a greater level of risk.

“Lackluster investments in copper mining are stumping supply, as the pandemic-driven market instability encourages investors to hold on to their capital. As the energy transition continues at pace and EV adoption grows in populous nations like China and India, the copper mining industry requires significant investment to keep up with demand,” says James Ley, global energy metals expert and Senior Vice President with Rystad Energy.

The growing renewables and EV markets have pushed copper demand higher, causing prices to soar. Prices have risen 70% during the pandemic. The current spike in infection cases, due mainly to the spread of the Omicron variant, is causing further supply chain bottlenecks, leaving prices at all-time highs entering 2022.

The outlook for copper investment paints a bleak picture for future supply, indicating a significant supply deficit could emerge from 2023 onwards. The expected demand increase is due to the market growth of renewables – solar, onshore and offshore wind, among others – EVs, construction and electronics. With India’s projected economic growth and the buildout of EVs from China, the demand projection could end up being conservative and the supply shortfall even more severe.

Supply concerns

Copper mining is an energy-intensive process that produces a large amount of carbon emissions. The government of Peru, one of the world’s largest exporters of copper, ordered several mines to close in November 2021 amid environmental protests. As a result, four mines in the southern Ayacucho region could be barred from further expansion, which would dent the copper, silver and gold portfolio of large UK-based minerals producer Hochschild Mining. In addition, the Las Bambas copper mine in southern Peru that produces 400,000 tpa of the material – or about 2% of global supply – will reportedly shut production due to transportation issues. Political instability in neighboring Chile, another major producer, further adds to the supply problems.

In recent years, mining investors have been primarily focusing on the lowest-risk projects, while also offering high dividends. Coupled with the ongoing issues of pandemic lockdowns, work stoppages and delays, copper supply growth has decelerated.

A supply deficit could cause projects in many industries to experience lengthier lead times, especially when considering copper demand from all sectors combined is projected to grow 32% by 2040, compared with 2020 levels. This includes the contributions of solar, onshore/offshore wind, hydroelectric, biomass and nuclear. Demand for oil and gas is expected to fall, with global production of these fossil fuels also expected to decrease.

Since 75% of mined copper is used in electrical wires, power grids and motherboards, it is an indispensable commodity. Due to continued demand growth outpacing available supply, intermittent supply shortages would likely significantly impact raw copper rather than semi-finished product inventory.

New discoveries

New copper resources continue to be discovered – such as Grasberg in Indonesia and Kamoa-Kakula in the Democratic Republic of Congo (DRC) – yet many remain undeveloped as potential mines can suffer from low ore grades or because fiscal or political uncertainty in the host country. Interestingly, UK brokerage Marex Spectron sees the potential for 2022 offering a copper surplus, saying in December 2021 that major new projects – such as Teck’s QBII mine in Chile and Anglo American’s Quellaveco project in Peru – could add 200,000 tpa. Ivanhoe’s mine in the DRC could add another 70,000 tpa, while the ramp-up at Freeport’s Grasberg mine could add a further 110,000 tpa. However, despite this supply growth potential, projects will require a politically stable environment, and their operators must be mindful of the emissions targets to entice would-be investors.

Mining companies are still among the highest dividend payers, and new copper discoveries remain undeveloped mainly due to perceived risks. Overall, any copper supply shortages will almost certainly encourage greater recycling levels to boost availability.

Similar Stories

New Research: 88% of high-growth companies look to tech to tackle trade challenges

View ArticleMatson announces quarterly dividend of $0.34 per share

The Board of Directors of Matson, Inc. (NYSE: MATX), a leading U.S. carrier in the Pacific, today declared a first quarter dividend of $0.34 per common share. The dividend will…

View Article

December 2024 crude steel production and 2024 global crude steel production totals

View Article

WorldACD Weekly Air Cargo Trends (week 3) - 2025

View Article

North American Transborder Freight was unchanged at 0.0% in November 2024 from November 2023

View ArticleDun & Bradstreet Global Business Optimism Insights Report reveals cautious economic outlook for Q1 2025

This shift suggests a redirection from previously elevated optimism levels seen in the latter half of 2024 and indicates a more cautious approach by businesses, particularly in terms of supply…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!