Clipper Data says market bullish on grains

Oct 17, 2020

Winter wheat dryness has intensified, as ongoing dryness across the US High Plains has limited moisture for wheat germination and establishment. This has pushed Kansas and CBOT wheat prices higher, with the US hard red wheat carry-out expected to be at a multiyear low. As the bread basket of Ukraine, the southern region remained short in soil moisture. Winter wheat conditions in central and eastern Russia also deteriorated. There is less than a month before the southern Russia crop heads for dormancy.

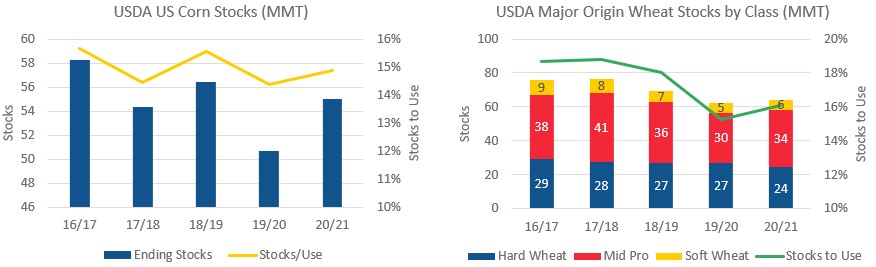

The US wheat balance sheet brought few surprises in the October WASDE reports as the prior release of the September Small Grains report was baked into expectations. Globally, stronger exports have confirmed higher old crop Russia production, as spring wheat yields brought an upside surprise. This, combined with the EU, more than offset lower Ukraine, Canada and Argentina production in the October release.

Global wheat offtake saw a strong uptick in September, led by MENA, China and Pakistan. This, coupled with the highest loadings seen in September, has confirmed the ongoing stock building in parts of the world, particularly MENA, including Egypt, Saudi Arabia and Morocco. This could lead to a future decline in import demand. For China and Pakistan, it was more due to structural reasons. Pakistan’s wheat market has been dominated by the government’s procurement of domestic production and distribution, but following last season’s poor ending stocks, it now allows imports by the private sector - lifting the 60% import duty. China relies on higher quality wheat imports to blend with domestic soft wheat – we saw more of that happening ex US and Canada this season with good import margins and the Phase 1 deal. The USDA in October revised up the crop year wheat imports from China and Pakistan, now at 7.5 mmt and 1.5 mmt respectively.

Despite keeping yields largely unchanged, the USDA has lowered US corn acreage in its October estimates by 1.0 mln acres, a steeper cut than the market had anticipated. A reduction in the Northern Plains, Southwest and Delta regions more than offset higher areas in the Eastern belt. The USDA reduced 20/21 corn ethanol use as its demand recovery stagnated, evidenced in the poor August corn grind number, despite August being a peak consumption month. The USDA also rationed corn animal feed use due to higher feedstock prices. Lower carry-in and production has led to 20/21 ending stocks of 2,167 mbu, now a much smaller YoY build compared to the estimate of 2,756 mbu just a couple of months ago. Globally, lower Ukraine production was partially offset by higher Argentine flows, reflected in shifts in export estimates, echoing the recent shipment pattern.

Similar Stories

December 2024 U.S. Transportation Sector Unemployment (4.3%) Was the Same As the December 2023 Level (4.3%) And Above the Pre-Pandemic December 2019 Level (2.8%)

View ArticleDP World appoints Jason Haith as Vice President of Freight Forwarding for U.S. and Mexico

DP World, a global leader in logistics and supply chain solutions, has announced the appointment of Jason Haith as Vice President, Commercial Freight Forwarding – U.S. and Mexico, effective immediately.…

View Article

Amaero secures final approval for $23.5M loan from Export-Import Bank

View ArticleU.S. Bureau of Labor Statistics employment situation

Total nonfarm payroll employment increased by 256,000 in December, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment trended up in…

View ArticleImport Cargo to remain elevated in January

A potential strike at East Coast and Gulf Coast ports has been avoided with the announcement of a tentative labor agreement, but the nation’s major container ports have already seen…

View ArticleS&P Global: 2025 U.S. transportation infrastructure sector should see generally steady demand and growth

S&P Global Ratings today said it expects activity in the U.S. transportation sector will continue to normalize in 2025, with growth rates for most modes of transportation slowing to levels…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!