China’s crude oil imports surpassed 10 million barrels per day in 2019

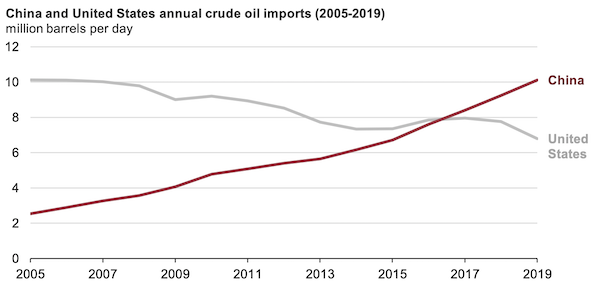

Mar 23, 2020China’s annual crude oil imports in 2019 increased to an average of 10.1 million barrels per day (b/d), an increase of 0.9 million b/d from the 2018 average. China remains the world’s top crude oil importer, surpassing the United States in 2017. China’s new refinery capacity and strategic inventory stockpiling, combined with flat domestic oil production, were the major factors contributing to the increase in China’s crude oil imports in 2019.

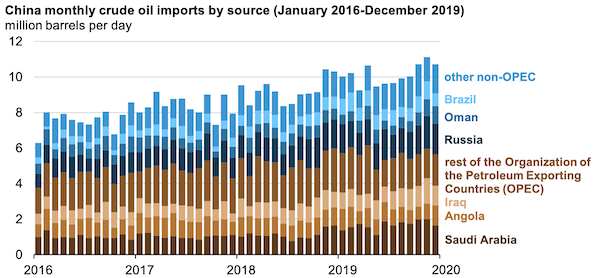

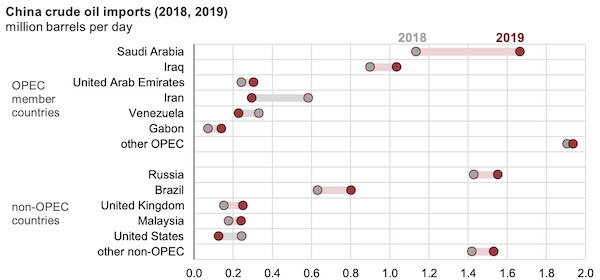

In 2019, 55% of China’s crude oil imports came from countries within the Organization of the Petroleum Exporting Countries (OPEC), the smallest share since at least 2005. China’s crude oil imports from Saudi Arabia increased by more than 0.5 million b/d in 2019 to 1.7 million b/d, or 16% of total crude oil imports.

From 2017 until earlier this year, OPEC members and other partner countries had been voluntarily reducing crude oil production, which resulted in some non-OPEC producers increasing their shares of China’s crude oil imports in recent years. In addition, in 2019, sanctions were placed on Iran and Venezuela that significantly affected their ability to export oil, reducing their shares of imports.

Russia remained the largest non-OPEC source of China’s crude oil imports in 2019, averaging 1.6 million b/d, or 15% of total crude oil imports. Brazil overtook Oman as the second-highest non-OPEC source of China’s crude oil imports, increasing by less than 0.2 million b/d to average 0.8 million b/d for the year. China’s crude oil imports from the United States declined in 2019, primarily as a result of trade negotiations that imposed tariffs on many U.S. goods, including crude oil.

Several factors contributed to China’s increase in crude oil imports in recent years. Although China’s domestic crude oil production increased 0.1 million b/d in 2019—averaging 4.9 million b/d—it has remained essentially flat since 2012, ranging between 4.8 million b/d and 5.2 million b/d. In contrast, the U.S. Energy Information Administration (EIA) estimates China’s consumption of petroleum and other liquids grew 0.5 million b/d in 2019 to 14.5 million b/d, and China’s net imports for crude oil and other liquids grew 0.4 million b/d to 9.6 million b/d in 2019.

China’s crude oil imports also grew in 2019 because of strategic stockpiling of crude oil and increases in commercial crude oil inventories following refinery expansions, which require increases in storage as refineries begin operations. Last year, China’s refinery capacity increased by 1.0 million b/d, primarily because two new refining and petrochemical complexes came online with capacities of 0.4 million b/d each. As a result, the country’s refinery processing also increased to an all-time high in 2019, averaging 13.0 million b/d for the year.

EIA estimates China’s domestic petroleum and other liquids consumption averaged 13.9 million b/d in the first quarter of 2020, a decline of 0.6 million b/d from the 2019 annual average, primarily as a result of the Chinese government’s containment measures related to the outbreak of the 2019 novel coronavirus disease (COVID-19). The economic and transportation effects from this outbreak are still developing and will likely affect China’s crude oil imports, refinery runs, and domestic consumption through the second quarter of 2020.

Principal contributor: Jeff BarroAn

Similar Stories

Change of Ørsted Region Americas CEO

View ArticleElkem reaches major milestone in advancing the circular economy for silicones

View Article

Strategic Marine delivers first purpose new build IMO Tier III CTV For Poland’s Offshore Wind Sector

View Article

U.S. Department of Energy: $20.2 million in projects to advance development of mixed algae for biofuels and bioproducts

View Article

New funding propels Pier Wind at Port of Long Beach

View Article

Most U.S. petroleum coke is exported

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!