China’s solar-sector battle puts quality at risk, Longi says

The fierce competition sweeping China’s solar sector is threatening the quality of production at some companies, as plunging profits trigger a scramble to cut costs, according to a top industry executive.

“We’ve noticed that people have started to sacrifice quality to cut costs, which is a dangerous signal,” Zhong Baoshen, chairman of Longi Green Energy Technology Co., said Friday at the Boao Forum for Asia in Hainan, China.

China dominates the global solar industry, but years of rapid expansion have generated serious overcapacity and a battle for survival among producers. With solar-panel prices slumping to record lows, companies have been forced to sell at or below production costs. Longi has cut thousands of jobs amid the downturn.

One of the ways that Chinese solar companies have brought down production costs over the past decade is by slicing ever-thinner square wafers that house photovoltaic cells, saving money by reducing material costs.

Now, some are doing that too quickly: pushing out products without adequate testing to understand how the cells will fare over a lifespan of 20-30 years, he said. “When people are slashing costs or skimping on raw materials, there comes a risk,” Zhong said.

Trade Talk

The Longi executive also called for governments in other major economies to avoid damaging global free trade, which he said remains necessary to keep clean-power costs low and bolster the global energy transition.

Chinese firms face restrictions on overseas sales as countries including the US and India put up trade barriers to support domestic industry and build new-energy supply chains that are less dependent on a single country. China accounts for more than 90% of global solar cell production.

Longi is happy to work with authorities in other countries to help create jobs, but Zhong dismissed the idea that relying on overseas suppliers of solar panels was a risk. Unlike with oil or gas, a sudden halt to the flow of panels would not have an immediate impact on power generation, he said.

“We understand the need to develop local manufacturing from the perspective of each country and region,” he said. “But I think governments should single that out as a topic for local employment, and not use so-called supply chain risks as a cover for their real agenda.”

Similar Stories

Sanctioned tankers giant passage to India is test case for oil

View ArticleAdnoc buys Iraqi oil in plan to export its own more pricey crude

United Arab Emirates oil giant Abu Dhabi National Oil Co. imported a crude oil cargo in a rare move after upgrading its only refinery, which will allow it to sell…

View Article

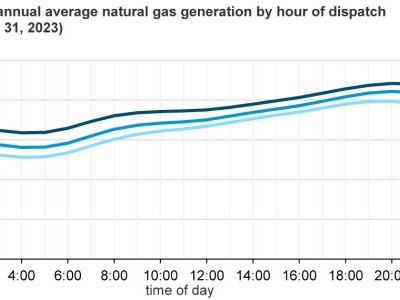

Today in Energy: U.S. natural gas-fired electricity generation consistently increased in 2022 and 2023

View ArticleSurveying the world’s path from fossil fuels to clean energy

Energy executives warn that it will be a long and costly journey, while activists and analysts say there are significant rewards and little time to waste.

View Article

IAG Cargo transitions 160-truck fleet at London Heathrow to hydrotreated vegetable oil

View Article

Ørsted inaugurates the Asia-Pacific region’s largest offshore wind farms

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!