China’s exports and imports hit new records on strong demand

China’s exports and imports grew faster than expected in November, with both hitting records as external demand surged ahead of the year-end holidays and domestic production rebounded on an easing power crunch.

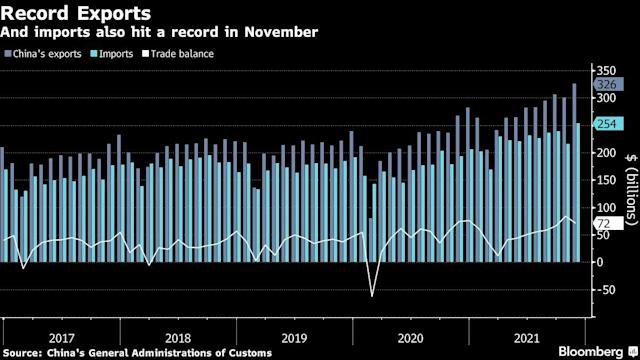

Exports rose 22% in dollar terms from a year earlier to almost $326 billion, while imports grew almost 32% to about $254 billion, the customs administration said Tuesday. Economists had forecast exports to grow by 20.3% and imports to increase by 21.5%.

The data show the continuing strength of global demand for Chinese goods, which has been strong throughout the pandemic. If the spread of the new omicron virus variant proves to be serious and other nations start to lock down again, that will likely provide support for China’s exports, especially personal protective gear and work from home devices.

“Exports picked up in line with seasonality in November and suggest still pretty solid momentum in external demand,” according to Michelle Lam, greater China economist at Societe Generale SA in Hong Kong. “The surprise in import growth was driven by a rebound in commodity volume, probably reflecting improving infrastructure capex demand as local governments stepped up stimulus toward the turn of the year.”

The U.S. was China’s biggest export destination in November, followed by the European Union and the Association of Southeast Asian Nations. Exports to the U.S. grew 28.3% in the first eleven months of the year, while imports from the country increased by 36.9% during the same period.

The values of plane imports grew the fastest in the January-November period, followed by coal, iron ore, and copper ore, according to a breakdown provided by the customs authority.

In November, both the value and volume of metal and energy imports soared. The volume of coal imports hit their highest level this year, natural gas imports were the strongest since January, while crude purchases reached a three-month high.

What Bloomberg’s Economists Think…

“Looking ahead, we expect shipments to remain strong into year-end, given signs that external demand is holding up. Even so, this external prop may not be sufficient to counter downward pressure on growth from domestic sources, including the cooling property sector.”

David Qu, economist

China’s economy has come under increasing pressure from a deepening housing market slump, which may continue to be a drag on growth over the next year. Policy makers moved to expand support for the nation’s economy Monday, with the central bank announcing a cut to most banks’ reserve requirement ratio which will release 1.2 trillion yuan ($188 billion) of liquidity.

A meeting of the Communist Party’s Politburo on Monday concluded with a signal of an easing in curbs on real estate, and a pledge to stabilize the economy in 2022.

Similar Stories

December CNBC/NRF retail monitor results show strong growth boosted by final Thanksgiving weekend days

Retail sales jumped strongly in December, boosted in part by two busy holiday shopping days during Thanksgiving weekend falling in the final month of the year, according to the CNBC/NRF…

View ArticleNAW presents Dirk Van Dongen Lifetime Achievement Award to Bergman, CEO of Henry Schein, Inc.

At the 2025 NAW Executive Summit Gala on January 28 in Washington, D.C.

View Article

St. Louis region’s chemical industry welcomes new investment

View Article

Navigating compliance: Adapting to changing Customs regulations in global supply chains

View Article

December 2024 U.S. Transportation Sector Unemployment (4.3%) Was the Same As the December 2023 Level (4.3%) And Above the Pre-Pandemic December 2019 Level (2.8%)

View ArticleDP World appoints Jason Haith as Vice President of Freight Forwarding for U.S. and Mexico

DP World, a global leader in logistics and supply chain solutions, has announced the appointment of Jason Haith as Vice President, Commercial Freight Forwarding – U.S. and Mexico, effective immediately.…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!