China loading up on sorghum gives century-old trader a boost

Eight months after the phase-one trade deal entered into force, China is loading up on American sorghum, with the cereal giving a 128-year-old trading company a boost.

Scoular Co., one of the biggest handlers of sorghum in the U.S., is benefiting from Chinese purchases of the grain used to feed livestock and poultry, said Paul Maass, chief executive officer of the Omaha, Nebraska-based company. Earnings were “strong,” with results for the year ended in May boosted by sales of sorghum even as the pandemic upended global markets.

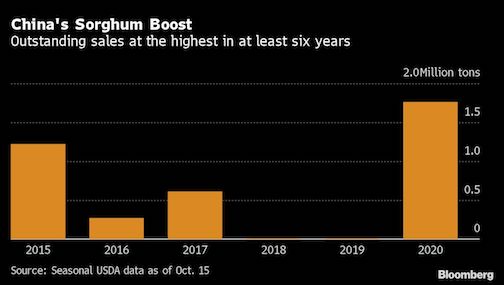

American sorghum sales started picking up shortly after the deal came into force in mid-February, with the commodity being one of the first to see sales to China. Exports picked up last season after almost grinding to a halt during the trade war, and outstanding sales for this season are currently at their highest in at least six years, data from the U.S. Department of Agriculture showed.

“We originate a lot of grain in North America that fits well into the export market, whether it’s Texas Gulf or the Pacific Northwest, and we are seeing that with corn, soy and milo in particular,” Maas said in a video interview, using another word for sorghum. “Milo is where we really felt it.”

American sorghum growers were some of the most hurt by the trade war, with prices so low that the grain had to be sold for ethanol, usually made from corn in the U.S. Farmers were first hit when China announced an investigation into American shipments in early 2018, and then tariffs followed.

The U.S. exported 3.9 million tons of sorghum to China last season, more than six times more than a year earlier, when the trade war menaced the market, USDA data showed. Some 460,000 tons have already been shipped this season and there are still outstanding sales of about 1.76 million tons, the highest for this time of year in at least six years.

Scoular is a private company and doesn’t publicly release earnings. The company declined to provide profit figures and disclose how much sorghum it had sold as a result of China purchases.

The phase-one deal has improved the outlook for agricultural commodity traders, which had been grappling with bumper crops and a lack of volatility for years. China has already purchased record amounts of American corn and sales of soybeans are running at their highest in data going back to 1991.

“Prior to China phase-one deal coming in stronger, you were kind of lugging through pretty strong balance sheets, pretty strong carryovers, you were lugging excess supplies through the market and that’s just a harder operating environment for everybody,” said Maass, who took the top job in 2016. “I’m thrilled we are operating against phase-one commitments.”

Similar Stories

December 2024 U.S. Transportation Sector Unemployment (4.3%) Was the Same As the December 2023 Level (4.3%) And Above the Pre-Pandemic December 2019 Level (2.8%)

View ArticleDP World appoints Jason Haith as Vice President of Freight Forwarding for U.S. and Mexico

DP World, a global leader in logistics and supply chain solutions, has announced the appointment of Jason Haith as Vice President, Commercial Freight Forwarding – U.S. and Mexico, effective immediately.…

View Article

Amaero secures final approval for $23.5M loan from Export-Import Bank

View ArticleU.S. Bureau of Labor Statistics employment situation

Total nonfarm payroll employment increased by 256,000 in December, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment trended up in…

View ArticleImport Cargo to remain elevated in January

A potential strike at East Coast and Gulf Coast ports has been avoided with the announcement of a tentative labor agreement, but the nation’s major container ports have already seen…

View ArticleS&P Global: 2025 U.S. transportation infrastructure sector should see generally steady demand and growth

S&P Global Ratings today said it expects activity in the U.S. transportation sector will continue to normalize in 2025, with growth rates for most modes of transportation slowing to levels…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!