China is so thirsty for soy that America could soon be importing

China’s appetite for U.S. soy is draining silos to the point that American processors may need to import the most beans in years this summer.

Soybean sales to overseas buyers are set to exceed the government’s estimates for the whole season as early as next month, according to Chicago-based consultants AgResource. Processors have also been crushing record amounts month after month. At the current pace, the U.S. is set to run out of soybeans, at least on paper.

The boom in U.S. shipments to China comes after Brazil and other countries effectively ran out of exportable supplies—prospects traders in North America are now facing. Matt Campbell, risk-management consultant at StoneX in West Des Moines, Iowa, said U.S. soy imports could reach the highest level since 2014 this year amid strong demand from domestic crushers—who process the soybeans into meal used as animal feed and oil for cooking and fuel—before fresh supplies roll in from the harvest.

While it’s not uncommon to see small amounts of trade among the top soy exporters—more deals are likely this year with futures prices in Chicago near a six-year high and expected to keep rising. That would make cargoes from South America more attractive to U.S. processors.

“Every year there are some imports,” Campbell said. “However, this year looks to be one of the heaviest amounts we will see.”

“It is a year in which supplies have been substantial but demand is huge,” John Baize, an independent analyst who also advises the U.S. Soybean Export Council, said in an interview.

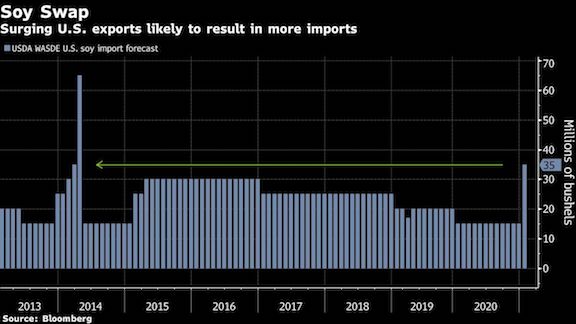

The USDA on Jan. 12 more than doubled its outlook for American imports of soybeans, projecting 35 million bushels during the season that began Sept. 1, and StoneX sees it as high as 70 million. That would be the most since 72 million were brought in during the 2013-14 season.

To be sure, that’s a tiny volume compared to the 2.23 billion bushels expected by the USDA to be shipped out of American ports. Prices in the U.S. will likely keep going up to the point that margins for processors are poor enough that demand is curbed.

“The U.S. really does need to curb domestic crushing in the short term because the Brazilian crop is delayed and China is buying even more cargoes for February,” said Tarso Veloso, an analyst at Chicago-based AgResource. “We expect March futures to go up to $14.60 a bushel and even $15 a bushel to curb domestic use.”

“At the current pace of exports, the U.S. could end up with negative stocks,” Veloso said. “But of course that’s on paper and would never actually happen, because prices would go up first to curb demand.”

The rising demand from China means American farmers will need to plant more corn and soy, Dan Basse, an analyst at AgResource, said at the Paris Grain Day conference. “We’re looking at planting every arable acre, and it’s still not enough to meet demand.”

Similar Stories

December 2024 U.S. Transportation Sector Unemployment (4.3%) Was the Same As the December 2023 Level (4.3%) And Above the Pre-Pandemic December 2019 Level (2.8%)

View ArticleDP World appoints Jason Haith as Vice President of Freight Forwarding for U.S. and Mexico

DP World, a global leader in logistics and supply chain solutions, has announced the appointment of Jason Haith as Vice President, Commercial Freight Forwarding – U.S. and Mexico, effective immediately.…

View Article

Amaero secures final approval for $23.5M loan from Export-Import Bank

View ArticleU.S. Bureau of Labor Statistics employment situation

Total nonfarm payroll employment increased by 256,000 in December, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment trended up in…

View ArticleImport Cargo to remain elevated in January

A potential strike at East Coast and Gulf Coast ports has been avoided with the announcement of a tentative labor agreement, but the nation’s major container ports have already seen…

View ArticleS&P Global: 2025 U.S. transportation infrastructure sector should see generally steady demand and growth

S&P Global Ratings today said it expects activity in the U.S. transportation sector will continue to normalize in 2025, with growth rates for most modes of transportation slowing to levels…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!