China is buying American but not enough to hit trade deal target

China continues to lag behind the pace of imports from the U.S. needed to meet the terms of the two nations’ trade deal, amid a rapidly worsening diplomatic standoff that’s sparking global fears of a new Cold War.

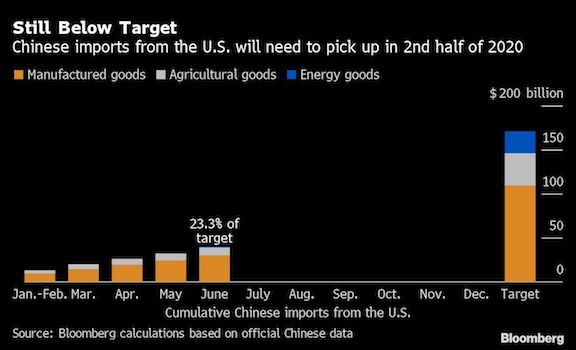

By the end of the first half of this year, China had bought about 23% of the total purchase target of more than $170 billion for goods in 2020, according to Bloomberg calculations based on Chinese Customs Administration data. That has quickened on a month-over-month basis from May’s 19% marker, but it means China needs to buy about $130 billion in the remainder of the year to comply with the agreement signed in January.

China has promised to purchase an additional $200 billion of U.S. goods and services over the 2017 level by the end of 2021. The agreement paused a bruising trade war between the world’s two largest economies caused in part by the Trump administration’s concerns over the size of the U.S. trade deficit with China. The coronavirus outbreak and the first-quarter contraction in China’s economy set back progress toward achieving the target.

The deal remains one of the key anchor points between Beijing and Washington at a time of tit-for-tat accusations of spying, consulate closures and official U.S. rhetoric that calls securing freedom from the Chinese Communist Party as “the mission of our time.”

Observers are worried that even this agreement could become a victim of the worsening relationship, but China is still increasing purchases. Imports of manufactured goods took the lead in June, with vehicles, pharmaceutical products, optical and medical instruments all seeing big jumps. Purchases of integrated circuits remained above $1 billion.

While purchases of energy products are only at about 5% of where they need to be by year-end, imports of coal in June more than doubled from the average of previous months, reaching the highest this year.

Shipments of agricultural products also increased despite some slowdown in soybean and pork imports. Purchase of cereals more than tripled in June from May. The trend will probably continue in July as China made two massive purchases of American corn in July, according to a U.S. Department of Agriculture statement.

“We of course hope that the deal reached can be implemented in earnest. China has always honored its words, and we will implement the agreement,” Hua Chunying, spokeswoman at the Ministry of Foreign Affairs said at a press conference on July 16, when asked about China’s stance on the phase-one deal.

The phase-one agreement says that official data from both China and the U.S. will be used to determine whether promises have been met.

Similar Stories

Preliminary U.S. imports for consumption of steel products November 2024

The U.S. Census Bureau announced today that preliminary November steel imports were $2.3 billion (1.9 million metric tons) compared to the preliminary October totals of $2.5 billion (2.2 million metric…

View ArticleS&P Global: Triborough Bridge and Tunnel Authority, NY Series 2025A revenue bonds assigned ‘A+’ rating; outlook stable

S&P Global Ratings assigned its 'A+' long-term rating to the Triborough Bridge and Tunnel Authority (TBTA), N.Y.'s proposed $1.3 billion (Metropolitan Transportation Authority [MTA] Bridges and Tunnels) real estate transfer…

View ArticleBiden-Harris Administration Announces CHIPS Incentives Award with SK hynix

CHIPS investment establishes a research hub in Indiana and brings next generation HBM and advanced packaging R&D to the U.S.

View ArticleBiden-Harris Administration announces CHIPS incentives awards with GlobalWafers to support domestic production of silicon wafers

Awards will establish the first domestic source of 300mm silicon wafers for advanced chips and expand production of 300mm silicon-on-insulator wafers

View ArticleUnited Nations Convention on negotiable cargo documents pilot projects

Since 2022, Working Group VI of the United Nations Commission on International Trade Law (UNCITRAL), a subsidiary organ of the UN General Assembly, has been developing a new international convention…

View Article

AAFA urges ILA to formally and swiftly return to negotiating table to reach a deal

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!