Cathay Pacific releases traffic figures for October 2022

Nov 18, 2022

Cathay Pacific carried a total of 400,909 passengers last month, an increase of 424.5% compared with October 2021, but an 85.4% decrease compared with the pre-pandemic level in October 2019. The month’s revenue passenger kilometres (RPKs) increased 416.6% year-on-year but were down 80.1% versus October 2019. Passenger load factor increased by 44 percentage points to 73.6%, while capacity, measured in available seat kilometres (ASKs), increased by 108% year-on-year, but decreased by 79% compared with October 2019 levels. In the first 10 months of 2022, the number of passengers carried increased by 166% against a 20.4% increase in capacity and a 167.8% increase in RPKs, as compared with the same period for 2021.

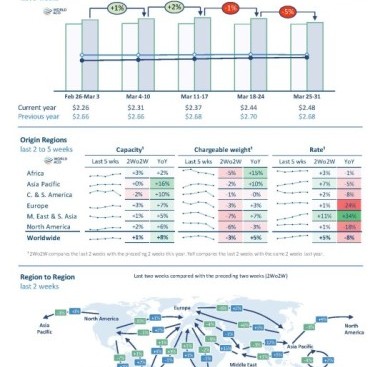

The airline carried 109,425 tonnes of cargo last month, a decrease of 20.1% compared with October 2021, and a 40.2% decrease compared with the same period in 2019. The month’s cargo revenue tonne kilometres (RFTKs) decreased 25% year-on-year and were down 36.2% compared with October 2019. The cargo load factor decreased by 13.9 percentage points to 69%, while capacity, measured in available cargo tonne kilometres (AFTKs), was down by 9.9% year-on-year, and was down by 37.2% versus October 2019. In the first 10 months of 2022, the tonnage decreased by 11.1% against a 21.9% decrease in capacity and a 30.9% decrease in RFTKs, as compared with the same period for 2021.

Travel

Chief Customer and Commercial Officer Ronald Lam said: “Following the Hong Kong SAR Government’s lifting of quarantine requirements for arrivals entering Hong Kong at the end of September, travel sentiment out of Hong Kong improved significantly in October. Demand for the first half of October mainly stemmed from flights to Bangkok, Singapore and Seoul. We then saw a surge in demand for travel to Japan when its quarantine requirements for arrivals were relaxed on 11 October.

“We increased our regional flight frequencies, in particular to destinations in Japan, in October. We also resumed services to Madrid, Milan, Bengaluru, Dubai and Kathmandu last month. More destinations and increased flight frequencies meant more choices and better connectivity for our customers at the Hong Kong aviation hub.

“Overall in October, passenger flight capacity increased 32% compared with September and we operated 21% of our pre-pandemic passenger flight capacity levels. Passenger numbers increased to nearly 13,000 per day, up from over 8,800 in September, and the load factor reached about 74%.

Cargo

“In terms of cargo, global economic headwinds and anti-pandemic measures on the Chinese Mainland continue to impact trade flows and production. While our tonnage carried fell in October year-on-year compared with the high base of 2021, it saw a 5% increase over September. We operated about 10% less cargo capacity compared with the same time last year as we flew fewer cargo-only passenger services. Overall, we operated about 63% of our pre-pandemic cargo flight capacity last month.

“Our expanded network in Europe was a bright spot with double-digit month-on-month growth in October as we resumed more of our passenger services. This provided our cargo customers with more options, especially for specialised shipments such as pharmaceuticals.”

Outlook

Looking ahead at the remainder of 2022, Mr Lam said: “The Group has already announced the addition of about 3,000 passenger flight sectors from October until the end of December this year and is on track to achieve its target of operating up to one-third of pre-pandemic passenger flight capacity levels by the end of 2022. Travel demand for the rest of 2022 continues to improve and is promising for the Christmas holiday period.

“Regarding cargo, while the peak season this year will be subdued when compared to the unprecedented peak last year, we still expect to see increased tonnage driven by seasonal e-commerce events as well as the start of the perishables season in the Southern Hemisphere. As the belly capacity provided by our passenger flights increases over the months ahead, we are extending the reach of our network and increasing the choice of schedules for our air cargo customers.

“Earlier this year, we said that we were targeting to be operating cash generative from August onwards. Since then, further adjustments to travel restrictions and quarantine requirements have come into effect in Hong Kong. As such, it is now our expectation that the second half of 2022 will be operating cash generative overall.

“At the same time, our second-half 2022 results for our airlines and subsidiaries are expected to see a marked improvement over our first-half 2022 results, although still a loss overall for the full year of 2022. However, the results from associates, the majority of which are recognised as three months in arrears, and which in some cases have already been announced, will include significant losses. As a result, a substantial loss for the Group, including airlines, subsidiaries and associates, is expected for the full year of 2022.”

Looking further ahead, Mr Lam said: “Earlier this week, the Group – comprising passenger airlines Cathay Pacific and HK Express – announced that it anticipates it will be operating around 70% of pre-pandemic passenger flight capacity by the end of 2023, with an aim to return to pre-pandemic levels by the end of 2024, ahead of the Asia-Pacific traffic forecast issued by the International Air Transport Association (IATA). We look forward to being a positive driving force behind the revival of Hong Kong’s international aviation hub status.”

Click here to view the full October figures and glossary.

Similar Stories

Alaska Air Group reports first quarter 2024 results

View Article

Munich Airport: Positive annual result and strong traffic growth

View Article

Scandinavian Airlines (SAS) and Worldwide Flight Services (WFS) partner for cargo handling at a fourth major airport in North America

View Article

EasyJet re-deploys fleet from Israel to summer hotspots

View Article

Singapore loses ‘World’s Best Airport’ crown to Qatar

View ArticleJet maker Embraer emerges as Brazil’s best stock on orders flow

Embraer SA’s push into a market long dominated by Boeing Co. and Airbus SE is bearing fruit in equity markets, as a flow of new orders from North America and…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!