Brazil pushes China for closer farm ties ahead of Lula’s visit

Hundreds of Brazilian agribusiness leaders flooded Beijing this week even before the arrival of President Luiz Inacio Lula da Silva, who’s betting a high-stakes trip to China will further open the world’s biggest commodities importer for his country’s products, helping him make peace with a sector that overwhelmingly supported his predecessor in last year’s election.

Brazil’s Agriculture Minister Carlos Favaro, who landed on Wednesday alongside the unusually large business delegation, has been laying the groundwork for several potential agreements between the two countries. In an interview on Friday, he said his mission is to re-establish warm ties between the countries, and refrained from giving explicit targets for bilateral commerce.

Trade and investment are the key drivers for any deepening of relations between the two countries. Lula wants to boost sales to China, which is already the biggest destination of Brazilian exports, and lure investment to upgrade the country’s infrastructure.

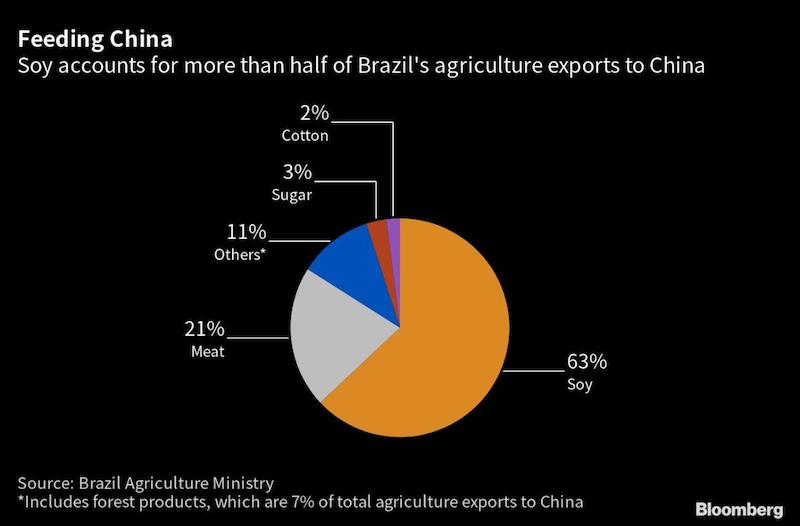

The South American nation is already the main supplier of agricultural goods to China, accounting for 60% of its soybean imports and 40% of its beef purchases. Now Brazil wants to push those numbers even higher while also working with Beijing on strategies to keep agricultural expansion from harming the environment.

That’s a delicate balance that Lula will try to strike once he arrives on Monday, a day later than originally planned due to a mild pneumonia case that his office announced Friday.

A successful trip may give Lula a boost at home, where he spent his campaign and the early days of his presidency at odds with an agribusiness sector that tends to support former President Jair Bolsonaro — and that accounts for nearly half of Brazil’s exports and a quarter of its slowing economy. The high-profile visit will also likely draw the attention of the US, which is simultaneously a major trading partner and rival of both countries, especially as Brazil pushes for gains in areas where the US is its biggest competitor.

Beef, Pork and Mad Cow

While Lula’s agenda for the trip is crowded, Brazil’s beef industry will likely take center stage at least in terms of trade and agribusiness-related talks. China is weighing whether to allow additional Brazilian exports of some pork products, including offal and bone-in meat, a move that could provide a $100 million annual boost to the industry in Brazil, according to Ricardo Santin, who heads the exporter group ABPA and is part of the delegation.

“Although China is a rather important market for Brazilian meat products, there is space to increase because the Brazilian share of the Chinese market is not very big,” the agriculture minister said.

Favaro has already scored multiple early victories. Brazil has a list of 50 meat-processing facilities it wants China to approve for exports, and China gave the green light to six of them Thursday, including a unit of JBS SA. Two more are pending and Brazil will continue to push for the remaining plants on a “step by step” basis, Favaro said.

China on Thursday also agreed to lift an export ban on Brazilian beef triggered in February by a single suspected case of mad cow disease. Current sanitary protocols were negotiated in 2015 and Favaro said Brazil believes it has proven itself a trustworthy enough supplier to make them less strict. But now is not the right time to renegotiate the protocols given the recent case, he said, adding that he expects the issue to come up at bilateral meetings in August instead.

Soy, Corn and Cotton

Soybean crushers want to see a boost too, after China last year allowed Brazil to begin exporting the soybean meal. The two countries also reached a deal last year to resume shipments of corn, an agreement that has already led to spikes in Chinese purchases and is likely to generate even more this year.

That threatens to displace US farmers from one of their key markets, while strengthened ties with China could also propel Brazil closer to its goal of unseating the US as the world’s top cotton exporter, said Alexandre Schenkel, head of Abrapa, an association of Brazilian cotton producers. Brazil will launch a new certification for cotton quality this week aimed at helping win the trust of China.

Infrastructure, Environment

Brazil wants new investments from Chinese firms in ports, shipping, rail and other infrastructure needed to move production from a vast country through export routes. Because agriculture goods are low in value, operations need to be efficient to make trade profitable.

“Considering China’s capacity for doing big infrastructure investments around the world, there’s a mutual benefit where they invest in making Brazil more competitive and it also opens opportunities for China,” Favaro said.

The massive scope of the agricultural trade between Brazil and China has already drawn scrutiny from environmentalists, who worry that the expansion of soybean and livestock production has accelerated deforestation in the Amazon rainforest and other regions. Further growth may draw even more scrutiny, especially amid Lula’s efforts to place climate action and forest protection at the heart of his international diplomacy efforts.

Favaro, however, argued that Brazil can double its farmland without generating more deforestation by rehabilitating vast tracts of degraded land. He met with the chairman of COFCO on Friday to pitch the company on a pilot program that would provide low-interest loans to farmers who agree to rehabilitate land in a low-carbon, socially responsible way.

Similar Stories

US spars with China over who subsidizes its industries the most

The US and China sparred over industrial subsidies at the World Trade Organization on Friday, with Beijing asking to set up a dispute panel to review the Inflation Reduction Act’s…

View Article

China’s made-in-Europe EVs pose new threat to region’s carmakers

View ArticleWorld’s No. 2 citrus shipper renews WTO EU dispute-panel call

South Africa asked the World Trade Organization to set up two panels to examine what the nation says are “unscientific and discriminatory measures” placed on citrus it exports to the…

View ArticleUkraine urges Hong Kong not to help Russia bypass sanctions

Ukraine’s Foreign Minister Dmytro Kuleba asked Hong Kong’s leader John Lee to take measures to prevent Russia and its companies from using the city to circumvent sanctions, in a rare…

View ArticleWall Street says a Trump Presidency could send oil prices lower

A US election victory for former president Donald Trump could send oil prices lower, according to some prominent Wall Street banks.

View ArticleUS seeks Mexico’s review of alleged denial of Workers’ Rights at Impro Industries Mexico, S. de R.L. de C.V.

For the seventh time in 2024, the United States has sought Mexico’s review under the USMCA’s Rapid Response Labor Mechanism.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!