Italy Weighing Candidates for New Alitalia Company

The Italian government is assessing several candidates to head a new state-controlled company to run failed carrier Alitalia SpA, newspaper Il Sole 24 Ore reported…

United Air Scraps $2.25 Billion Bond Deal After Terms Disappoint

United Airlines Holdings Inc. abandoned a $2.25 billion sale of junk bonds because it wasn’t satisfied with the terms, said people familiar with the transaction.

Atlas Air and Southern Air provide interim pay increase for pilots in agreement with union

Atlas Air Worldwide Holdings, Inc. (Nasdaq: AAWW) today announced that its wholly-owned subsidiaries Atlas Air, Inc. and Southern Air, Inc. have reached an agreement with…

India’s Top Airline to Put Some Staff on Leave Without Pay

IndiGo, Asia’s biggest budget airline by market value, will ask some employees to take as many as five days leave a month without pay over…

JetBlue Sells Loyalty Points to Bolster Cash by $150 Million

JetBlue Airways Corp. sold loyalty points to Barclays Plc for $150 million, making the carrier among the first in the U.S. to use the method…

United Airlines Sees Weak Demand for $2.25 Billion Junk Bond

United Airlines Holdings Inc.’s junk-bond sale is struggling to gain traction with investors as orders of just $1.5 billion were placed for the $2.25 billion…

Lufthansa confirms talks to hand Germany 25% stake in rescue

Europe’s biggest airline is about to get an important new shareholder.

Frontier Air ditches extra-space plan after congressional outcry

Frontier Airlines quickly reversed course on a plan to charge extra for passengers who want to guarantee a spot next to an unoccupied middle seat,…

British Airways owner IAG taps UK funds to survive slump

British Airways parent IAG SA tapped U.K. government-backed loans to boost liquidity, in a sign of the damage being wrought by the Covid-19 pandemic on…

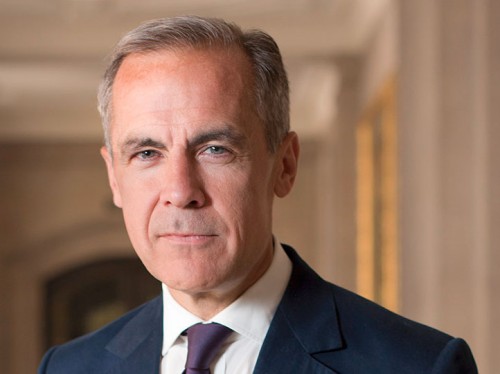

Airline bailouts need green strings attached, Carney says

Governments must take advantage of a $3 trillion green investment opportunity to recover from the coronavirus shock, former Bank of England Governor Mark Carney said.

Get the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!