WorldACD Weekly Air Cargo Trends (week 49)

Dec 15, 2023Worldwide air cargo demand has rebounded significantly above last year’s levels, driven by strong export volumes from China, with preliminary tonnages for November up +5%, year on year (YoY), and up +1% on the previous month, taking combined tonnages for the peak period October and November around +3% higher than last year, according to the latest figures from WorldACD Market Data.

Although demand slipped slightly in the first full week of December compared with the previous week, and overall worldwide prices levelled off, air cargo rates ex-Asia Pacific on the big head-haul lanes to North America and Europe remain significantly above their levels two or three weeks ago, thanks to a surge in demand ex-China.

Weekly analysis

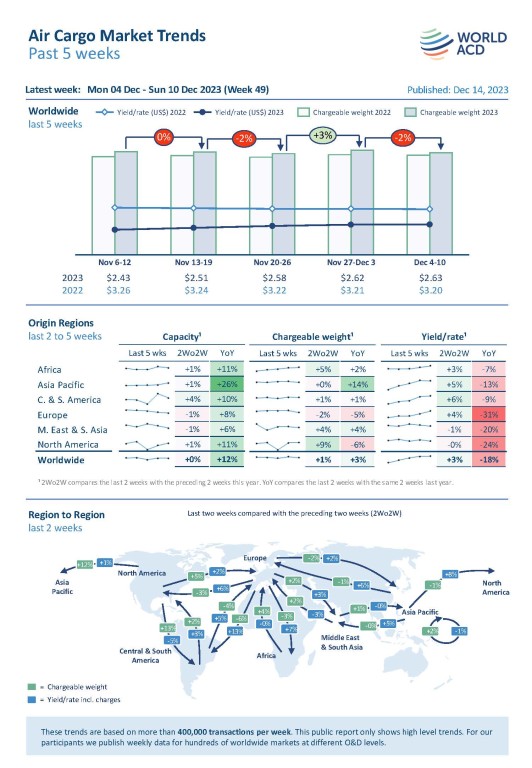

Preliminary figures for week 49 (4 to 10 December) show a -2% decrease in tonnages and close to stable global average rates, compared with the previous week, based on the more than 400,000 weekly transactions covered by WorldACD’s data. Tonnages have followed a similar pattern as they did this time last year, showing a slight weakening compared to the previous week, after a quick recovery from the seasonal post-Thanksgiving dip, although this year’s recovery was quicker and stronger than last year.

Comparing weeks 48 and 49 this year with the preceding two weeks (2Wo2W), overall tonnages increased +1%, and overall global average rates continued to rise by +3%, with capacity stable. The slight increase in tonnages, on a 2Wo2W basis, is partly explained by the post-Thanksgiving holiday recovery in the USA, leading to an increase of +9% for the North America region (2Wo2W), compared with +3% this time last year.

Looking at regional developments, on a 2Wo2W basis, the impact of the post-Thanksgiving recovery is clearly visible ex-North America to, respectively, Asia Pacific (+12%), Europe (+5%) and Central & South America (+13%). Changes in tonnages between other regions were fairly stable, except between Europe and Central & South America (westbound -6%, eastbound -4%) and between Europe and Africa (southbound -3%, northbound +4%).

On the pricing side, the strong increases in recent weeks ex-Asia Pacific have continued (+5%), on a 2Wo2W basis, with a further big jump to North America (+8%) and Europe (+6%). Average yields outbound from Central & South America (+6%), Europe (+4%) and Africa (+3%) are also up compared with the previous two weeks. Most notably, average rates have increased +13% ex-Europe to Central & South America (2Wo2W).

Year-on-Year perspective

On a global basis, volumes in weeks 48 and 49 remain above their levels this time last year, now standing +3% higher, YoY, driven mostly by a +14% increase ex-Asia Pacific, with more-modest rises ex-Middle East & South Asia (+4%), ex-Africa (+2%), and ex-Central & South America (+1%). There remain significant decreases in tonnages ex-North America (-6%) and ex-Europe (-5%), although these are far less severe than the deficits reported in previous weeks, most notably ex-North America.

Meanwhile, overall available capacity has increased by +12% compared with last year, with capacity ex-Asia Pacific up by a noteworthy +26%. Other regions also show significant YoY capacity increases: ex-North America (+11%), ex-Africa (+11%), ex-Central & South America (+10%), ex-Europe (+8%) and ex-Middle East & South Asia (+6%).

Worldwide average rates are currently -18% below their levels this time last year, at an average of US$2.63 per kilo in week 49, although they remain significantly above pre-Covid levels (+47% compared to December 2019).

Similar Stories

Los Angeles Industrial CRE Market Update – 4th qtr. 2024

TEU and airfreight numbers continue to improve, but excess capacity has muted any genuine change to the state of the leasing market.

View Article

CPaT announces new major partnership with “Saudia Academy”

View Article[Freightos Weekly Update] Mexico increases trade barriers for Chinese imports

Ocean rates out of Asia overall trended up slightly to end the year, but with Lunar New Year approaching and a range of January transpacific GRIs announced, prices could face…

View Article

E-commerce is air cargo golden egg but there’s a downside

View Article

Take-off of French cargo airship startup flying whales neither smooth nor simple but investors keep Faith

View Article

Silk Way AFEZCO and FF Construction collaborate to shape the future of Silk Way Cargo Village

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!