WorldACD Air cargo trends for the past 5 weeks (wk 47):

Dec 02, 2022

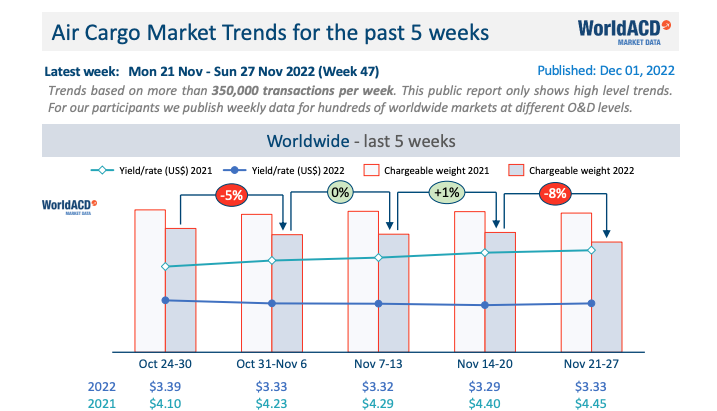

Global air cargo tonnages have continued to slide downwards in November, normally a buoyant month in the air freight calendar, with a further steep decline in the last full week led by falling volumes to and from North America.

Figures for week 47 (21 to 27 November) show a significant overall drop of -8% in worldwide flown tonnages compared with the previous week, and a slight increase (+1%) in average prices. The strong decrease in chargeable weight has been mainly caused by Thanksgiving in the USA, but also globally we see a continuation of the declining volume trend of recent months. Although there have been no signs of the usual seasonal uplift in rates, average prices have stabilized from most origin regions compared to previous weeks. One exception is rated ex-Central & South America showing a positive trend, while prices ex-North America have been on a downward trend.

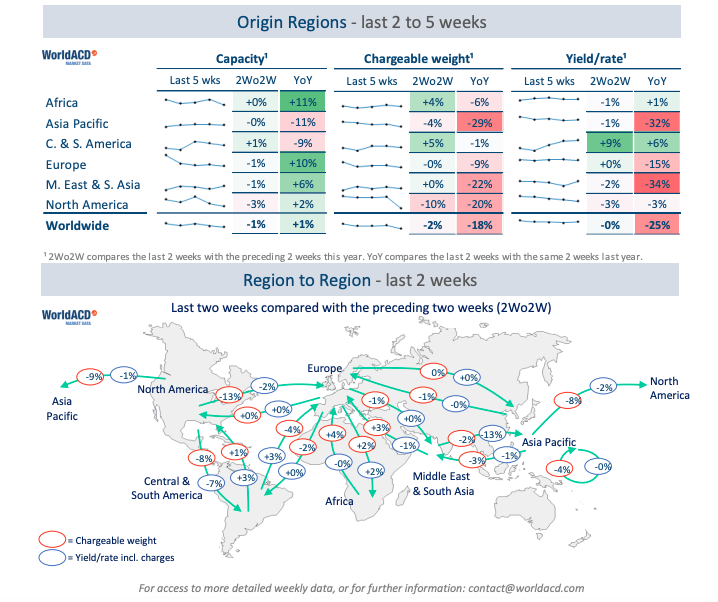

Comparing weeks 46 and 47 with the preceding two weeks (2Wo2W), tonnages decreased -2% below their combined total in weeks 44 and 45, while average worldwide rates remained stable, in a slightly decreasing capacity environment (-1%) – based on the more than 350,000 weekly transactions covered by WorldACD’s data.

Across that two-week period, outbound tonnages were down significantly from North America to all regions due to Thanksgiving (-13% to Europe, -9% to Asia, and -8% to Central & South America respectively), on a 2Wo2W basis. Furthermore, notable decreases were recorded in the Asia Pacific to North America (-8%), intra-Asia Pacific (-4%), and Central & South America to Europe (-4%). Meanwhile, increases were recorded from some other regions, most notably ex-Africa to Europe (+4%) and the Middle East & South Asia to Europe (+3%).

Year-on-Year perspective

Comparing the overall global market with this time last year, chargeable weight in weeks 46 and 47 was down -18% compared with the equivalent period in 2021, at a slightly increased capacity (+1%). Notably, tonnages ex-Asia Pacific are -29% below their strong levels this time last year, and the Middle East & South Asia origin tonnages are -22% below last year. But there were also year-on-year drops outbound from both North America

(-20%) and Europe (-9%), despite higher capacity.

Capacity from all the main origin regions, with the exception of Asia Pacific (-11%) and Central & South America (-9%), is significantly above its levels this time last year: Africa +11%, Europe +10%, Middle East & South Asia +6%, and North America +2%.

Worldwide rates are currently -25% below their levels this time last year at an average of US$3.33 per kilo, despite the effects of higher fuel surcharges, but they remain significantly above pre-Covid levels.

Similar Stories

Port Authority of NY and NJ and Revel break ground on largest electric vehicle charging station at JFK

View Article

DHL integrates the groundbreaking GEN3 Evo race car into its Formula E logistics

View ArticleDelta Air Lines Inc. upgraded to ‘BBB-’ on expectation for stronger-than-forecast credit measures

• S&P Global Ratings expects Delta Air Lines Inc. will generate sustainably stronger credit measures than we previously forecast, supported by its steady margin expansion and increasing revenue. • In…

View Article

Unsworth touches down at Heathrow

View Article

By the numbers: American Airlines wraps up 2024

View Article

Swissport and Lufthansa win top prize at Cargo IQ Q-Rally

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!