WorldACD Air cargo trends for the past 5 weeks (wk 45):

Nov 21, 2022There are still no signs of any fourth-quarter (Q4) seasonal uplift in air cargo demand or pricing, with the downward trend of the last several months continuing into the second week of November – when peak season is usually in full flow.

Following a steep decline in the week to 6 November (week 44), reported by WorldACD last week, the latest preliminary figures from WorldACD Market Data show that weakening trend continue in this week’s report – although the drop was less steep on a week-over-week basis.

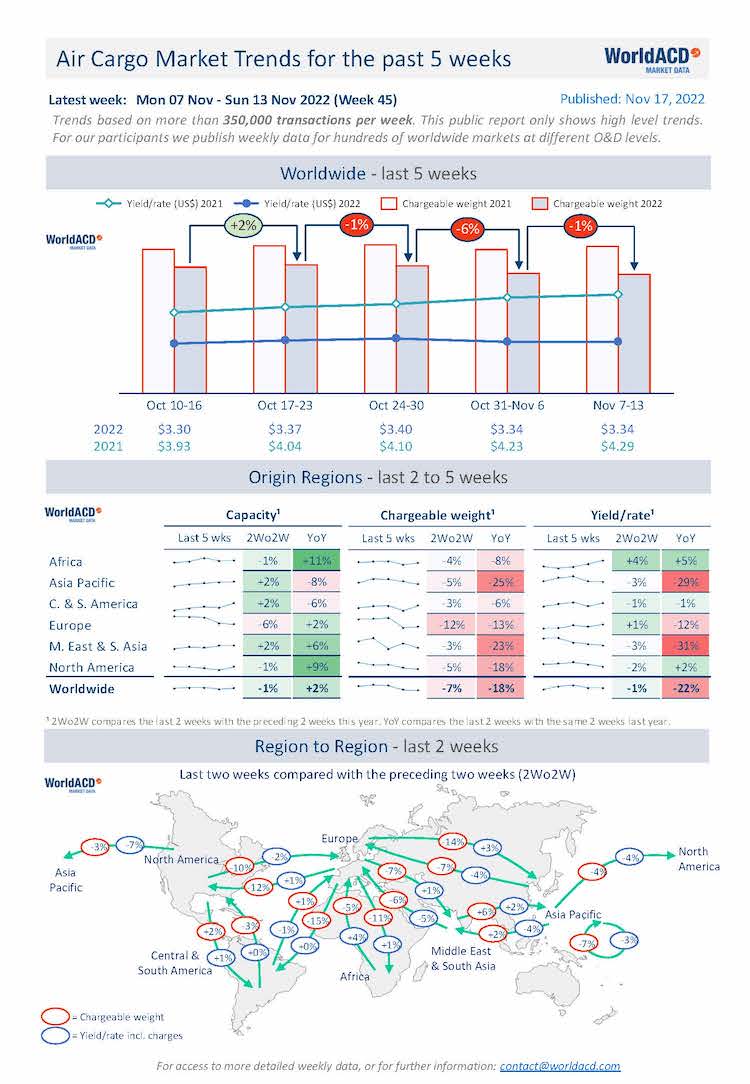

Figures for week 45 (7 to 13 November) show a further -1% drop in worldwide flown tonnages from the previous week, and a stable average price. But comparing weeks 44 and 45 with the preceding two weeks (2Wo2W), tonnages were -7% below their level in weeks 42 and 43, while average worldwide rates decreased by -1%, in a decreasing capacity environment (-1%) – based on the more than 350,000 weekly transactions covered by WorldACD’s data.

Across that two-week period, outbound tonnages dropped from all the main regions, most notably ex-Europe (-12%), ex-Asia Pacific (-5%) and ex-North America (-5%). On a lane-by-lane basis, strong decreases were recorded between Europe and North America (-12% westbound and -10% eastbound) and between Europe and Asia Pacific

(-7% westbound and -14% eastbound).

There were also double-digit percentage drops in tonnages from Europe to Central & South America (-15%) and to Africa (-11%), while intra-Asia Pacific volumes fell by

-7%. Chargeable weight growth outbound from Middle East & South Asia to Asia Pacific was the only significant positive exception (+6%), on a 2Wo2W basis.

Year-on-Year Perspective

Comparing the overall global market with this time last year, chargeable weight in weeks 44 and 45 was down -18% compared with the equivalent period in 2021, despite a capacity increase of +2%. Notably, tonnages ex-Asia Pacific are -25% below their strong levels this time last year, and Middle East & South Asia origin tonnages are -23% below last year. But there were also double-digit percentage year-on-year drops outbound from both North America (-18%) and Europe (-13%), despite higher capacity.

Capacity from all the main origin regions, with the exception of Asia Pacific (-8%) and Central & South America (-6%), is (significantly) above its levels this time last year: North America +9%, Middle East & South Asia +6%, Europe +2% and a double-digit percentage rise from Africa (+11%).

Worldwide rates are currently -22% below their levels this time last year at an average of US$3.34 per kilo, despite the effects of higher fuel surcharges, but they remain significantly above pre-Covid levels.

Similar Stories

Inauguration of the Fly’in technology center: Daher paves the way for the future of decarbonized aviation

View ArticleHorizon Aircraft signs Letter of Intent with Discovery Air Chile Ltda., expanding global presence of Cavorite X7 Hybrid eVTOLs

New Horizon Aircraft Ltd. (NASDAQ: HOVR), doing business as Horizon Aircraft (“Horizon Aircraft” or the “Company”), a leading hybrid electric Vertical Take-Off and Landing (“eVTOL”) aircraft developer, announced today it…

View Article

WorldACD Weekly Air Cargo Trends (week 1) - 2025

View Article

Lufthansa Cargo exhibiting at Fruit Logistica 2025

View Article

A flying start to 2025 but after 14 months of double-digit demand growth, air cargo stakeholders remain cautious

View ArticlePharma.Aero expands global network with six key new members

CEVA Logistics, Skandi Network, SCL Cold Chain, Shipex NV, Pharming Group, and ARTBIO join the life sciences logistics collaborative platform

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!