WorldACD: Air cargo trends for the past 5 weeks (wk 27)

Jul 15, 2022Volumes drop again despite capacity rise

WorldACD's latest views on air cargo market developments, covering each of the last 5 weeks up till Sunday July 10.

Air cargo volumes drop again despite capacity rise

Worldwide air cargo volumes have dropped further in the last two weeks despite the continued gradual recovery of capacity, the latest figures from WorldACD Market Data reveal, as consumer confidence and spending fades in several major international markets.

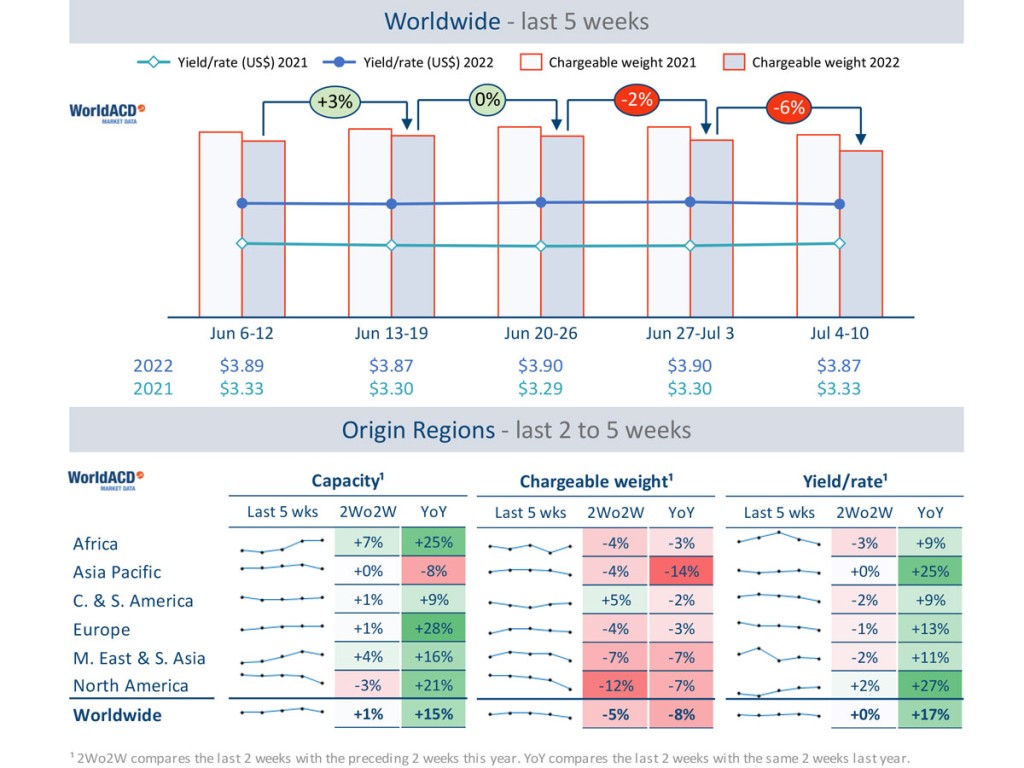

In week 27 (July 4 - 10), worldwide chargeable weight decreased by -6% compared with the week before, and the average worldwide rate decreased slightly, based on the more than 350,000 weekly transactions covered by WorldACD’s data and analysis of the main international air cargo lanes.

Comparing the last two weeks with the preceding two weeks (2Wo2W), average worldwide rates remained stable, while chargeable weight fell -5% and overall capacity increased +1% compared with the preceding two weeks.

Chargeable weight from North America to Europe and Asia Pacific went down particularly strongly in the last two weeks (-16% and -12%, respectively), a period that included the Independence Day national holiday in the US.

Compared with last year, the last two weeks showed a worldwide rate increase of +17%, despite a weight decline of -8% and a capacity increase of +15%.

Other highlights

On the biggest head-haul trades from East Asia, Asia Pacific to Europe average rates and chargeable weight both decreased -1% in the last two weeks compared with the preceding two weeks. Rates from Asia Pacific to North America fell -3% at slightly lower volumes (-1%).

A longer-term view of the key Asia Pacific outbound market shows that volumes for the two weeks to 10 July were down -14%, YoY, and capacity was -8% below last year’s levels, although average rates on Asia Pacific outbound markets remain stubbornly high: +25% up compared with this time last year. Those rates figures are based on a mix of spot and contract rates and include charges, including the currently much-elevated fuel surcharges.

On the demand side, one of the biggest two-week changes in volumes was a -8% decrease in intra-Asia Pacific volumes, compared with the previous two weeks, while average rates were only slightly down (-1%).

Europe to Africa volumes also saw a -8% decline, 2Wo2W, at a +6% rise in average rates. Meanwhile, chargeable weight from Central & South America to North America showed +9% growth, 2Wo2W, after falling -5% in the previous two-week analysis period.

Similar Stories

Inauguration of the Fly’in technology center: Daher paves the way for the future of decarbonized aviation

View ArticleHorizon Aircraft signs Letter of Intent with Discovery Air Chile Ltda., expanding global presence of Cavorite X7 Hybrid eVTOLs

New Horizon Aircraft Ltd. (NASDAQ: HOVR), doing business as Horizon Aircraft (“Horizon Aircraft” or the “Company”), a leading hybrid electric Vertical Take-Off and Landing (“eVTOL”) aircraft developer, announced today it…

View Article

WorldACD Weekly Air Cargo Trends (week 1) - 2025

View Article

Lufthansa Cargo exhibiting at Fruit Logistica 2025

View Article

A flying start to 2025 but after 14 months of double-digit demand growth, air cargo stakeholders remain cautious

View ArticlePharma.Aero expands global network with six key new members

CEVA Logistics, Skandi Network, SCL Cold Chain, Shipex NV, Pharming Group, and ARTBIO join the life sciences logistics collaborative platform

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!