Venezuela-US detente sparks jump in Asian fuel-oil margins

Profits from making one of the world’s dirtiest fuels are soaring in Asia as Chinese refiners snap up replacement feedstocks for dwindling Venezuelan oil shipments after a partial sanctions reprieve allowed exports to the US to resume.

Fuel-oil margins in Singapore reached a nine-month high after flows of thick, sulfurous Venezuelan crude to Asia slumped by roughly 40% over the past five months. At the same time, deliveries to US refineries surged after the regime of Nicolas Maduro negotiated an agreement that eased some US sanctions.

Refiners in Chinese hubs such as Shandong are filling the gap by snapping up high-sulfur fuel oil from Russia that can be interchanged for Venezuela’s bituminous crude. Fuel oil is typically used to power ship engines and, in some regions, electricity-generating stations.

China imported 327,000 barrels a day of high-sulfur fuel oil in February, a record in data going back to 2018, according to market intelligence firm Kpler. Chinese demand is expected to remain strong, according to industry consultant FGE.

“The substitution of bitumen by fuel oil is the main driver behind higher fuel oil crack margins in Singapore,” said Mohith Velamala, an oil analyst at BloombergNEF. “The flow of fuel oil cargoes to Shandong is quite strong right now.”

Margins are widening at a time when energy markets already were in upheaval following last month’s European ban on Russian seaborne fuel imports.

Commodity-pricing agencies such as S&P Global Platts have excluded Russian fuel oil in its assessments following the ban, contributing to the rally, according to Richard Jones, an analyst at Energy Aspects Ltd. Margins may widen further in coming months as some Middle Eastern economies burn more of the fuel to power air conditioners, he added.

Profit margins from making fuel oil are tilting the balance in favor of sour crude oils amid concerns over the stability of supplies of the Russian Urals grade of crude, and growing US exports of light, low-sulfur oil from the Permian Basin, according to the last report from OPEC.

Similar Stories

World Hydrogen North America doubles in size to keep pace with exponential growth of hydrogen industry

World Hydrogen Leaders announced that the “World Hydrogen North America 2024” congress and exhibition will be taking place in Houston, Texas from May 21st- 23rd...

View Article

Boeing makes its largest purchase of blended sustainable aviation fuel

View ArticleUnited States requests second USMCA Rapid Response Labor Mechanism Dispute Settlement Panel

Today’s announcement follows a request the United States sent to Mexico on January 18, 2024 asking Mexico to review whether workers at Atento Servicios were being denied the rights to…

View Article

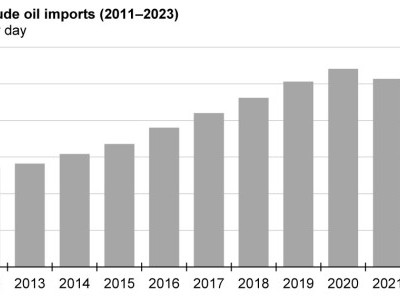

China imported record amounts of crude oil in 2023

View ArticleLower economic growth and trade disruptions in 2024 impact development

While the global economic slowdown in 2023 was less severe than originally projected, UN Trade and Development (UNCTAD) in the latest report (https://unctad.org/system/file...) warns that further growth deceleration could be…

View ArticleCustomCells strengthens its commitment in eAviation

CustomCells, a leading innovator in the development of premium lithium-ion battery cells, announces its strategic move towards achieving Design Organization and Production Organization certifications from the European Union Aviation Safety…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!